Receipts from capital gains tax (CGT), inheritance tax (IHT) and stamp duty land tax (SDLT) were expected to rise sharply over our March 2014 forecast. This box set out the drivers behind that rise, in particular the impact of rising effective tax rates.

This box is based on HMRC stamp duty and house prices data from February 2014 .

Receipts from capital taxes – which include capital gains tax (CGT), inheritance tax (IHT), stamp duty land tax (SDLT) and stamp duty on shares – are expected to rise sharply from 1.0 per cent of GDP in 2012-13 to 1.8 per cent of GDP by 2018-19. This would be higher than their 1.6 per cent of GDP peak in 2007-08, prior to the financial crisis. This reflects rising asset prices over the forecast period and the structure of the particular taxes.

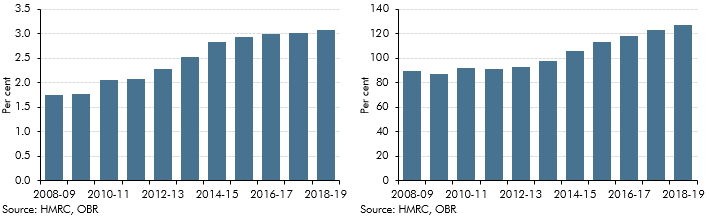

SDLT receipts are expected to have risen by 37 per cent in 2013-14. This reflects the rebound in property transactions from depressed levels as credit conditions have eased, strong house price inflation in London (which already accounts for over 40 per cent of total SDLT) and the tax structure of SDLT. With a ‘slab’ structure, where you pay one rate on the whole property price, and fixed nominal thresholds, SDLT is highly geared to changes in house prices. In particular, with the rate of stamp duty rising from 1 per cent to 3 per cent at a threshold of £250,000 the amount of stamp duty paid on a transaction rises from £2,500 for a transaction worth £250,000 to £7,500 for one worth £1 more. We now expect the average house price to exceed the 3 per cent threshold for the first time this year. The average effective tax rate on SDLT is expected to rise from 1.7 per cent in 2008-09 to over 3 per cent by the end of the forecast period.

Chart A: Stamp duty land tax effective tax rate (left) and Chart B: Average house prices as a proportion of the 3 per cent threshold (right)

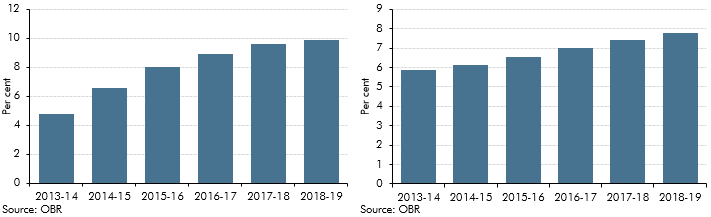

With housing accounting for around 50 per cent of estates notified for probate, the recovery in house prices over the past year has also helped to generate an 11 per cent rise in inheritance tax receipts in 2013-14. Further rises in house prices, equity prices and the stock of household deposits over the forecast period and the tax structure of IHT are expected to drive a rise of nearly 70 per cent in IHT receipts by 2018-19. The nil-rate band of £325,000 and transferable nil rate (for widows and widowers) of a further £325,000 are both being frozen until the end of 2017-18. Our forecast suggests that the proportion of deaths resulting in estates large enough to attract IHT liabilities will double over the next five years from a little under one in 20 to a little under one in ten. The effective tax rate on estates that attract IHT will also increase, largely as IHT is paid on a bigger proportion of the overall estate.a However, these effects would be partly offset by a roughly 40 per cent fall in the average size of estates, as a larger number of relatively smaller estates are brought into IHT.

Chart C: Share of deaths subject to IHT (left) and Chart D: Inheritance tax effective tax rate (right)

Although CGT was flat in 2013-14, we expect yield from the tax to more than double by 2018-19. CGT is highly geared to changes in equity prices since around three-quarters of chargeable gains are related to financial assets and CGT is only charged on the gain rather than the whole disposal price. We assume equity prices will rise from their current starting point in line with nominal GDP.