Forecast evaluation report – October 2023

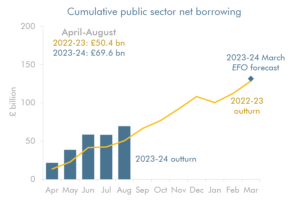

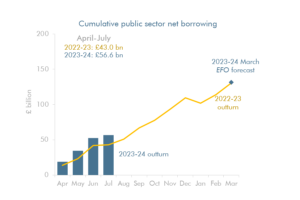

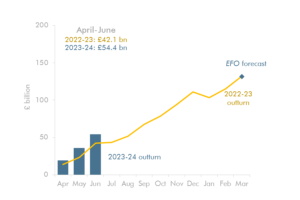

Our latest Forecast evaluation report (FER) will be published at 11am on Thursday 19 October. Our FER examines how our forecasts compare to subsequent outturn data and identifies lessons for future forecasts. This report will focus on how our March 2021 and March 2022 economy and fiscal forecasts for 2022-23 fared against the outturns.