In our March 2023 Economic and fiscal outlook, we evaluate the distorting impact of the frozen VAT registration threshold – the turnover threshold at which firms must register for VAT. This box looked at the tendency for businesses to bunch just below the threshold, as they limited their turnover to avoid needing to register. At the time of the box the threshold had been frozen at £85,000, and was due to remain at that level until the end of March 2026.

This box is based on OBR data from March 2023 .

One of the many aspects of the tax system that is currently subject to a freeze (meaning a threshold that typically rises with inflation is frozen in cash terms) is the turnover threshold at which firms must register for VAT. It reached £85,000 in 2017-18 and on current policy will be frozen at that level for eight years, until March 2026.a Our forecast assumes that this freeze will raise £1.4 billion a year in VAT revenues by 2027-28, by increasing the number of firms within the VAT system by 169,000 compared with indexing the threshold to RPI inflation.

Given the administrative burden and pricing consequences of being subject to the VAT regime, the registration threshold also creates an incentive for firms to cap their annual turnover just below it. And freezing the threshold while firms’ turnover rises due to inflation means that over time, while more firms become subject to VAT and more revenue is raised, there are also more firms that pile up against the threshold by capping their turnover.

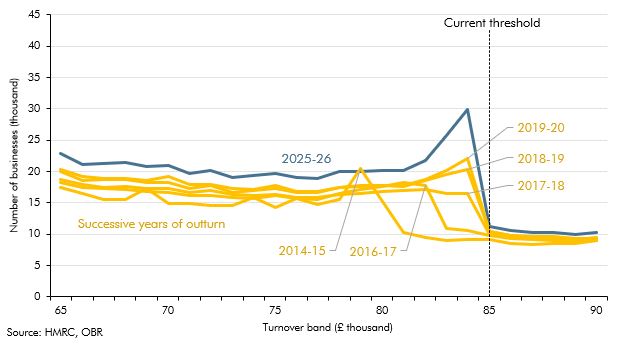

Chart C shows the growing extent of the distortion in the distribution of firms by size in the yellow outturn lines. These show that the distortion predates the current freeze, with the bunching of firms shifting rightwards as the threshold was raised each year. But it also shows that since 2017-18 when the threshold first reached £85,000, the scale of the distortion below the threshold has been increasing, with 2019-20 the latest year for which outturn data are available. The blue line shows what our forecast assumes about this distortion by 2025-26 when the freeze ends. Relative to 2017-18, the number of firms capping their turnover is expected to have almost doubled from 23,000 to 44,000. And relative to a smooth distribution of firms by size, the lost turnover associated with this distortion among these traders is expected to have risen from £110 million to £350 million.

Chart C: Bunching in the VAT turnover distribution at the registration threshold

This box was originally published in Economic and fiscal outlook – March 2023