As the stock of foreign holdings of UK debt has risen this century, so have questions about the risks of increasing, relatively high, levels of these holdings. This box looked at the why holdings of debt by foreign investors may lead to greater market volatility.

This box is based on OBR data from 2023 .

As the stock of foreign holdings of UK debt has risen this century, so have questions about the risks of increasing, relatively high, levels of these holdings. Foreign privately owned UK debt as a proportion of total debt has almost doubled to 25 per cent since 2004 and is now well above the advanced economy average of 18 per cent.

For many domestic holders, gilts are a natural asset to hold in a portfolio matching and potentially hedging against other sterling assets and liabilities. These holders may therefore be relatively reluctant to move out of gilts, making their holdings less volatile and less sensitive to market movements and sentiment. Overseas holders of gilts are less likely to have a such a structural desire for sterling assets. Instead, gilts are more likely to be seen as just one of a number of government bond assets they hold. As a result, smaller changes in the relative attractiveness of gilts can mean foreign investors quickly switch to other assets in potentially large volumes.

A notable instance of the potential vulnerabilities of foreign ownership of debt manifesting was during the bond market crisis of 1994 when government bond yields rose sharply in a number of countries. The IMF suggests this crisis came about due to a combination of global movements.

The US Federal Reserve raised interest rates as the Bundesbank halted rate rises, potentially leading to pessimism in both markets. This occurred alongside a backdrop of trade disputes intensifying between the US and Japan and bond and equity prices declining in the emerging markets in Asia and Latin America.a

The Bank for International Settlements found that international disinvestments appeared to have caused major instabilities in the G7 European economies (France, Germany, and Italy) during 1994. Even when allowing for the relationship between withdrawals and changes in yields, there were sizeable spikes in bond market volatility due to a cumulative withdrawal of foreign investment of nearly $68 billion across the three countries. It has been suggested that foreign investment appeared to be asymmetric, with foreign investors slowly building up holdings of debt but rapidly selling them in periods of stress. By contributing to market volatility, this could mean that benefits of inflows could be outweighed by the drawbacks of outflows b

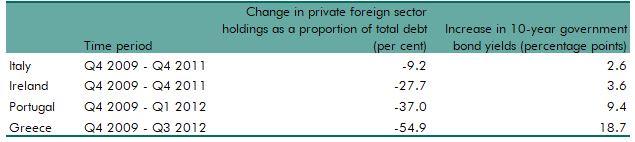

Evidence of foreign ownership of debt increasing bond market sensitivities was also seen in the aftermath of the global financial crisis of 2007-08. Analysis of the euro area found that in times of crisis domestic investors will typically repatriate funds as foreign investors pull out of the market,c with particular evidence found in support of the ‘repatriation phenomenon’ between 2008 and 2014.d The link between private foreign investment outflows and shifts in bond market rates was notable among particularly stressed countries in the aftermath of the crisis. Table A outlines steep declines in private foreign ownership of debt as a proportion of total debt across four stressed EU member states from the final quarter of 2009.

Table A: Changes in private foreign holdings of government debt and 10-year government bond yields

This box was originally published in Fiscal risks and sustainability – July 2023