In recent years there has been a significant increase in the number of people setting themselves up as single-director companies (‘incorporations’), implying an increase in the share of household income received as dividends. ONS estimates of households dividend income were revised significantly as part of Blue Book 2017, and better capture this rise in incorporations. This box discussed the implications of these revisions, which implied a much higher level of household disposable income and household saving than previous estimates.

This box is based on ONS data from September 2017 and June 2017 .

In recent years there has been a significant increase in the number of people setting themselves up as single-director companies (‘incorporations’) rather than working as an unincorporated self-employed worker or an employee. This is likely to reflect the tax advantages of doing so, as well as underlying trends in the nature of work, as discussed in Box 4.1 of our November 2016 EFO. One implication is that a rising share of households’ income will have been received as dividends from their own business rather than as wages and salaries or the mixed income measure of earnings from self-employment.

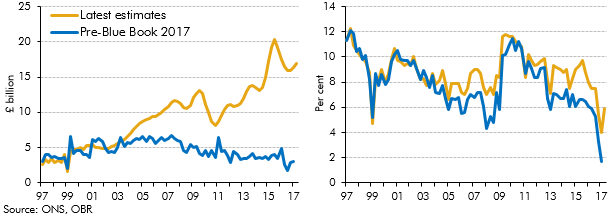

Dividend income is a component of household disposable income and, as such, affects estimates of household saving and net lending. Prior to this year’s Blue Book, the Office for National Statistics (ONS) estimated the dividend income received by households using historical proportions of household income. In the Blue Book, it moved to using HMRC data and forecasts (which in turn are consistent with our tax forecasts), to derive an implied level of dividend income. The revised estimates should better capture the rise in incorporations. They imply a much higher level of household dividend income than previously estimated (Chart A) and, since they do not affect estimates of household consumption, a higher saving ratio (Chart B) and improved household net lending position. The upward revision to dividend income is offset in a downward revision to corporate net lending. The upward trend in incorporations means that the revisions to dividend income and household saving are larger in more recent years.

Chart A: Household dividend income (left) and Chart B: Household saving ratio (right)

The path of dividend income is more volatile in 2016 and 2017 than in earlier years due to the large amounts of income shifting that occurred ahead of the pre-announced dividend tax rise in April 2016 (discussed in Box 4.3 of our March 2017 EFO). The effect has been to raise dividend income significantly in the 2015-16 tax year, and to reduce it subsequently. Household disposable income is also reduced by the tax paid on this dividend income, which is generally paid with a lag of around a year through the self-assessment system. These tax payments are recorded in the National Accounts when the tax is paid, rather than accruing it to the point when the dividend income was received. This timing difference is a key factor in explaining the very low saving ratio in the first quarter of 2017, at which point dividend income was subdued because some had been brought forward into 2015-16 but tax payments were boosted by the lagged payment of self-assessed tax on that shifted dividend income.

This box was originally published in Forecast evaluation report – October 2017