On 31 January 2020, the UK left the EU and the transition period was set to finish at the end of 2020. This box set out our estimate of the effect of the EU referendum result on productivity to date. It also outlined the effect that leaving the EU and trading under the terms of a typical free trade agreement - which we assumed in this forecast - will have on productivity in the long run.

This box is based on ONS data from February 2020 .

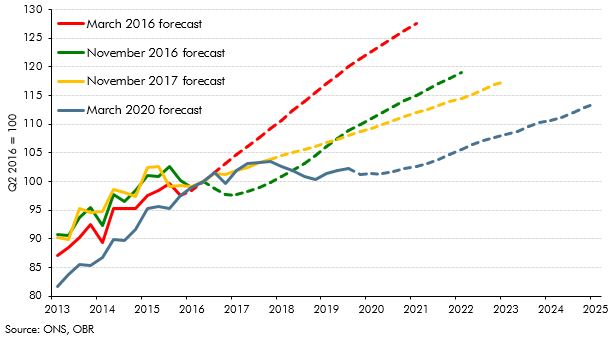

In our November 2016 forecast – our first following the EU referendum – we assumed that the UK would leave at the end of March 2019. With the possibility of a transition period, and our forecast extending only to 2021, it was therefore likely that the UK would still be trading under EU rules for most of the forecast period. To form our productivity judgement, we therefore concentrated on the near-term effect of heightened uncertainty on business investment and capital deepening, rather than longer-term effects from higher trade barriers. We anticipated that this would reduce the level of productivity by 1.4 per cent by the first quarter of 2022 – 1.0 percentage points of which was expected to have occurred by now – relative to what would otherwise have happened.

In the event, business investment has been even weaker than we expected immediately after the referendum (Chart A). Recent productivity growth may have also been dampened by a diversion of resources away from productive activities to prepare for Brexit – especially the possibility of ‘no deal’.a As a result of these two factors, we have increased our estimate of the impact of Brexit on productivity to date, from 1.0 to 1.4 per cent. At least some of these effects may start to unwind once the details of the future trading regime are known.

Chart A: Successive OBR business investment forecasts

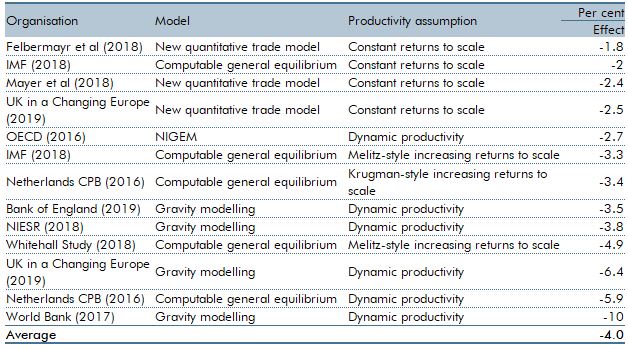

Once the transition period ends, the effect of higher trade barriers on trade intensity and productivity will increasingly come into play.b Drawing on available analysis,c we have assumed since our November 2016 EFO that both exports and imports would be around 15 per cent lower after 10 years than they otherwise would have been. More recent studies confirm that this assumption is broadly consistent with the average estimated effect of leaving the EU, to trade instead under the terms of a typical free trade agreement.d

Higher trade barriers impose an additional burden on exporters and importers, lowering (total factor) productivity directly. In addition, they inhibit the exploitation of comparative advantage, leading to lower trade intensity and a less efficient international distribution of production. While some of the adjustment will need to take place quickly, the consequential changes to the UK’s industrial structure may be quite drawn out. As a result, the process of adjustment is likely to weigh on productivity growth for several years. Some studies suggest that dynamic effects – for instance through the impact on knowledge transfer – are also possible.e

With the outcome of the negotiations still unknown, we have not modelled the long-run impact on productivity and GDP of a specific trading relationship. But, consistent with the formal negotiating objectives of the UK and the EU, we have looked at estimates of the effect of leaving the EU to trade under the terms of a typical free trade agreement. These point to a central estimate of an effect on potential productivity – i.e. including both the effects on total factor productivity and capital deepening – in the region of 4 per cent in the long run (Table A), although the range of estimates is wide.

Table A: Long-run effect on productivity of trading with EU on FTA terms

With the impact of Brexit on productivity already having reached 1.4 percentage points, according to our estimates, around one third of the long-run impact is, in effect, already in the data. While some of the drag on investment from uncertainty should unwind once uncertainty over the future trading relationship between the EU and UK is resolved, any reversal should be more than offset by the effect of higher trade barriers on productivity. There is little evidence about the pace at which these effects will be manifest, but we assume that it will take 15 years for the impact to come through in full, but with some front-loading. Specifically, we assume a further third of the long-run productivity effect – in net terms – will take place over our current forecast period and the final third beyond the forecast horizon (and incorporated this effect into our long-term economic determinants, discussed in Annex B). There is, of course, considerable uncertainty about both the size and timing of the effect of Brexit on potential productivity, but it is completely dwarfed by the uncertainty surrounding the underlying path of future productivity growth (also discussed in Annex B).

This box was originally published in Economic and fiscal outlook – March 2020