The UK’s exit from the EU presented fiscal savings to the Government in the form of transfers to EU institutions that featured in spending and retained customs duties. We assumed these would be fully recycled into substitute UK spending in previous forecasts. This box explained how we treated these flows as ‘DEL in waiting’ and how this related to the large increases in departmental spending.

In our November 2016 EFO, we set out broad-brush assumptions regarding the UK’s prospective exit from the EU. These included two fiscally neutral holding assumptions, related to the UK’s direct fiscal interactions with the EU – namely the transfers to EU institutions that feature in AME spending and the customs duties collected on behalf of the EU. Specifically, we assumed that net expenditure transfers to EU institutions – after factoring in the cost of the financial settlement – would be fully recycled into substitute UK spending. These transfers were labelled as ‘Assumed spending in lieu of EU transfers’ in AME, but have in effect been ‘DEL in waiting’. Customs duties were treated in the same way, but on a net rather than a gross basis.

We do not typically anticipate Government policy in this way, but it quickly made commitments in respect of farming support, industrial strategy and science programmes that meant that if we had not done so, our central forecast would have been inconsistent with the intended path of public spending. Now that the UK has left the EU and the Government has set out the path of departmental spending over the next five years, we can remove the assumption that the direct fiscal savings from Brexit will be spent – there is no more ‘DEL in waiting’ as it is now in DEL.

As the Government has chosen to increase DEL spending by more than the implied AME savings and retained customs duty receipts, it is moot – from the point of view of the overall public finances – whether the Government will actually fully replace all the previous EU spending programmes. We have therefore not attempted to map the individual spending lines.

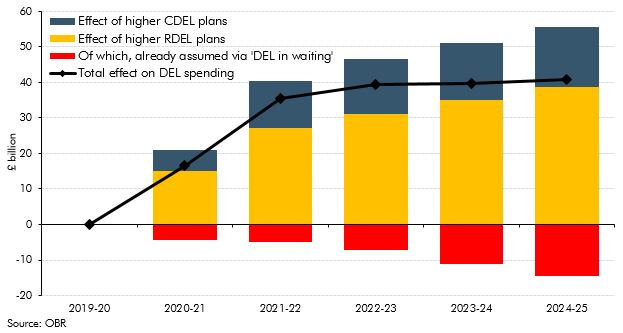

Table C shows how we moved from our pre-measures forecast containing ‘DEL in waiting’ within AME to a post-measures forecast with that assumption removed. ‘DEL in waiting’ was the sum of customs duties retained from January 2021 and the difference between our ‘no-referendum counterfactual’ view of EU transfers and the financial settlement. This increased from £4.3 billion in 2020-21 to £14.6 billion in 2024-25. After our underspend assumptions, the Government’s new DEL spending plans raise RDEL and CDEL spending in 2024-25 by £38.9 billion and £16.7 billion respectively. This means £40.9 of the £55.5 billion increase in DEL spending in 2024-25 feeds through to higher total managed expenditure and therefore to borrowing (Chart C).

Table C: DEL spending and use of the direct fiscal savings from Brexit

Chart C: DEL-in-waiting versus new DEL spending plans

This box was originally published in Economic and fiscal outlook – March 2020