Between March and May 2020, the Government introduced three loan guarantee schemes to support the economy during the coronavirus pandemic. These schemes ended on 31 March 2021 and have since been replaced by a single scheme that launched on 6 April 2021. An overview of each scheme is provided below:

- Coronavirus Business Interruption Loan Scheme (CBILS). The CBILS launched on 23 March and provided support to smaller businesses with financing of up to £5 million. The Government provided lenders with a partial guarantee (80 per cent) against the outstanding loan balance and paid any interest and lender-levied fees for the first 12 months.

- Coronavirus Large Business Interruption Loan Scheme (CLBILS). The CLBILS launched on 20 April and provided support to mid-sized and larger businesses with financing of up to £200 million, depending on business size. The Government provided the lender with the same partial guarantee (80 per cent) against the outstanding balance of the finance.

- Bounce Back Loan Scheme (BBLS). The BBLS launched on 4 May and provided support to businesses that were losing revenue due to the pandemic, with loans of up to £50,000. The Government provided the lender with a full 100 per cent guarantee against the outstanding balance and has sought to make the loans as easy as possible to access by minimising lenders’ usual underwriting checks. The Government also covered the first 12 months of interest payments and introduced a ‘Pay As You Grow’ facility allowing borrowers to request the extension of their loan term, and take repayment holidays.

- Recovery loan scheme (RLS). The RLS is the successor scheme to CBILS, CLBILS and BBLS and provides finance up to £10 million per business with an 80 per cent guarantee to the lenders. Businesses that used the previous schemes are still able to apply for this scheme (provided they meet eligibility criteria). It launched on 6 April 2021 and was initially open until 31 December 2021, now extended to 30 June 2022 with a reduced finance limit and 70 per cent guarantee.

The Government has also directly issued £1.1 billion of convertible loans to ‘innovative’ small and medium-sized start-up enterprises through the Future Fund.

Prior to our March 2021 Economic and fiscal outlook (EFO), the ONS classified the first three schemes as standardised guarantee schemes. This means that spending (in the form of a capital transfer) is recorded at the time the guarantees are provided, reflecting amounts likely to be called – increasing public sector net borrowing (PSNB). This is different to the timing of the impact on debt, which will increase when guarantees are actually called over several years.

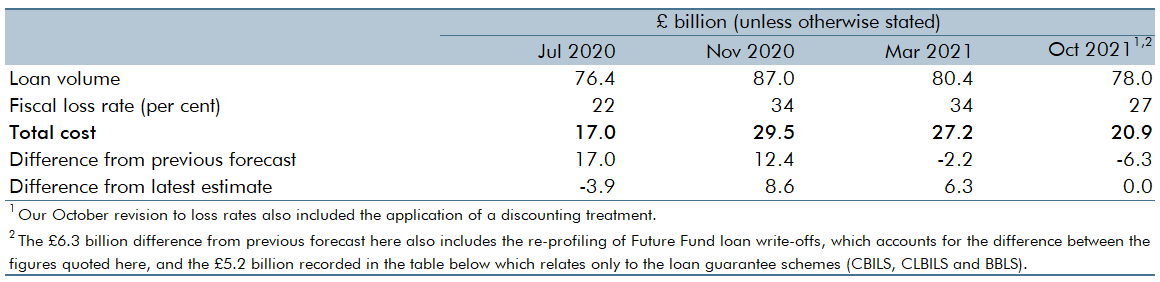

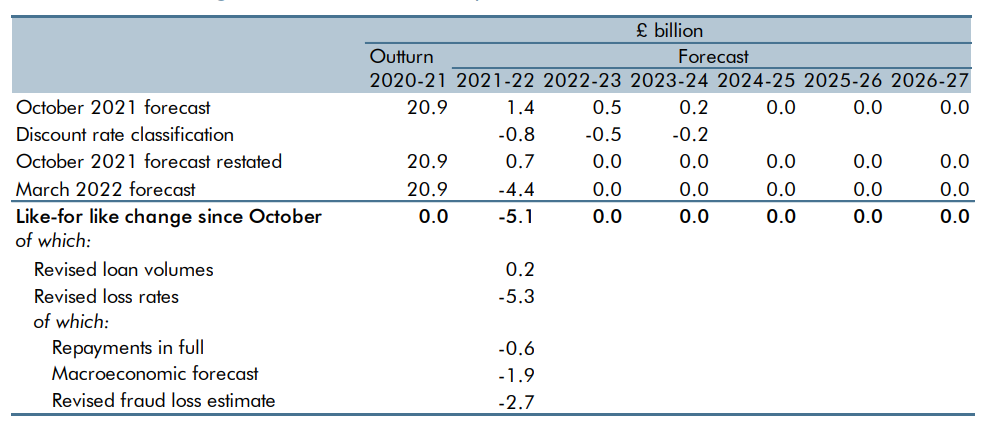

In our latest forecast, the cost of future guarantee claims relating to CBILS, CLBILS and BBLS is recorded as a loss of £20.9 billion in 2020-21 and a fiscal gain of £4.4 billion in 2021-22. The former reflects the estimates included in the ONS’s monthly public sector finances statistics at the time of our March 2022 EFO, while the latter reflects updated estimates from the Department for Business, Energy and Industrial Strategy (BEIS) that were incorporated into that forecast.