The Government announced the establishment of a new UK Infrastructure Bank (UKIB) at Budget 2021 to tackle climate change and support regional and local economic growth. It does this in part by replacing some of the activity of the European Investment Bank (EIB). This box looked at how UKIB will operate and how this compares to the EIB, as well as briefly exploring potential fiscal and classification risks.

This box is based on EIB and OBR data from February 2021 .

The Government has announced the establishment of a new UK Infrastructure Bank (UKIB) this year to help deliver on its National Infrastructure Strategy.a Like the European Investment Bank (EIB) of which the UK is no longer a member, the UKIB will extend loans, equity financing, and guarantees to fund projects that will help tackle climate change (‘net zero’) and to support regional and local economic growth (‘levelling up’). The Treasury has placed a cap on the bank’s capital over the next five years that amounts to £12 billion in actual liabilities (to finance loans and equity) and a further £10 billion in contingent liabilities (in the form of guarantees). The Bank also will take over the UK Guarantee Scheme, which can currently issue up to £40 billion in guarantees, though the Bank will initially be able to issue £10 billion of this.

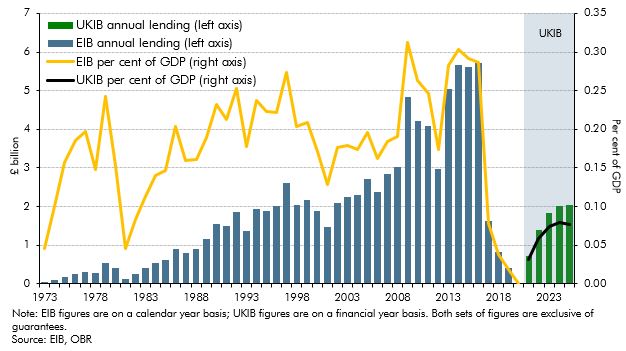

As an EU member state, the UK received almost €120 billion (or £89 billion) in loans and equity from the EIB between 1973 and 2019. In the five years prior to the EU referendum in 2016, EIB lending averaged £5 billion a year, but it fell sharply in 2017 and was less than £1 billion a year in 2018 and 2019. The Government forecasts that the UKIB will lend and invest around £1½ billion a year (net of lending to local authorities that would otherwise have taken place through the Public Works Loans Board). This would be equivalent to around a third of the financing that was provided by the EIB prior to the EU referendum (Chart G). National investment banks exist in many countries. One of the largest and longest established is Germany’s Kreditanstalt für Wierderaufbau (KfW), which as of 2019 has total assets of €506 billion (14.7 per cent of Germany’s GDP).

Chart G: UKIB lending forecast relative to historical EIB lending

The Government’s intent for UKIB is to boost private sector investment in UK infrastructure. We therefore considered whether to reflect its launch explicitly in our economy forecast. However, given the scale its operations (at around 0.1 per cent of GDP a year) and the fact that it replaces only some EIB activity, we have not adjusted our economy forecast. Our fiscal forecast reflects the direct effect of the bank’s activities on public sector net debt (which rises to £6.6 billion by 2025-26) and its more modest effects on public sector net borrowing (which lower it by amounts that rise to £0.3 billion in 2025-26, largely from guarantee fees).

The UKIB’s balance sheet will provide another channel along which the public sector as a whole is exposed to wider economic risks, thereby increasing the potential impact of future economic shocks on the fiscal position. The projects that the UKIB will invest in are likely to involve a reasonable degree of risk, as will the financing tools it will use. Projects may have revenue or construction risks, resulting in loss of forecast revenue or additional costs, or the Government could see calls on guarantees or loans may be unpaid.

As well as being a potential source of real world fiscal risk, the UKIB’s operations could generate

statistical classification risks. Our forecast assumes that the UKIB itself will be classified as a

central government body, while any private sector entities that it engages with will remain

classified as such. But if the UKIB were to be deemed to have taken sufficient control over those

entities, they could be classified to the public sector, or large infrastructure projects could be

recorded on the public sector’s balance sheet. If reclassified, the liabilities of these entities would

be captured in headline measures of public sector net debt but their non-liquid financial assets

(such as equity) and fixed assets (such the infrastructure networks themselves) would not be

recognised as assets in public sector net debt.

This box was originally published in Economic and fiscal outlook – March 2021