The average maturity of UK government bonds is longer than the average maturity of government debt in most other advanced economies. But the average maturity of the net debt of the public sector as a whole (including the Bank of England) has shortened considerably since the global financial crisis. In this box, we explored how the Bank of England's quantitative easing operations have shortened the maturity of public sector net debt, dramatically increasing the sensitivity of debt interest spending to changes in short-term interest rates.

This box is based on Bank of England, DMO and OBR data from February 2021 .

The average maturity of UK government bonds (known as gilts) is longer than the average maturity of government debt in most other advanced economies. But the average maturity of the net debt of the public sector as a whole (including the Bank of England) has shortened considerably since the global financial crisis. This is due to large-scale gilt purchases by the Bank of England, via its Asset Purchase Facility (APF), as part of its quantitative easing (QE) operations.

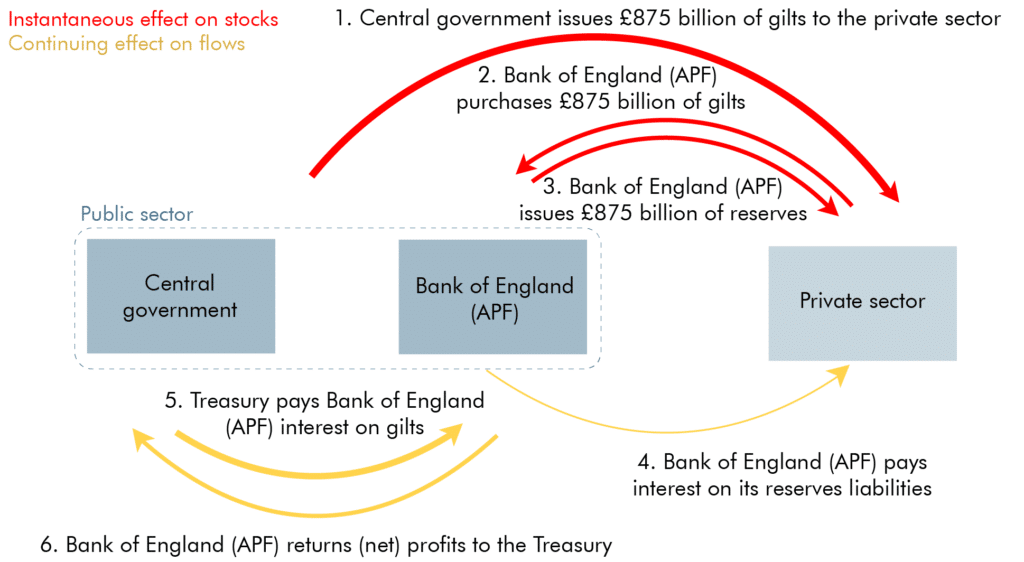

These gilt purchases have been financed through the creation of extra central bank reserves. These can be thought of as akin to a deposit account that private banks hold at the central bank, on which the Bank pays interest at its policy rate (‘Bank Rate’). The gilts are therefore effectively replaced as a liability of the public sector (the outstanding interest on the debt is returned to the Treasury via the APF) by the reserves created to finance their purchase (Figure A).

By the end of 2021-22, 32 per cent of the public sector’s gross debt (£875 billion out of £2.7 trillion) will be in the form of central bank reserves issued to finance gilt purchases. As these reserves currently pay an interest rate of 0.1 per cent – whereas the gilts they have in effect refinanced pay an average interest rate of 2.1 per cent – the net interest saving for the public sector as a whole is estimated at £17.8 billion in 2021-22.

However, because the gilts purchased by the Bank have an average maturity of 13 years, whereas the liabilities issued to finance them carry an overnight rate of interest, this net saving comes at the price of a significant reduction in the average maturity of the net debt of the public sector as a whole. This dramatically increases the sensitivity of debt interest spending to changes in short-term interest rates.

Figure A: Direct effects of the Asset Purchase Facility on the public finances

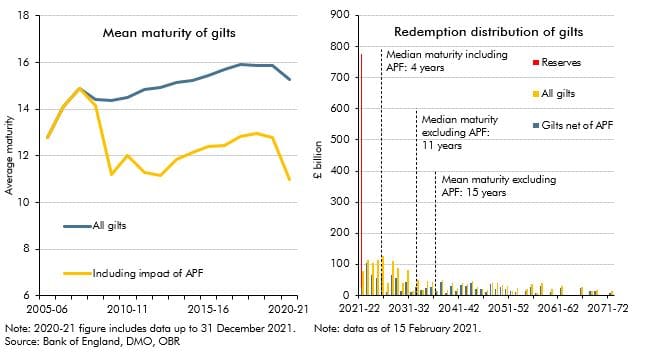

To illustrate this, the left-hand panel of Chart A shows that the mean maturity of the government’s total gilt liabilities, including those held in the APF, was over 15 years at the end of 2020, very long by international standards. This means that changes in long-term interest rates affect debt interest payments relatively slowly (with around a third of the effect felt within five years). By contrast, the interest paid on the entire stock of central bank reserves responds immediately to changes in Bank Rate. The Bank has not yet completed all the purchases necessary to complete its latest round of QE, but the effect of the £750 billion worth of gilts by the end of 2020 has been to reduce the effective mean maturity of the gilt stock to 11 years. By the end of the current gilt purchase programme in 2021-22, it will have fallen further to around 10 years. This lower mean maturity results in greater interest rate sensitivity.

On the face of it, this looks very similar to what would have happened if there had been no gilt purchases by the Bank but the Government had issued an equivalent quantity of Treasury bills (which typically pay a rate of interest that is very close to Bank Rate) instead of the gilts that were acquired by the APF. And the response of debt interest spending to changes in interest rates would indeed be very similar. Such Treasury bills would need to be refinanced as they matured, however, leaving the Government exposed to financing risk. That is not an issue with financing through the issuance of central bank reserves, as reserves do not mature as bills do and can only be redeemed into cash. So while the effect on interest rate sensitivity is similar to what would have happened if the Government had financed its borrowing by issuing £875 billion of 3- month Treasury bills, the effect on financing risk is the equivalent to having done so by issuing that amount of perpetual floating-rate bonds.

Chart A: Mean maturity and redemption distribution of gilts

But when assessing medium-term fiscal risks, the median maturity – representing the point at which half of the stock will have responded to interest rate changes – is probably a more useful summary statistic than the mean; the latter will be heavily influenced by the presence of very long maturity debt whereas the redemption profile of gilts is very front-loaded. The right-hand panel of Chart A shows the impact of QE on the median maturity of public sector debt. With large redemptions in the near term and a tail of smaller very long-dated gilts, this results in a median maturity that is considerably lower than the mean – 11 years versus 15 when ignoring the APF, but a more dramatic shortening to 4 years rather than 11 when the effects of the APF are factored in.

This median maturity will continue to decline over 2021 as the Bank continues to buy gilts. In addition, the other main sources of government financing (Treasury bills and NS&I savings products) are either variable rate or short-dated, which further increases interest rate sensitivity relative to that implied by gilt liabilities alone. Including these liabilities as well reduces the median maturity to less than one year by March 2022.

Overall, this means that 59 per cent of the government’s debt liabilities will respond to interest rate changes over the forecast period. The equivalent figure would have been 44 per cent prior to the commencement of the QE programme in 2009 when debt levels were also much lower.

To illustrate the potential fiscal impact of an increase in interest rates, if short- and long-term interest rates were both 1 percentage point higher than the rates used in our forecast – a level that would still be very low by historical standards – it would increase debt interest spending by £20.8 billion (0.8 per cent of GDP) in 2025-26. To put this into context, it is roughly equivalent to two-thirds of the medium-term fiscal tightening announced by the Chancellor in this Budget.

In isolation, such a rise in interest rates would therefore make the task of keeping debt on a sustainable path more difficult. But debt sustainability is also affected by the level of debt, the rate of growth in GDP and the primary balance, so any assessment of the broader fiscal risks posed by greater interest rate sensitivity also needs to take on board the reason for the increase in interest rates:

- In a benign scenario where the increase in interest rates reflects higher economic growth, the debt stock could ultimately be lower and the primary balance more favourable, all resulting in a virtuous fiscal circle.

- But malign scenarios are possible too. If interest rates rise because investors demand a higher risk premium for some reason, this would be more likely to be accompanied by a deteriorating economic and fiscal position, resulting in a vicious fiscal circle. In such circumstances, governments can find it difficult to make the spending cuts and tax rises necessary to restore the debt trajectory to a sustainable path.

This box was originally published in Economic and fiscal outlook – March 2021