Since our 2021 Fiscal risks report - which showed that reaching net zero carbon emissions will have significant impacts on the public finances in the UK - estimates of the fiscal impacts of reducing emissions in other countries have begun to be produced. In this box we recapped our 2021 work and discussed how IMF and French analysis compared to it.

This box is based on Climate change commission, OBR and IMF data from December 2020, July 2021 and June 2023 .

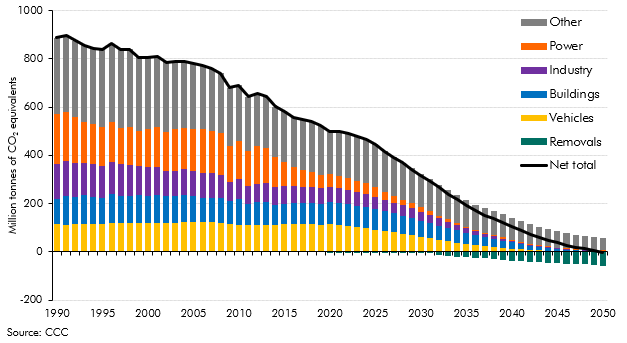

While the UK’s territorial CO2 emissions have fallen significantly since 1990, thanks in large part to the switch from coal to gas power generation, achieving the Government’s net zero target by 2050 will become increasingly difficult. Vehicles, buildings, industry, and power make up the majority of emissions remaining in 2020, and these four sectors plus the yet-to-be-developed removals sector are the largest source of future abatement in the Climate Change Committee’s (CCC’s) balanced net zero pathway, shown in Chart D.

Chart D: Emissions in the CCC’s balanced net zero pathway

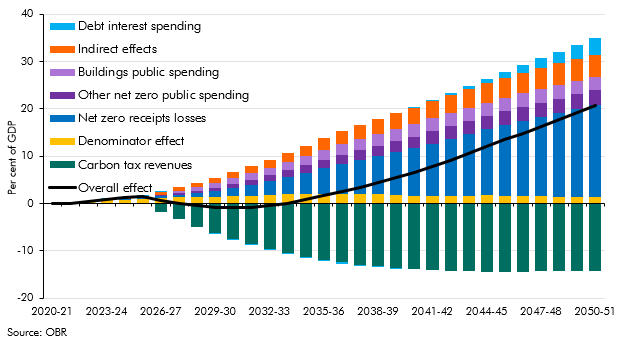

Our 2021 Fiscal risks report (FRR) set out a range of scenarios for the potential fiscal cost of getting to net zero by 2050. Our central estimated impact on the primary balance was around minus 0.8 per cent of GDP (£20 billion a year in today’s terms) – equivalent to adding 21 per cent of GDP to debt by 2050 – with the loss of fuel duty revenues the largest single cost (around three times larger than public investment in net zero). Of these costs, decarbonising power generation only accounted for about 8 per cent of total investment, with the cost of decarbonising buildings (largely heating, which we assume will require electrification) estimated to account for half the investment costs, as Chart E shows.

Chart E: Impact of net zero transition on public debt

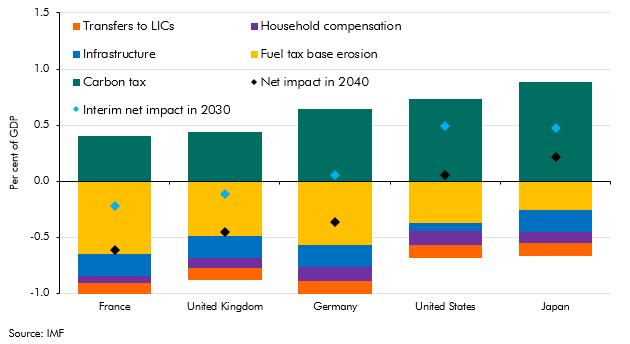

The IMF has recently produced cross-country comparisons of the impact on primary borrowing of a ‘global deal scenario’ for getting to net zero.a As Chart F shows, it finds that in the UK, Germany, and France, the imposition of a carbon tax is unlikely to be enough to offset the erosion of fuel tax bases and costs of public investment spending required to reach net zero, so the impact on the primary balance from decarbonisation in these countries will grow to a deficit of ½ per cent of GDP by 2040, compared to 1.2 per cent of GDP in 2040 in our 2021 analysis. The IMF assumes less public spending is required to decarbonise the buildings sector than in our approach, but against that is assumes that the bottom three deciles of the income distribution are compensated for the costs of net zero, and that some modest transfers to low-income countries (LICs) are provided. In both the US and Japan, the impact in 2030 is initially positive, due to the greater opportunity to tax emissions, although it falls nearer zero by 2040 as new and existing tax bases are eroded.

Chart F: Effect on 2040 primary fiscal balances of a global net zero deal scenario

Two more detailed French studies present broadly comparable estimates of the fiscal costs associated with the transition to net zero in France. Unlike the IMF’s, both French studies follow our assumption that significant public spending will be required in western European economies to retrofit the building stock to fit the needs of a net zero world. In 2022, the General Inspectorate of Finance produced a stylised illustration of the potential cost of net zero (assuming positive ‘indirect effects’ on productivity from the transition) equivalent to an additional to debt of around 10 per cent of GDP in 2040 and 15 per cent of GDP in 2050, compared to 6 and 21 per cent of GDP respectively for the UK in our FRR 21 scenario.b The authors of a 2023 report to the French Prime Minister estimated the cost at 25 per cent of debt-to-GDP by 2040 (around 20 percentage points above our figure in that year).c This second higher estimate reflects more significant investment costs (half of which are paid by the public sector), negative indirect effects on productivity, and no assumed impact on the tax-to-GDP ratio.

This box was originally published in Fiscal risks and sustainability – July 2023