Over the last 3 years, the UK corporation tax system has witnessed four major changes which have consequences on the outlook for business investment. In this box, we explored the effect of the corporation tax rate rise and the super-deduction on investment, before assessing the impact of moving from temporary to permanent full expensing as announced in this Autumn Statement.

This box is based on ONS data from October 2023 and September 2023 .

The last three years have witnessed four major changes in the general corporate tax system:a

- The March 2021 Budget announced a permanent increase in the headline rate of corporation tax from 19 to 25 per cent for firms with profits over £250,000. This took effect from April 2023. The 19 per cent tax rate was retained for smaller firms, which account for 18.5 per cent of total receipts.

- The same Budget introduced a temporary 130 per cent super-deduction for all qualifying plant and machinery investments undertaken between April 2021 and March 2023.

- In the March 2023 Budget, the Chancellor announced temporary full expensing, which gave a 100 per cent tax deduction for all qualifying plant and machinery investments undertaken between April 2023 and March 2026.

- In this Autumn Statement, the Chancellor has announced permanent full expensing for all qualifying plant and machinery investments.

This succession of tax changes took place against the background of a rapidly changing economic landscape, including supply bottlenecks for key inputs, a spike in inflation, and a dramatic rise in the cost of capital from higher interest rates. Against this volatile background, this box considers the evidence on how business investment has responded to past tax changes and the likely impact of permanent full expensing.

Corporation tax increase and the super-deduction

The increase in the corporation tax rate was previously assumed to reduce the optimal long-run capital stock and business investment via a higher long-run cost of capital. In isolation, we estimated this would lower potential output by 0.2 per cent over the forecast period, increasing to 0.3 per cent in the longer term.

In 2021-22 and 2022-23, we assumed firms would bring forward some investment to take advantage of the temporary 130 per cent super-deduction, which we initially assumed would have, on its own, a peak business investment impact of 10 per cent. As well as boosting investment in its own right, this measure provided a counteracting effect to the incentive firms would have otherwise had to delay investments to take advantage of capital allowances being more generous after the corporation tax rate rise in April 2023.b

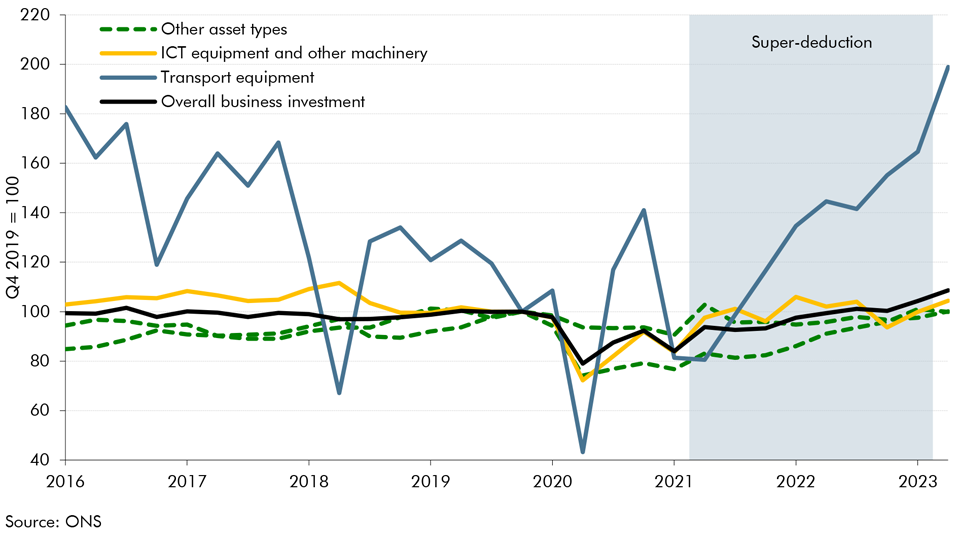

We subsequently revised down the impact to 5 per cent in March 2022, informed by survey evidence from Deloitte and the CBI suggesting lower take-up and strong corporation tax data. Based on the latest outturn data, there is some evidence that the super-deduction brought forward some qualifying investments, although it does not seem to have significantly boosted overall business investment. Over the two-year super-deduction period, business investment has risen for some asset groups that were eligible for the super-deduction, such as transport and ICT equipment and machinery (Chart F). However, classifications of qualifying assets and data for business investment asset groups do not fully align, making it difficult to draw firm conclusions.c

Chart F: Business investment by asset type

More recent survey evidence has indicated a smaller but still positive impact from the super-deduction, with the Business Insights and Conditions Survey (BICs) suggesting at least a 2 to 3 per cent increase in business investment from the policy for a ‘representative’ firm – lower than our estimated peak of 5 per cent. This may reflect the fact that large firms who were more likely than others to use the super-deduction, typically invest more, or that they responded more to the changes in their incentives than a representative firm. It could also be due to the limited time window for businesses to take advantage of the subsidy. Overall, given the disruptions from the pandemic, energy crisis, and Brexit, and the impact of the pre-announced rise in corporation tax, the fact that investment did not fall over the past two years suggests that the super-deduction worked as intended to support investment.

Temporary and permanent full expensing

At the time of our March 2023 forecast, we expected the new temporary investment allowances announced in the Budget to incentivise firms to bring forward further capital spending in the qualifying timeframe of March 2023 to April 2026. This boosted investment by just over 3 per cent a year over a period of three years (as the scheme’s longer duration meant the incentive to concentrate investment was weaker than we assumed for the years the super-deduction was in place). So far, respondents to the Bank of England’s latest Decision Maker Panel survey have reported an average expected rise in investment of 1.5 per cent over the years that temporary full expensing was in place.d

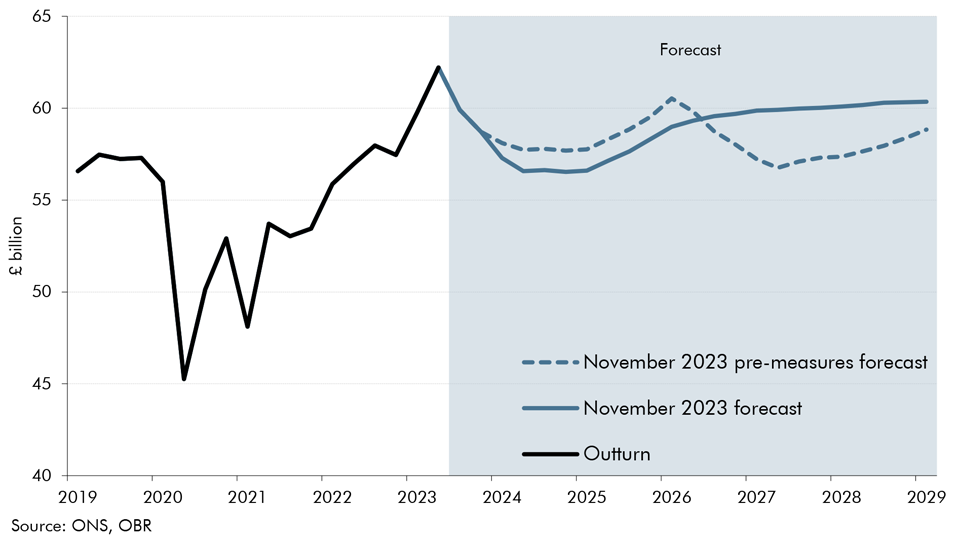

In this Autumn Statement, the Chancellor has announced that the 100 per cent capital allowances measure will be made permanent. By delivering a lasting reduction in the cost of capital, we assume this would induce a rise in the economy’s optimal capital stock of 0.5 per cent in the long run, which was absent in the case of temporary capital allowances. Permanent full expensing removes the near-term incentive to bring investment forward into the period over which the temporary policy would have been in place. This means that real investment is lower in the first half of the forecast period by £11 billion compared to what we previously assumed (Chart G). But it is higher in the medium term by £25 billion. Overall, the shift from temporary to full expensing has increased total business investment by £14 billion over the forecast period or £3 billion a year (1.2 per cent on average). For discussion of the GDP implications of this higher investment, see Box 2.1.

Chart G: Business investment forecast

This box was originally published in Economic and fiscal outlook – November 2023