In this forecast, there were two policy switches that shifted spending between RDEL and AME, which applied from 2015-16 onwards. This box outlined these changes and examined the subsequent impact these would have on our forecast.

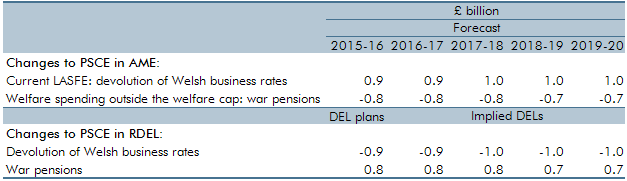

In this forecast, there have been two switches between RDEL and AME that apply from 2015-16 onwards. Within AME, these changes reduce welfare spending and increase local authorities’ self-financed current spending (current LASFE), giving a small increase overall that is mirrored by a small net reduction in RDEL. Specifically, as shown in Table A:

- war pensions will be will be switched out of Ministry of Defence AME into Ministry of Defence RDEL; and

- business rates in Wales will be switched out of the Welsh Assembly DEL into (non-departmental) current LASFE. In effect, they will be treated as finance raised and spent in Wales rather than as central government funding distributed from Whitehall.

Table C: DEL and AME switches for war pensions and Welsh business rates

DEL plans for 2015-16 have also been updated to reflect the DEL spending financed by Scottish taxes and borrowing in the DELs for Scotland. Specifically:

- within PSCE in RDEL, RDEL has been increased by £0.5 billion, for the spending financed by the Scottish devolved taxes for land and building transactions and landfill; and

- this is offset within PSCE in RDEL by a reduction in the Scottish block grant of £0.5 billion.

PSGI in CDEL already includes £0.3 billion of capital spending that is expected to be financed by Scottish borrowing. This was included in CDEL plans in PESA 2014.