Since our March 2014 Economic and fiscal outlook, our debt interest spending forecast was revised down significantly as market expectations of the interest rates at which the Government can borrow and service its debt moved progressively lower and as inflation fell. This box explained some possible factors that could have caused market expectations of interest rates to rise and the effect on the fiscal position of a sudden increase in interest rates.

In several recent forecasts we have revised down debt interest spending as market expectations of the interest rates at which the Government can borrow and service its debt have moved progressively lower and as inflation has fallen.

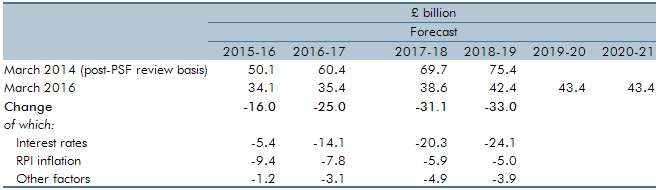

Since March 2014 our forecast for the budget balance in 2018-19 (the final year of that forecast) has deteriorated by £22.6 billion from a small surplus to a deficit of £21.5 billion in this forecast. That has occurred despite a £33.0 billion reduction in expected debt interest spending in that year. As Table C shows, lower interest rates (conventional and real gilt yields and short-term rates) explain the majority of the change, with lower RPI inflation and other factors (e.g. updated assumptions about gilt holdings in the APF) contributing smaller amounts.

Table C: Sources of changes to debt interest spending since March 2014

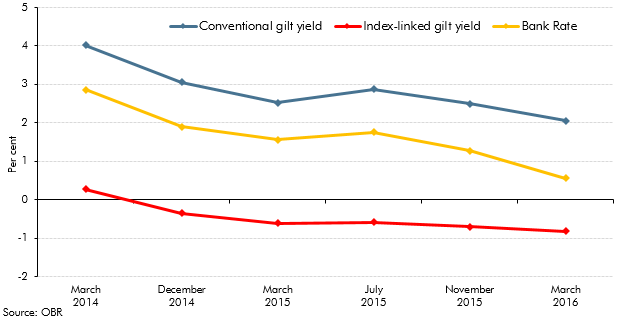

Chart C shows how market expectations for the 2018-19 level of the key interest rates that drive our debt interest forecast have fallen since March 2014. Bank Rate expectations have fallen from around 3 per cent in March 2014 to only just above ½ per cent now. Expectations of yields on conventional and index linked gilts have also fallen significantly.

Chart C: Successive market expectations for interest rates in 2018-19

Given how low the market yield curve has fallen – and the extent to which lower interest rates have cushioned the effects of other forecast changes – the rest of this box reviews the sensitivity of debt interest spending to changes in various factors and what might drive them.

What could cause market expectations of interest rates to rise?

When considering the possible implications of higher interest rates, it is important to think about the underlying drivers of any change. In broad terms:

- if market expectations move higher because strengthening growth prospects mean that markets expect monetary policy to be tightened, the upward pressure on borrowing from higher interest rates via debt interest spending would be offset by the effects of a stronger economy in boosting receipts and reducing some welfare spending; but

- if interest rate expectations move higher due to higher risk premia (e.g. due to greater uncertainty about inflation prospects or the outlook for the economy and public finances) those offsetting factors could be absent or could even exacerbate the direct effect of higher debt interest spending. Yields on UK government bonds have typically been very closely correlated with those on US government bonds, so it would also be possible for developments in the US economy and markets to cause gilt yields to rise, which might also be associated with smaller offsetting effects on UK borrowing.

What would be the effect on the fiscal position of a sudden increase in interest rates?

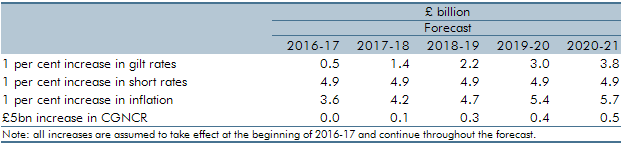

Debt interest payments are very sensitive to changes in market interest rates, inflation and borrowing. Alongside each EFO, we publish a table of debt interest ready reckoners on our website that quantifies these sensitivities. Table D contains the ready reckoners consistent with this forecast. The overall effect on net borrowing would, as described above, depend on what had driven any change to these determinants of the forecast. Looking just at the direct effect on debt interest spending, the table shows that:

- the effect of a persistent increase in conventional gilt rates would build only gradually over time, as higher rates only apply to new debt issuance, and UK conventional gilts have a relatively long average maturity;

- higher short-term interest rates would quickly lead to higher debt interest costs, through the APF holdings and as short-term debt rolls over;

- an increase in RPI inflation would also have an immediate impact, as it increases accrued payments on both old and new index-linked debt. The table shows the consequences of a succession of shocks to annual inflation, with the higher impact over time mainly reflecting a rising stock of gilts; and

- assuming interest rates were to remain unchanged, an increase in the central government net cash requirement would have a more modest effect over the forecast period.

Table D: Debt interest ready reckoner

This box was originally published in Economic and fiscal outlook – March 2016