Revisions to National Accounts data are a normal part of the Blue Book process, which reconciles the different measures of GDP and incorporates information from annual data sources. This box explored the different picture of the late 2000s recession and recovery in light of the 2012 Blue Book.

In Blue Book 2012 the ONS fully ‘balanced’ the 2010 GDP data for the first time and rebalanced 2009. This process involves using detailed industry level data to align the output, income and expenditure measures of GDP. As a result we now have a different picture of the recession and recovery to that painted in the earlier vintages of data. These changes reflect the inclusion of more data in the GDP estimates and methodological changes, such as the move to a CPI based GDP deflator.a

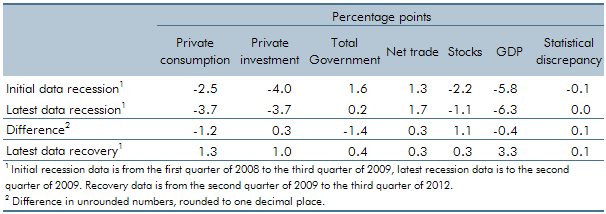

The 2008-09 recession is now thought to have been shorter and sharper than the original ONS estimates. Latest estimates show the trough of the recession in the second quarter of 2009, a quarter earlier than the original estimate. The peak-to-trough fall in GDP is now estimated to have been 6.3 per cent, compared to the original estimate of a 5.8 per cent fall, as shown in Table A. The composition of the fall in GDP during the recession has also changed. Private consumption and government spending were weaker than previously thought, whereas private investment, stock building and net trade were stronger.

It is notable that the recovery so far has been driven by growth in private consumption and private investment with net trade making only a small contribution to GDP growth. This low contribution reflects the weakness of net trade in the first half of this year. Up until the final quarter of 2011 net trade had made a contribution to GDP growth of 0.9 per cent. The contribution of net trade and private consumption has been revised up from earlier vintages of data, while the contribution of stock building and government spending has been revised down. The revisions to net trade during the recession and early part of the recovery had helped to in part resolve the puzzle of why net trade had not responded more strongly to the depreciation of sterling. But data so far in 2012 suggests that this puzzle may be re-emerging, although the weakness of the euro area also helps to explain the recent net trade data.

Table A: Contributions to real GDP growth during the 2008-09 recession and the recovery