From late-2008 to 2013, the rate of CPI inflation in the UK had been consistently higher than the euro area equivalent measure. This box, published in our December 2013 Economic and fiscal outlook, outlined a number of factors which had contributed to the divergence including exchange rate movements, changes in VAT and utility prices.

This box is based on Eurostat inflation and ONS inflation data from November 2013 and November 2013 respectively.

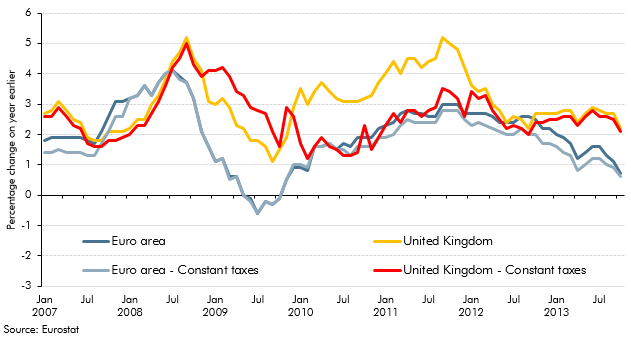

CPI inflation has been consistently higher in the UK than in the euro area since late-2008 (Chart A). This experience of higher inflation in the UK can be divided into three periods:

- in late 2008 and 2009, inflation in the UK was boosted by the 25 per cent depreciation of sterling from mid-2007, which lifted UK import prices and more than outweighed the 2.5 percentage point cut in the main rate of UK VAT on 1 December 2008;

- in 2010 and 2011, UK inflation was pushed higher by two separate 2.5 percentage point increases in the main rate of VAT, in January 2010 and January 2011. The impact is illustrated in Chart A, where ‘constant tax’ CPI inflation is estimated to have been broadly similar in the UK and euro area; and

- after a short period of similar inflation rates in mid-to-late-2012, UK inflation has not fallen as quickly as euro area inflation over the past year. Annual inflation in October 2013 was 2.2 per cent in the UK and 0.7 per cent in the Euro area.

Chart A: CPI inflation in the euro area and the UK

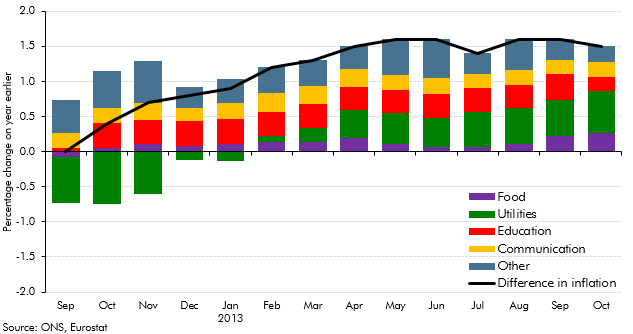

Chart B: Contribution to difference in euro area and UK inflation

Over the past six months, UK inflation has been around 1.5 percentage points higher than euro area inflation. The recent divergence reflects a number of factors. Since mid-2012, the euro has appreciated, while sterling has depreciated slightly and the lags associated with these exchange rate movements are likely to explain part of the difference. Food and utility prices also make significant contributions (Chart B), with core inflation in October 0.9 percentage points higher in the UK than the euro area. Education and communication price inflation also contribute, reflecting rises in UK tuition fees and higher telephone service price increases.

Higher utility price rises reflect an element of catch up. Eurostat estimates that energy price levels remain lower in the UK than the euro area average. Retail gas and electricity prices per kilowatt hour in the UK are estimated to be €0.05 and €0.17 versus €0.07 and €0.21 in the euro area, with lower taxes, levies and network costs explaining much of the difference.