We were asked by our stakeholders whether we considered the implications for current spending on public services (RDEL) in our forecasts to be central, as we are tasked with producing a central forecast. This box outlined RDEL implied spending from 2016-17 to 2019-20 (years in which firm spending plans did not exist and RDEL levels were set by a government policy assumption). The box also examined the implied breakdown of RDEL by some of the main spending areas in 2019-20, in particular examining the implications of then-current government RDEL assumptions for public services spending that was not protected in some way.

The remit set for the OBR by Parliament requires us to base our forecasts on the current policy of the current Government, and not to consider alternative policies. But we are also tasked with producing a central forecast. So we have been asked by stakeholders whether we consider the implications for current spending on public services (RDEL) of our forecast to be central.

The Government has set out detailed spending plans, department by department, through to 2015-16. For the remaining years of the forecast – which are also the remaining years of the next Parliament – it has made a ‘policy assumption’ regarding the growth of the current and capital components of total spending or Total Managed Expenditure (TME). By subtracting our forecasts for debt interest, social security and other so-called Annually Managed Expenditure (AME), we can derive implied limits on capital and current (or ‘resource’) spending by central government departments. These are referred to as Capital Department Expenditure Limits (CDEL) and Resource Departmental Expenditure Limits (RDEL). In essence, RDEL corresponds to day-to-day central government spending on public services and administration (including grants to local government). It is largely made up of spending on public sector pay and procurement.

Our forecast shows TME dropping from 45.3 per cent of GDP at its peak in 2009-10 to 40.5 per cent of GDP this year. It then drops to 39.5 per cent in 2015-16, the final year for which there are detailed departmental spending plans. The Government’s TME policy assumptions then imply a further drop to 35.2 per cent by 2019-20. Taken together, this implies a total cut in spending of 10.1 per cent of GDP over 10 years, with 48 per cent of that reduction due to be achieved by this year (the half-way point) and therefore 52 per cent still to come.

Within TME, the burden of cutting public spending falls most heavily on RDEL – especially over the remaining years of the consolidation. This is largely because of upward pressure on major parts of AME (notably debt interest and – thanks to the ‘triple lock’ – state pension costs) and the Government’s assumption that it would not cut the share of GDP spent on investment further from 2018-19 onwards.

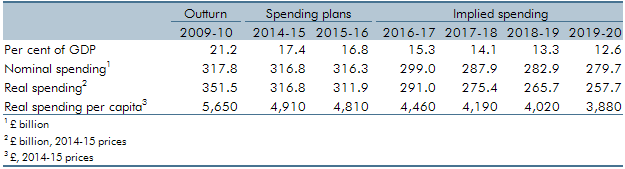

Table F also shows what this implies. In cash terms, we expect RDEL to have fallen from £317.8 billion in 2009-10 to £316.8 billion in 2014-15, a period over which nominal GDP will have risen by 21.3 per cent, whole economy prices by 10.6 per cent and the population by 3.6 per cent. This implies that over this Parliament, RDEL will have fallen by 17.8 per cent relative to the size of the economy, by 9.9 per cent in real terms and by 13.1 per cent in terms of real spending per person (from £5,650 per head to £4,910 per head in 2014-15 prices). Over the full 10 years, taking into account the final year of detailed spending plans and the four years of the spending assumptions, these declines increase to 40.3, 26.7 and 31.3 per cent respectively (taking real spending per head to £3,880).

On each definition, the figures imply that roughly 40 per cent of the total implied cut in day-to-day public services spending between 2009-10 and 2019-20 will have taken place over this Parliament, with roughly 60 per cent to come in the next. And most of the implied spending cuts in the next Parliament lie beyond the period for which there are currently firm departmental plans. Consistent historical data for RDEL are not available over a long period, but the closest equivalent in the National Accounts implies that by 2019-20 day-to-day spending on public services would be at its lowest level since 2002-03 in real terms (based on whole economy inflation), since 2001-02 in real terms per capita and since the late-1930s as a share of GDP.

Table F: Resource DEL spending

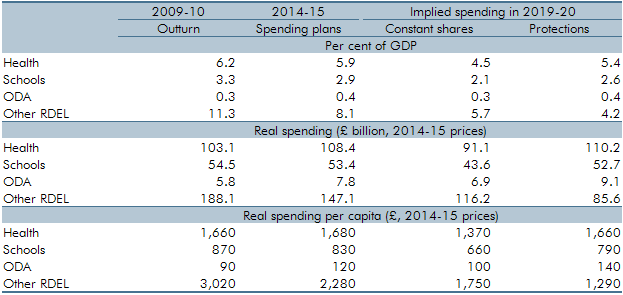

In considering whether the levels of RDEL implied by the Government’s detailed plans and spending assumption are consistent with a central forecast, we also need to address any additional constraints implied by their possible composition. As noted above, the Government has not set out a policy on the composition of RDEL beyond 2016-17, so we need to make an assumption in the spirit of current policy. Two obvious options present themselves:

- the composition of RDEL remains constant from 2015-16 onwards, the final year for which detailed plans have been set; or

- the real terms protections of spending on health and schools, and the per cent of GNI target for aid, are maintained, leading to sharper cuts in unprotected spending.

Table G sets out the implications of these assumptions. If all departments experienced proportionately equal cuts, health spending would be 1.4 per cent of GDP lower in 2019-20 than in 2014-15, down 16.0 per cent in real terms, taking real per capita spending down by 18.5 per cent. But if existing protections were assumed to continue through to 2019-20, health spending would be just 0.5 per cent of GDP lower than in 2014-15. In real terms, it would be flat from 2015-16 (a year in which health RDEL spending reflects changes announced in the Autumn Statement) and down 1.2 per cent in real per capita terms. However, spending on other departments would be 3.9 per cent of GDP lower than in 2014-15 and 7.1 per cent lower than the peak in 2009-10. Real per capita spending on these other departments would be 43.4 per cent lower than planned this year and 57.3 per cent lower than in 2009-10. The largest departments included in this ‘other’ line are the Ministry of Defence (£26.8 billion of RDEL excluding depreciation in 2014-15, or 1.5 per cent of GDP) and the Department for Business, Innovation and Skills (£13.8 billion or 0.8 per cent of GDP).

Table G: Implied breakdown of RDEL in 2019-20

The implied cuts in RDEL during the next Parliament would pose a significant challenge if they were confirmed as firm policy, one that would be all the greater if existing protections were maintained. But we do not believe that it would be appropriate for us to assume, ex ante, that these cuts would be inherently unachievable and make it our central forecast that this or a future Government would breach its stated spending limits if it chose and tried to implement them. After all, the squeeze on spending has already been significant over this Parliament and – to date – central government spending has continued to come in comfortably below the DEL limits set by the Treasury, while local authorities continue in aggregate to build up their financial reserves rather than running them down. But if this ceased to be the case, we might need to include an ‘allowance for overspending’ in our forecasts, similar to the ‘allowance for shortfall’ that we currently incorporate to reflect likely underspending against DEL plans.

It is quite possible, of course, that this or a future government would adopt different policies, in terms of its ultimate fiscal objectives, the mix of tax and spending, or the mix within spending. In which case we would reflect this in our central forecast. Indeed, both member parties of the Coalition have said that they would adopt a different approach to tax and spending policies if either was elected to govern alone, as has the Labour Party. Doubtless each party will be asked to provide greater details of its plans in the run-up to the General Election.