In the March 2018 Economic and fiscal outlook (EFO) we set out in detail how we calculated the cost of the Government’s financial settlement with the EU. This box from our October 2018 EFO updated our estimate of the financial settlement’s cost and the reasons for the changes since March.

In Annex B of our March 2018 Economic and fiscal outlook (EFO), we set out how we estimated the cost of the EU financial settlement, as well as the year-by-year payment profile and future developments and uncertainties. The financial settlement is part of the draft Withdrawal Agreement between the UK Government and the EU.

There are three main components of the settlement:

- the period up to 2020, in which the UK will continue to contribute to the EU budget as if it had remained in the Union;

- outstanding commitments at the end of 2020, which have been agreed but not yet paid by the time the current Multiannual Financial Framework (2014-2020) ends; and

- other actual and contingent liabilities and corresponding assets, which includes pension liabilities, fines, and financial assets.

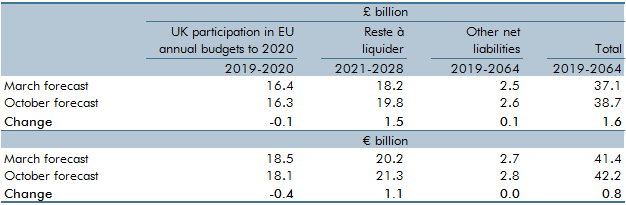

Table A shows the breakdown of the components of the EU financial settlement. The Treasury estimated that the total cost of the settlement would be between €40 billion and €45 billion, equivalent to £35 billion to £39 billion at the then exchange rate of €1.13 per pound.a In March, we estimated that the total cost of the settlement would be €41.4 billion (£37.1 billion). Our current estimate is that the cost will be €42.2 billion (£38.7 billion) – a 1.9 per cent increase in euro terms, but a 4.2 per cent increase in sterling terms thanks to a drop in the pound.

Table A: Settlement components and time periods

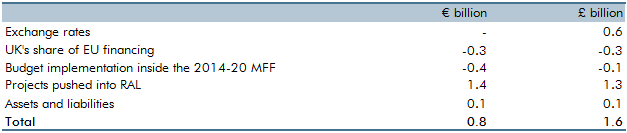

Table B decomposes the change in our estimate of the cost of the financial settlement since March. The total change in euro-denominated liabilities is €0.8 billion, which is mostly due to the slower implementation of the EU budget in the 2014-20 MFF, pushing more projects into the RAL (i.e. the amount of committed expenditure that is outstanding at the end of the MFF). The UK’s share of the EU budget has fallen due to sterling weakening relative to the euro, but when the settlement is converted into sterling, this is more than offset by the increase in liabilities from the weaker exchange rate. There is only a small effect from other net liabilities.

Table B: Changes in the cost of the EU financial settlement since March

This box was originally published in Economic and fiscal outlook – October 2018