This box discussed the continuing impact of the multiple freezes and changes to personal tax thresholds between March 2021 and November 2022. It provided an update on the estimated receipts from these policies, and the additional number of tax payers by tax band.

This box is based on HMRC and OBR data from November 2023 .

Over the 4 fiscal events between March 2021 and November 2022, virtually all the main allowances and thresholds in income tax and National Insurance Contributions (NICs) were frozen rather than indexed to inflation, as is the default in legislation:

- In March 2021, the income tax personal allowance (PA) was frozen at £12,570 and the higher rate threshold (HRT) at £50,270, from 2022-23 to 2025-26. The freezes were extended for a further two years in November 2022, when the upper earnings limit and upper profits limit for NICs were also frozen, meaning all these allowances and thresholds were to be frozen to 2027-28.

- In March 2022, the primary threshold and lower profits limit for NICs were increased to align with the PA (with an equivalent rise in Class 2 NICs) and then frozen until 2025-26, a freeze which was extended in November 2022 to 2027-28. In addition, the employer NICs secondary threshold was also frozen from 2023-24 to 2027-28.

- In November 2022, the additional rate threshold (ART) was lowered from £150,000 to £125,140 from April 2023 to align with the PA taper. This is the first change to the ART since it was introduced at £150,000 in April 2010, and it will remain frozen in cash terms.

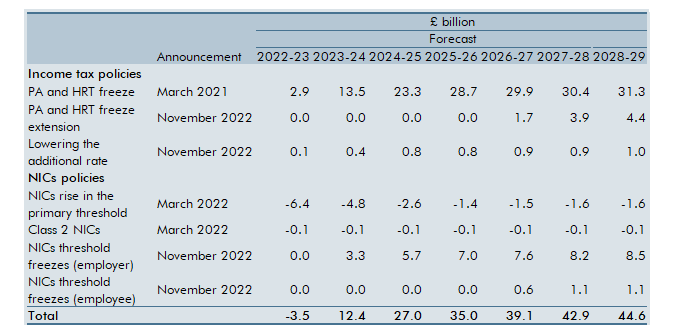

Table A: Latest costings of personal tax threshold measures

Freezing thresholds, rather than raising them in line with inflation, increases tax receipts as rising wages tip ever greater numbers of workers into the tax system or onto higher rates, a trend known as ‘fiscal drag’. From one forecast to the next, higher-than-expected earnings both increase the numbers expected to be paying a higher rate of tax and the amount of tax that they pay.

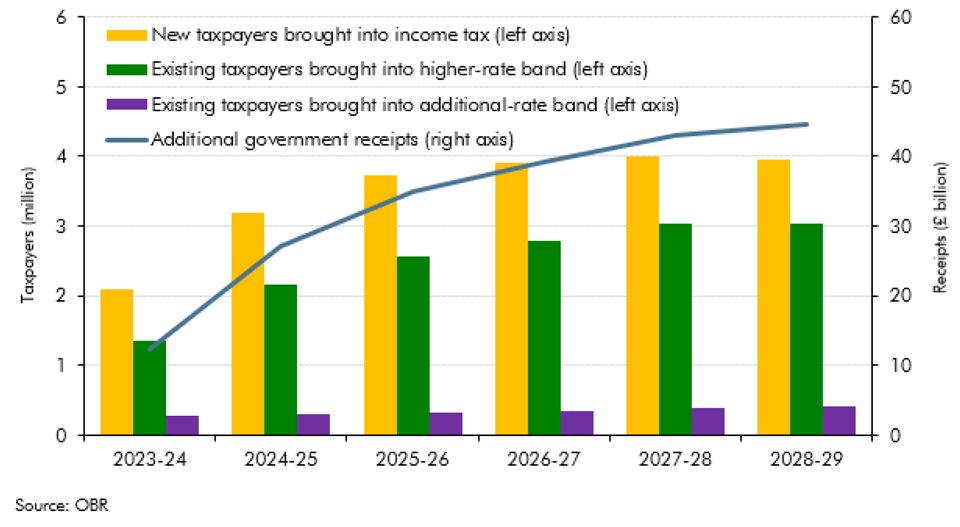

Between 2022-23 and 2028-29, this set of threshold freezes means nearly 4 million additional individuals will be expected to pay income tax, 3 million more will have moved to the higher rate, and 400,000 more onto the additional rate (Chart A). This represents an increase in the number of taxpayers in each band of income tax – 11 per cent for the basic rate band, 68 per cent for the higher rate and 49 per cent for the additional rate. Relative to our March forecast, this is a respective increase in 2027-28 of 830,000, 900,000, and 43,000.

Relative to raising thresholds by CPI, this set of freezes are now estimated to raise £42.9 billion (Table A) by 2027-28 and £44.6 billion by the end of the forecast (1.4 per cent of GDP). The 2027-28 figure is £13.6 billion higher than in our March forecast, as a result of the higher and more persistent inflation in this forecast. The reduction in the employee rate of NICs in this Autumn Statement will reduce the impact of the primary threshold freeze by only around £180 million.a Frozen thresholds are the largest contributor to the rising overall economy-wide tax burden – responsible for almost a third the 4.5 per cent of GDP increase in taxes from 2019-20 to 2028-29.

Chart A: Effect of threshold freezes on additional taxpayers and tax receipts

This box was originally published in Economic and fiscal outlook – November 2023