Depending on ONS classification assets relating to PFI contracts can be on the public sector or the private sector balance sheet. This box outlined the accounting of PFI contracts in the National Accounts and WGA.

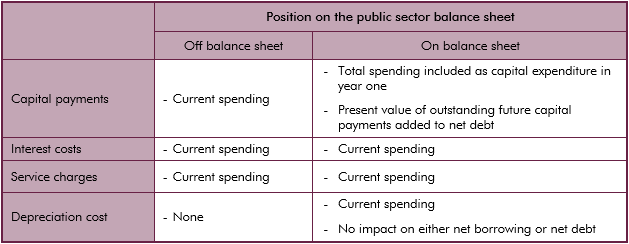

In the National Accounts, an asset relating to a PFI contract must be on either the public sector balance sheet or the private sector balance sheet, but not on both. The treatment is determined by the ONS, based on where significant risks of the project are perceived to lie. Table B summarises the accounting treatment of any related payments, depending on whether the asset is on the public sector balance sheet or not. Such costs include the initial capital costs, and interest and where appropriate, service charges, which relate to the operation and maintenance of the asset.

Table B: Summary of National Accounts treatment of PFI payments

When the asset remains on the private firm’s books, the transaction is treated in the public finances as if it was a long-term rental contract (an ‘operating lease’). Payments are included in the public finances when they materialise, increasing current spending, lowering the current budget balance and pushing up net borrowing and net debt.

Conversely, where the asset resides on the public sector balance sheet, the transaction is equivalent to the purchase of the asset, matched by a deferred payment (a ‘finance lease’). Capital costs are recognised upfront, through an increase in investment spending and therefore net borrowing. Although the full capital sum is not exchanged, public sector net debt, which is typically considered a cash-only measure, is raised by the present value of outstanding future capital payments. Over time, capital repayments reduce this liability and hence its impact on net debt. Interest and service charges are expensed as current spending as they are paid. In addition, as the asset is on the balance sheet, a depreciation charge is also made. This increases current spending but has no impact on either net borrowing or net debt.

Whether an asset is on or off the public sector balance sheet in the WGA is determined by which side has effective control over the asset. Thereafter, the treatment of costs is analogous to the National Accounts treatment above. If the asset is off the public sector balance sheet, all costs appear on the operating statement. But if the asset is on the balance sheet, there is a corresponding liability. Only interest and service costs appear on the operating statement, as well as a depreciation charge. Capital repayments lower the balance sheet liability over time.