In the December 2014 Economic and fiscal outlook, we identified the adjustment in the euro area as a risk to our forecast. This box highlighted some of the key indicators that commentators were using to measure the progress of that rebalancing.

This box is based on Eurostat current account, labour and financial sector and IMF international financial data from November 2014 and October 2014 respectively.

In previous EFOs and again in this forecast, we have identified the ongoing adjustment in the euro area as a risk to the UK economic outlook. This adjustment has progressed since the late 2000s recession, but remains far from complete.

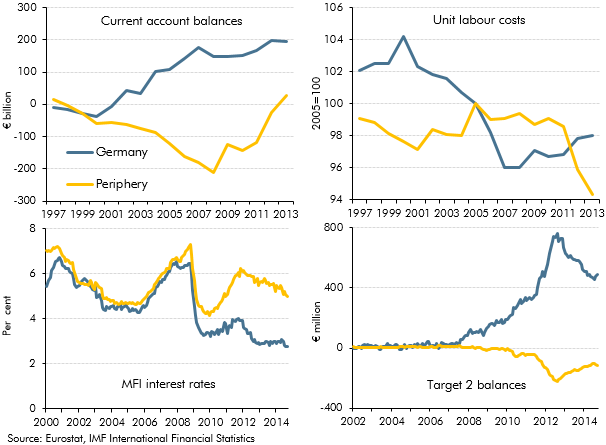

Chart A presents four different indicators of macroeconomic and banking sector adjustment that are among those used by commentators to monitor how rebalancing is progressing. They compare developments in Germany with those on average in Greece, Italy, Spain and Portugal as a representative composite ‘periphery’ economy.

Indicators of macroeconomic adjustment include:

- current account balances: these illustrate the balance of domestic demand and supply in individual economies. Periphery deficits widened up to 2008 and have narrowed since, while surpluses in Germany have continued widening. A recent IMF paper argued that the adjustment there has been to date has been largely cyclical and relative to non-EA countries. Given that the EU accounts for over 40 per cent of UK exports, this will have weighed on the UK economy via weakness in external demand.a

- relative unit labour costs: these illustrate the relative competitiveness of economies. From the introduction of the euro in 1999 up to the crisis, unit labour costs fell substantially in Germany but increased in the periphery. Unit labour costs have fallen dramatically in the periphery since 2011 as a result of internal devaluation and have increased in Germany over the same period, showing progress in rebalancing.

Indicators of banking sector adjustment include:

- interest rates paid by the private sector:these illustrate the extent to which banking sector imbalances are affecting domestic private sectors. Interest rates paid by companies in the periphery and Germany have diverged since the financial crisis, with those in the periphery substantially higher. The spread has narrowed somewhat since the ECB’s pledge to do ‘whatever it takes’ to preserve the euro in July 2012, but a large part of the difference remains; and

- ‘Target2’ balances in the euro area central banking system: Target2 is the payment system that processes interbank transfers in the EU, with imbalances reflecting the extent to which commercial banks need to draw on the support of their national central banks. The German Bundesbank accrued large surpluses on these balances between 2008 and 2012, with corresponding deficits at the central banks of periphery economies. These disparities have since narrowed, but remain higher than their pre-crisis levels.

Chart A: Indicators of euro area rebalancing