In the run up to the July 2015 Budget, fiscal policy had been tightened every year since 2010-11. This box, published in our July 2015 Economic and fiscal outlook, set out the fiscal multiplier framework used to estimate the overall effect of changes in fiscal policy on the economy. This box also outlined two ways in which this framework changed with regards to the tapering of multiplier effects across time and the assumed differences in multiplier effects on real and nominal GDP.

This box is based on ONS government spending data from June 2015 .

In June 2010, the interim OBR estimated the impact that the additional fiscal tightening announced in the Coalition’s first Budget would have on growth through the use of ‘fiscal multipliers’. These implied that a discretionary tightening of 1 per cent of GDP would, in the first instance, reduce output by 1 per cent in the case of investment cuts; 0.6 per cent in the case of cuts to day to day public services and welfare spending; 0.35 for VAT increases; and 0.3 per cent for income tax and NICs increases. The multiplier was assumed to diminish or taper over five years, as the initial effect was offset by changes in monetary policy, the exchange rate and real wage adjustments.

In this forecast, we have applied the same real multipliers that the interim OBR used in the June 2010 forecast. But we have adjusted the way in which we apply them in two ways:

- in June 2010 the interim OBR assumed that the multipliers would taper from the point of implementation. This implied that changes to the fiscal consolidation path taking effect later in the forecast period would not be offset by monetary policy or other factors until sometime after their implementation. This was consistent with a significant degree of spare capacity being expected to persist over the forecast period, limiting the scope of monetary policy and other factors to offset them. With our current estimate of spare capacity significantly smaller, and expected to close within the forecast horizon, it seems more likely now that the demand impact of pre-announced changes to tax and spending would be partly or wholly offset. We have therefore assumed that the multipliers taper from the point of announcement, rather than the point of implementation; and

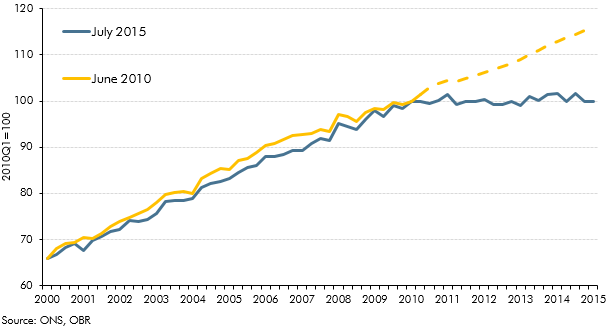

- in applying multipliers to changes in taxes or spending, it is also important to consider whether the effect on nominal GDP (the nominal multiplier) may differ from the effect on real GDP (the real multiplier). We judge that this is likely to be the case for day to day spending on public services, which is broadly equivalent to government consumption in the expenditure measure of GDP and is subject to the ‘resource departmental expenditure limits’ (RDEL) set out by the Treasury. Changes in the cash level of RDEL spending affect the implied price of government consumption in the National Accounts, partly via real world changes to the price of procurement and partly via statistical effects, notably the way in which the direct measures of output for some public services are not affected by changes in cash spending (e.g. the number of pupils taught is driven by demography, not cash spending). As a result, the effective nominal multiplier for RDEL will generally be larger than the real multiplier. In June 2010, the interim OBR assumed that around a quarter of changes to RDEL would affect the implicit price of government consumption through the real-world procurement price channel. A multiplier of 0.6 was then applied to the remaining three quarters of the change in RDEL, implying an effective real multiplier of around 0.45. In the event, much more of the squeeze on RDEL spending since 2010 has shown up as weaker growth in the measured price of public services than weaker growth in volumes, as shown in Chart A. As a result, we overestimated the extent to which the cuts in RDEL spending would act as a direct drag on measured real GDP growth.

Chart A: The government consumption deflator

Reflecting this experience, in this forecast we have applied the same effective real RDEL multiplier that the interim OBR used in June 2010, but we now assume that around two-thirds of nominal RDEL changes are reflected in the government consumption deflator. This implies a higher effective multiplier for the effect of RDEL changes on nominal GDP (as measured) of 1.1. The results of applying this approach to the changes to the path of consolidation announced in this Budget are set out in Box 3.3.

This box was originally published in Economic and fiscal outlook – July 2015