Forecast evaluation report 2021

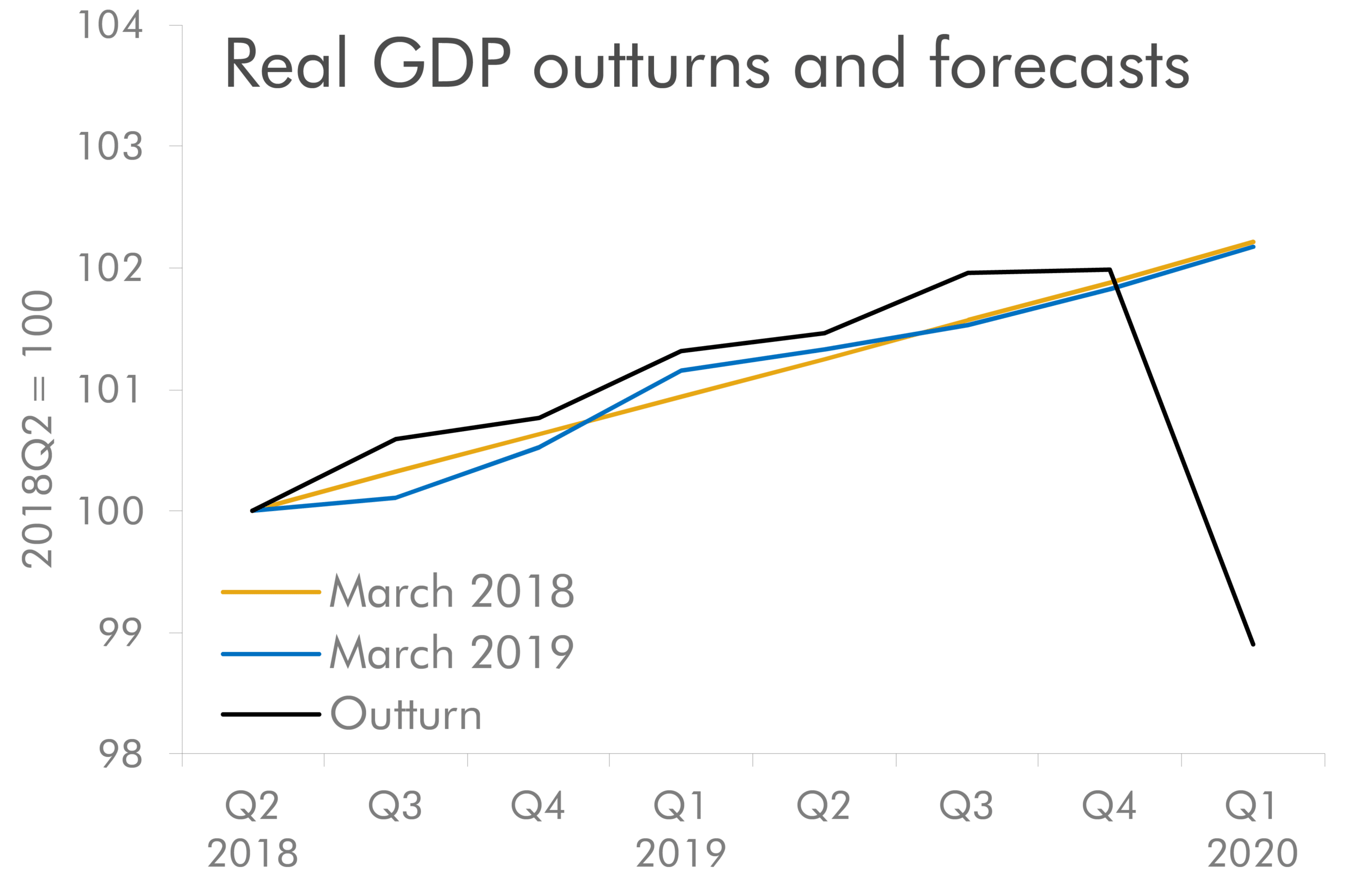

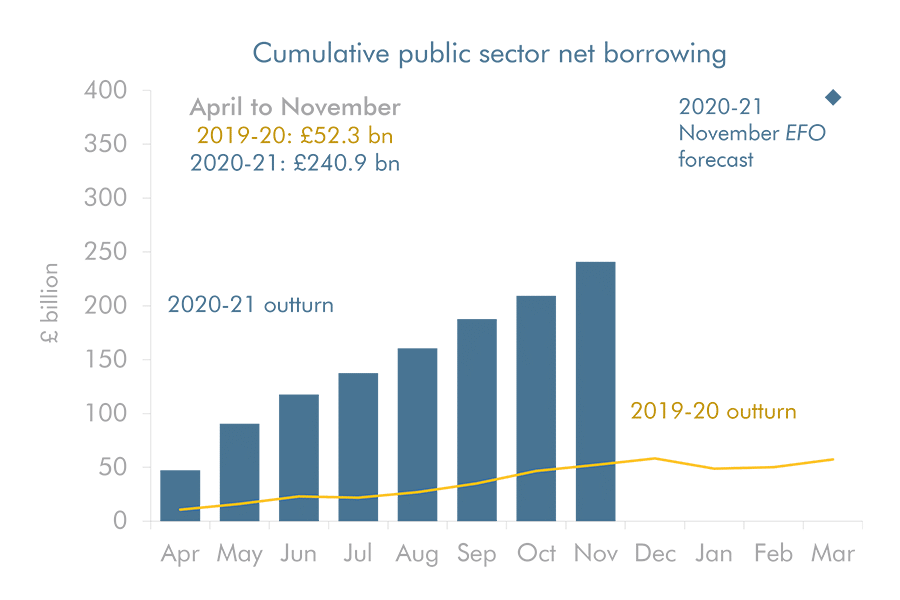

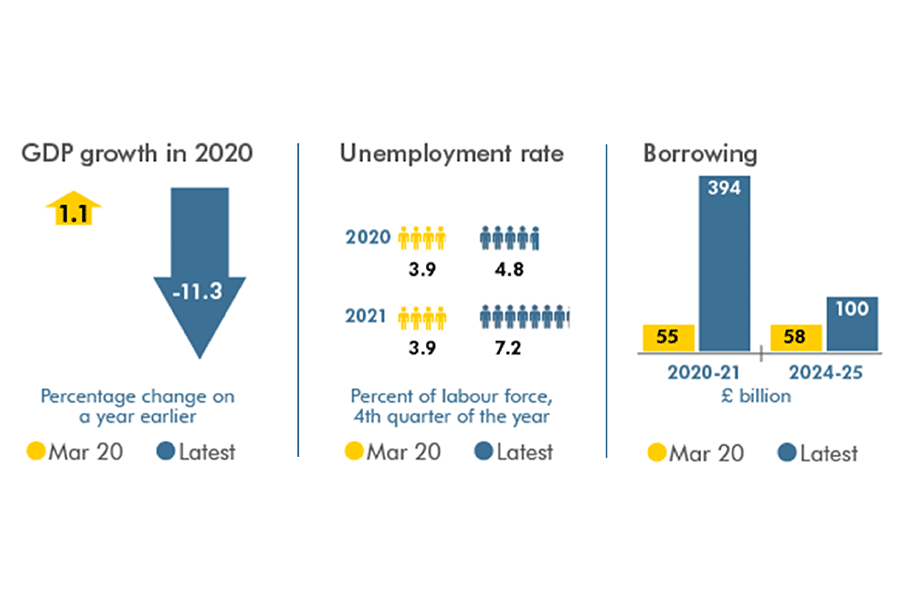

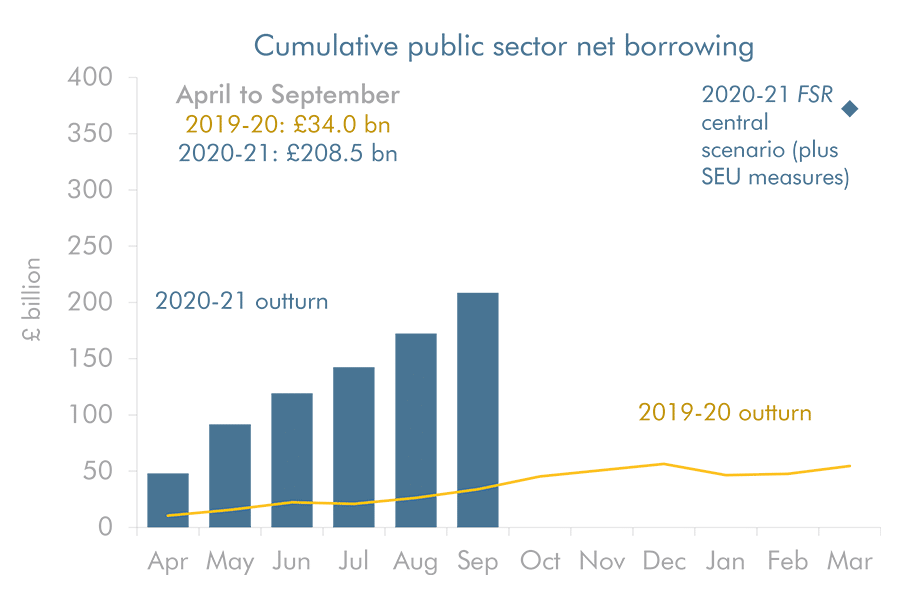

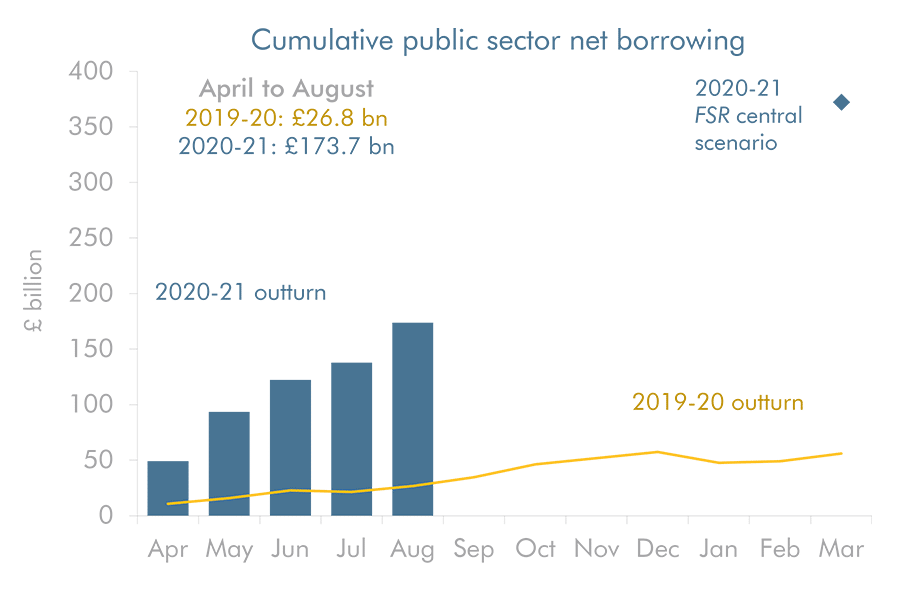

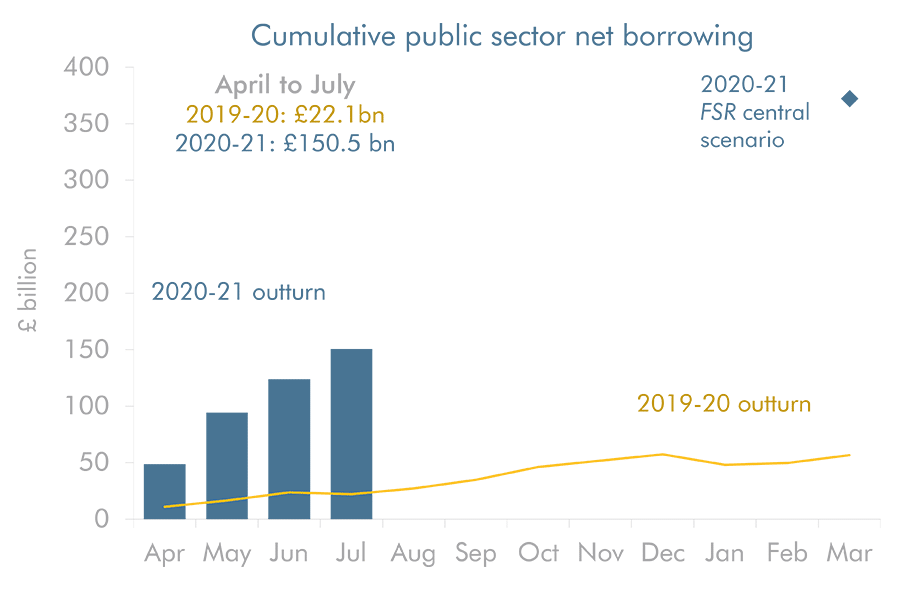

Next year’s Forecast evaluation report will look back at what will probably be the largest official economic forecast errors ever, reflecting the full effect of the coronavirus pandemic on the economy and public finances in 2020-21. In this year’s brief report, we look back at our March 2018 and March 2019 forecasts for 2019-20. Both…