There has been a notable shift in the environment of interest rates over the past 18 months in the UK. This box looked at the extent of surprise for rate rises relative to market implied expectations and the increase in capital adequacy ratios of UK banks since the global financial crisis.

This box is based on Bank of England, OBR and IMF data from 2023 Q1 and 2022 Q4 .

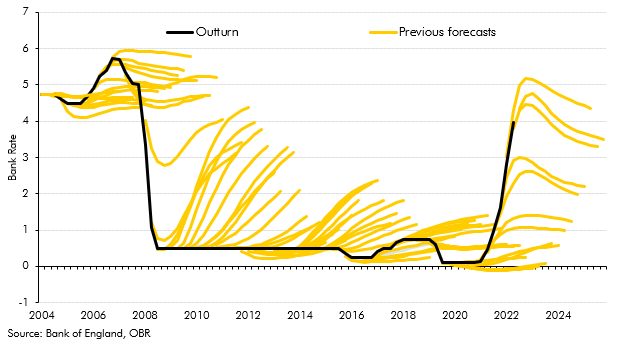

The UK has experienced a notable shift in its interest rate environment over the past 18 months, marked by the re-emergence of higher interest rates after a prolonged period of historically low rates. Bank Rate has now reverted to around its pre-financial crisis levels, but has done so more rapidly than most expected. The unexpected speed at which interest rates have jumped (both in the UK and globally) may pose risks to the financial sector. To demonstrate the extent of the surprise, Chart A shows market expectations for Bank Rate at the time of successive Bank of England Inflation Reports and Monetary Policy Reports, alongside its actual path. Financial markets continuously expected rates to rise between 2008 and 2020, when in fact they remained at 0.5 per cent for much of the period. But in 2022 this trend reversed, and Bank Rate is now around 4 percentage points above the level expected just 18 months ago.

Chart A: Financial market-implied and actual Bank Rate path

The financial sector is inherently exposed to large and unexpected changes in interest rates, and global interest rate hiking cycles have often coincided with episodes of distress in the financial sector.a And financial instability is one of the largest sources of risk to the public finances. The direct fiscal costs are potentially substantial, as they can involve injecting liquidity or capital in the form of public funds into the banking system to stabilise it and protect depositors and creditors. And the indirect costs from wider economic disruption can be even larger and long-lasting, as evidenced by the UK’s persistently weak growth performance since 2008.

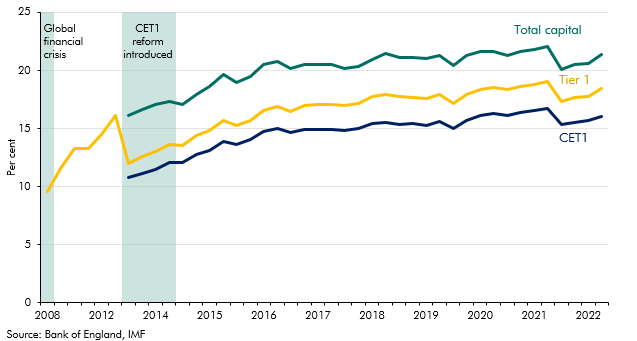

To mitigate these risks in the banking sector, governments and regulators introduced more stringent capital adequacy requirements following the financial crisis. The Basel III framework played a central role in these reforms. One of the key changes was the emphasis on Tier 1 capital, which represents the core capital of a bank and includes common equity and other qualifying instruments. The Tier 1 capital ratio became a crucial metric to assess a bank’s financial strength and ability to absorb losses. Regulators also introduced the CET1 ratio, consisting primarily of common equity, as an additional measure of a bank’s capital adequacy that is deemed the highest quality capital due to its loss-absorbing capacity. The CET1 ratio became a key benchmark to assess a bank’s financial soundness and its ability to withstand adverse economic conditions and absorb losses during shocks. These measures of capital adequacy have risen since 2008 (Chart B).

UK banks are subject to capital rules that mean their exposure to interest rate risk is specifically capitalised against. They also have substantial buffers of liquid assets, and access to Bank of England liquidity facilities that should help to protect them against liquidity risks that could arise (in relation to interest rate risk or otherwise). They are therefore now better capitalised and positioned to handle challenges posed by sharply rising interest rates. And the Bank of England’s Financial Policy Committee’s latest assessment is that “the UK banking system remains resilient”.b Nevertheless, given the relative size and opacity of some parts of the shadow banking sector (as we discussed in our 2019 FRR), significant direct and indirect fiscal risks remain.

Chart B: Capital adequacy ratios of UK banks

This box was originally published in Fiscal risks and sustainability – July 2023