In our March 2023 Economic and fiscal outlook, we evaluate the impact of the freeze or reduction of various personal tax thresholds since April 2021. This box looked at the receipts generated by these measures as well as the impact on taxpayers: the number of new taxpayers these measures create and the number of taxpayers pulled into higher and additional rates.

This box is based on OBR data from March 2023 .

Many personal tax thresholds have been frozen in cash terms since April 2021, whereas previously most were due to rise in line with CPI inflation. The resulting ‘fiscal drag’ is set to raise significant sums as the average effective tax rate (total tax paid as a share of total income) rises more quickly over time. This happens as nominal earnings rise relative to tax thresholds, so that more of taxpayers’ income is taxed, and more of what is taxed falls into higher tax bands.a The most important threshold changes and freezes include:

- At March Budget 2021, then Chancellor Sunak announced that the personal allowance (PA) and higher-rate thresholds (HRT) of income tax would be frozen at 2021-22 levels for the four years up to and including 2025-26. At Autumn Statement 2022 Chancellor Hunt extended the freeze by a further two years. The now six-year freeze in the PA takes its real value in 2027-28 back to its 2013-14 level.

- The additional-rate threshold (ART) was lowered from £150,000 to £125,140 from April 2023 (to align with the personal allowance taper) at Autumn Statement 2022. It had been frozen in cash terms at £150,000 since its introduction in April 2010 and will remain frozen in cash terms at its lower level.

- The primary threshold and lower profits limit for NICs were increased to align with the PA at Spring Statement 2022 (with an equivalent rise in Class 2 NICs) but (like the PA) also frozen until 2025-26. The freeze was extended to 2027-28 at Autumn Statement 2022, when the employer NICs secondary threshold was also frozen from 2023-24 to 2027-28. The latter measure means that all the main personal tax thresholds are now frozen in cash terms across our entire forecast period.

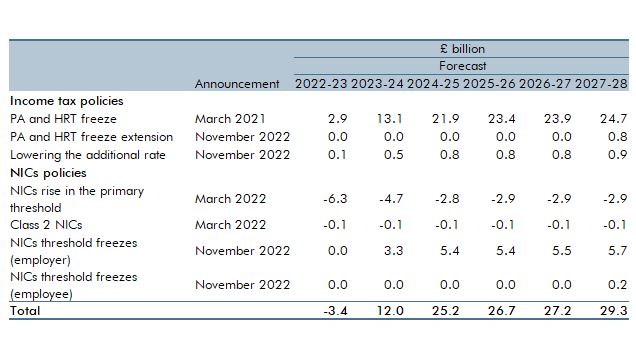

Our latest estimate is that these measures will increase receipts by a combined £29.3 billion a year (1.0 per cent of GDP) in 2027-28, as shown in Table A. Based on HMRC ready reckoners, this would be equivalent to a 4p increase in the basic rate of income tax. It is dominated by the yield from freezing the PA and the HRT.

Table A: Latest costings of personal tax threshold measures

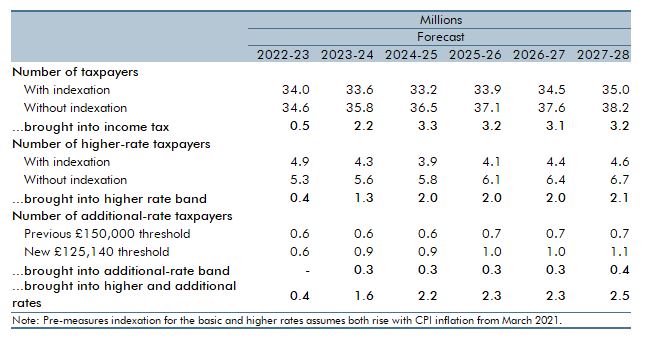

As nominal earnings grow, these measures bring more people into income tax and NICs, and pull more taxpayers into higher and additional rates than would have occurred had the thresholds continued to rise with CPI inflation (i.e. there would be fewer taxpayers subject to each marginal tax rate in the counterfactual, assuming the same level of earnings growth). Based on our latest forecasts for earnings growth and CPI inflation, these measures are expected to generate 3.2 million (9 per cent more) new taxpayers, 2.1 million (47 per cent more) new higher-rate taxpayers, and 0.35 million (47 per cent more) additional-rate taxpayers by the end of the forecast than would have been had the thresholds continued to be uprated with inflation or, in the case of the ART, remained flat at a higher level. These figures are a touch lower than our estimates in November thanks largely to the revised profile for CPI inflation.

Table B: Number of individuals moved into paying income tax and into paying higher marginal tax rates due to threshold policies announced since March 2021

This box was originally published in Economic and fiscal outlook – March 2023