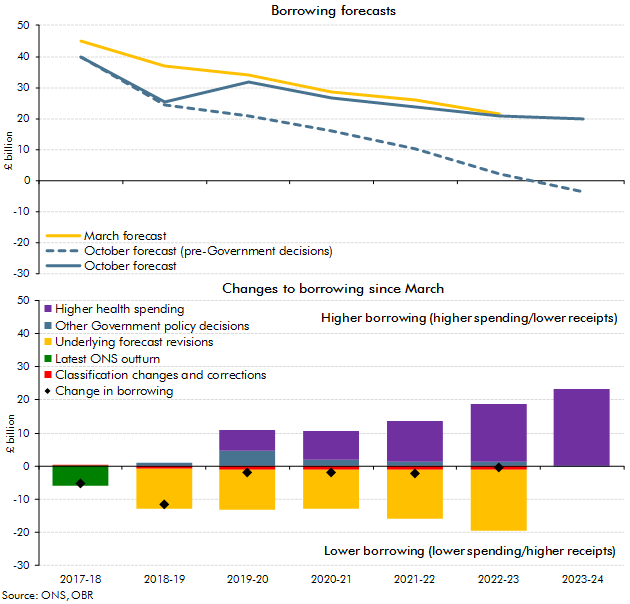

At first glance the outlook for the public finances in the medium term looks much the same as it did in March. But this masks a significant improvement in the underlying pace of deficit reduction, that on its own would have put the Government on course to achieve its objective of a balanced budget for the first time. As it happens, this underlying improvement had already been swallowed up by the Prime Minister’s promise of higher spending on the NHS made in June. The remaining Budget policy measures are a further near-term giveaway that gradually diminishes over the forecast, leaving the deficit in 2022-23 little changed overall.

The public finances have performed better so far this year than we and outside forecasters expected back in March, even though the economy has grown less quickly. Once again, the ONS has revised last year’s budget deficit lower, relative both to its initial estimate in April and to our forecast from March. Borrowing has also fallen more sharply in the first half of 2018-19 than anticipated, relative to the same period last year. As a result – and before the impact of any policy decisions – we have revised borrowing £11.9 billion lower for the full year (like for like), creating a more favourable starting point for the forecast. This reflects stronger tax revenues and lower spending on welfare and debt interest than expected.

The performance of the real economy has been less impressive relative to expectations. We have revised real GDP growth in 2018 down from 1.5 to 1.3 per cent, but primarily due to the temporary effects of the snowy first quarter. Thereafter we expect slightly stronger growth over the forecast as a whole than in March, reflecting a downward revision to our estimate of the sustainable rate of unemployment and an upward revision to potential labour market participation, reflecting new data on participation by age that we flagged back in July.

The upward revision to cumulative GDP growth means that the underlying improvement in the budget deficit rises from £11.9 billion this year to £18.1 billion by 2022-23. At 0.6 per cent of GDP, on average, this is the largest favourable underlying forecast revision we have made since December 2013, but only the sixth largest we have made in either direction since 2010. On its own, this would have been sufficient to achieve a budget surplus of £3.5 billion in 2023-24, meeting the ‘fiscal objective’ of balancing the budget by 2025.

But the Budget spends the fiscal windfall rather than saving it. Most significantly, it confirms funding for the NHS settlement announced in June, the cost of which rises from £7.4 billion in 2019-20 to £27.6 billion in 2023-24 in gross terms and from £6.3 billion to £23.4 billion adjusting for the boost it gives to nominal GDP. The rest of the package has the familiar Augustinian pattern of a near-term giveaway followed by a longer-term takeaway, increasing borrowing by £5.3 billion in 2019-20 but reducing it by £0.2 billion by 2023-24.

Chart 1.1: Public sector net borrowing: October versus March

The giveaways include raising the income tax personal allowance to £12,500, increasing the generosity of universal credit and the traditional one-year freeze in fuel duty rates. Public services spending outside health also gets a boost rising to £3.2 billion by 2022-23, so that it no longer falls in real terms over the forecast. The main takeaways include a new tax on large digital businesses, a tightening of rules on people who work through their own company, the reversal of the 2016 decision to abolish Class 2 National Insurance contributions for the self-employed and the restriction of the NICs employment allowance to small businesses. Departmental capital spending has also been cut from 2019-20 onwards, a decision that does not appear on the Treasury’s scorecard of policy measures.

The overall effect of the Budget measures is to increase the deficit by £1.1 billion this year and £10.9 billion next year, rising to £23.2 billion in 2023-24. This is the largest discretionary fiscal loosening at any fiscal event since the creation of the OBR. Combined with the underlying forecast improvement and some small classification changes, the deficit has been revised down by £11.6 billion this year (to £25.5 billion), but by only around £2 billion a year on average thereafter. This leaves a deficit of £19.8 billion or 0.8 per cent of GDP in 2023-24, with just two years left to meet the balanced budget objective.

The forecast changes and policy decisions leave the Chancellor with £15.4 billion (0.7 per cent of GDP) of headroom against his ‘fiscal mandate’, which requires the structural budget deficit to lie below 2 per cent of GDP in 2020-21. The Budget policy package has been fine-tuned to ensure that this is precisely the same margin as he had in March.

The Chancellor also meets his supplementary target of reducing public sector net debt as a share of GDP in 2020-21. In this forecast it falls by 3.2 per cent of GDP in that year, compared to 3.0 per cent of GDP in March. (The ending of the Bank of England’s Term Funding Scheme contributes 2.3 percentage points of the decline.) Net debt falls from 83.7 per cent of GDP this year to 75.0 per cent of GDP in 2022-23. This is down from 77.9 per cent of GDP in our March forecast, reflecting higher nominal GDP, slightly lower cumulative borrowing over the forecast, plus further planned sales of RBS shares and student loans.

As always, we highlight the considerable uncertainty that lies around any medium-term fiscal forecast. Experience shows that a favourable revision in one forecast can be followed by an unfavourable one in the next and that policy decisions ought to be robust to that. As we explain in the Foreword, this has also been an unusually challenging forecast process, with repeated failures to observe the agreed timetable. This has resulted in a regrettable (but thankfully small) inconsistency between our economy and fiscal forecasts, as well as the Government announcing a complicated package of measures that further delays and increases the generosity of universal credit, where we cannot certify the impact on borrowing as central and reasonable on the basis of the information we were provided. This implies greater scope for subsequent revisions than would normally be the case.

The big picture in this forecast is of a relatively stable but unspectacular trajectory for economic growth – close to 1½ per cent in every year – plus a gradual further decline in the budget deficit and in net debt as a share of GDP. Given the lack of any meaningful basis on which to predict the outcome of the negotiations over the future relationship between the UK and the EU – which may continue well beyond any near-term Withdrawal Agreement – we have based this forecast on the same broad-brush assumptions regarding the impact of Brexit that we have made in our previous post-referendum forecasts.

As we explained last month in Discussion Paper No.3: Brexit and the OBR’s forecasts, we will adjust our assumptions as necessary for the eventual agreements on trade, migration, budget contributions and other issues. In the near term, it is worth emphasising that this forecast assumes a relatively smooth exit from the EU next year. A disorderly one could have severe short-term implications for the economy, the exchange rate, asset prices and the public finances. The scale would be very hard to predict, given the lack of precedent.

Read more in the October 2018 Economic and fiscal outlook