Introduction

Since the financial crisis, the Bank of England’s Monetary Policy Committee (MPC) has deployed unconventional forms of monetary policy to support the economy. The full consequences of these interventions for the public finances – in the sense of comparing what the public finances look like now with how they would have looked in the absence of such interventions – is impossible to estimate with any confidence. Most of the effects are indirect – including the extent to which gilt purchases reduced gilt yields; the extent to which that induced further changes in asset prices; what effects that had on economic activity and employment; and so on. A second order, but still important, question to ask is how unconventional monetary policy measures have been directly accounted for in the public finances. We address that question in this explainer, which:

- outlines these unconventional monetary policies;

- defines some of the public sector fiscal aggregates affected by them;

- details the direct effects of the Asset Purchase Facility’s (APF) gilt purchases on the public finances;

- describes the direct effects of the APF’s corporate bond purchases;

- sets out the direct effects of the Term Funding Scheme; and

- summarises the combined effects of these schemes to date and our latest forecast for their effects to the end of 2023-24.

Unconventional monetary policies

The Chancellor’s current remit to the MPC directs it to maintain consumer price inflation at 2 per cent and, subject to that, to support the Government’s objective of achieving strong, sustainable and balanced growth. In normal times, the MPC pursues these objectives by adjusting Bank Rate, the interest rate at which the Bank remunerates commercial banks’ cash holdings at the Bank – this is often referred to as ‘conventional’ monetary policy. But when Bank Rate reaches its effective lower bound – as in the wake of the financial crisis – the MPC may provide further support to the economy through ‘unconventional’ monetary policies, such as large-scale asset purchases (‘quantitative easing’) and schemes to facilitate the provision of credit.

Under quantitative easing, the Bank of England purchases financial assets, financed by issuing additional commercial bank reserves (on which the banks earn Bank Rate). The sellers of those assets use the proceeds to invest in other assets, driving up asset prices generally, so reducing yields and thus borrowing costs for firms, as well as increasing the market value of all asset-holders’ wealth. Both effects will tend to boost aggregate demand. The increase in banks’ reserves may also encourage them to increase the supply of credit.[1]

The APF is the subsidiary of the Bank of England set up to manage these purchases on the Bank’s behalf. It is indemnified by the Treasury and currently holds two broad types of asset acquired through quantitative easing:

- Gilts have comprised the bulk of the assets on the APF’s balance sheet since its inception. Total cash invested in gilts stood at £428 billion at the end of 2017-18.[2]

- High-quality corporate bonds make up the rest of the APF’s assets. These purchases were made under the Corporate Bond Purchase Scheme (CBPS). The cash invested in this scheme stood at £10 billion in 2017-18.

Several policies have also been introduced to lower banks’ funding costs and improve the supply of credit. Two of these schemes remain in operation:[3]

- The Bank of England’s Funding for Lending Scheme provided funding to finance commercial banks’ lending to the real economy, with the terms varying inversely with the quantity of loans extended. The maximum size reached under the scheme, which closed to new loans in January 2018, was around £70 billion. It was designed to encourage banks and building societies to expand their lending to households and private non-financial corporates, by providing funds at cheaper rates than those prevailing in the market at the time.[4]

- The Term Funding Scheme (TFS) – introduced following the EU referendum – provided cheap funding to commercial banks and building societies, with the expectation that the they would then pass the low rates through to households and businesses. A total of £127 billion was extended under the scheme, which closed to new loans in February 2018. The loans have a 4-year term and we assume that all those currently outstanding will be repaid at the expiry of their term in 2020-21 or 2021-22.[5]

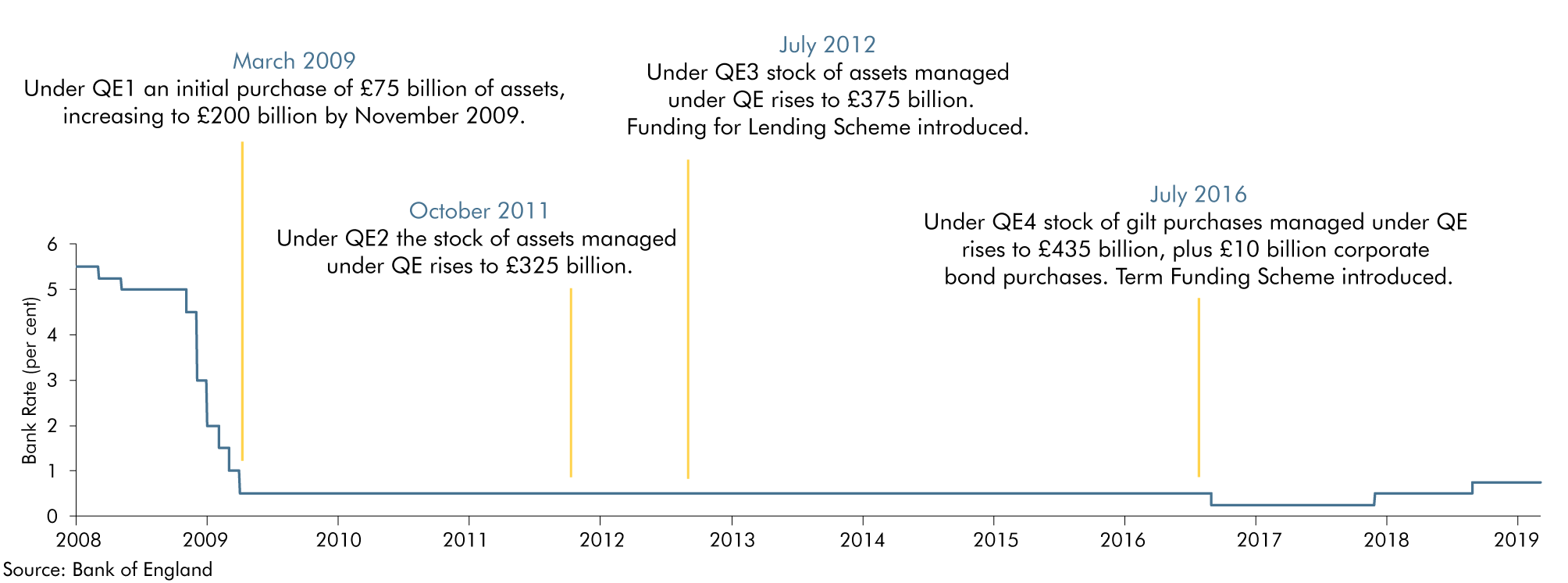

The timeline of these interventions is shown in Chart 1.1. They all involve flows of cash between the public and private sectors and changes in the assets on the public (and private) sector balance sheets. As a result, they have a direct impact on the metrics used to measure the state of the public finances, as described in subsequent sections. In addition, they affect the public finances indirectly through their effects on economic activity and interest rates. We attempt to capture both types of impact in our fiscal forecasts, but it is only possible to quantify the direct accounting effects with precision.

Chart 1.1: Conventional and unconventional monetary policy since the crisis

Public sector fiscal aggregates

The main fiscal aggregates that we focus on are public sector net borrowing (PSNB) and public sector net debt (PSND). PSNB is the difference between public sector spending and receipts in a given year. PSND is the stock of the public sector’s debt liabilities minus its liquid assets.[6] As such, it is largely the stock of the government’s cash borrowing over time.

The APF and Bank of England are both classified as part of the broader public sector. Public sector cross-holdings (debts owed by one part of the public sector to another) ‘consolidate out’, having no effect on PSND. Quantitative easing and lending through the TFS both involve the public sector acquiring assets and incurring liabilities (by issuing reserves). In each case, the balance sheet transaction has an immediate effect on the public finances that is followed by continuing effects on income and expenditure.

Despite superficial similarities, the three interventions – gilt purchases, corporate bond purchases and lending under the Term Funding Scheme – affect PSNB and PSND in strikingly different ways. The accounting treatments of each intervention depend on the treatment of the asset acquired (corporate bonds and loans are illiquid assets, which do not net off PSND) and on whether the liability corresponding to the asset acquired is a public or private sector one (gilts are public sector liabilities, whereas corporate bonds and TFS loans are private sector ones).

The interventions affect PSNB to the extent that they affect spending and receipts by different amounts. The effect on PSND reflects this borrowing impact, plus the impact of any financial transactions and valuation effects. (Financial transactions affect the public sector net cash requirement, but not PSNB. Valuation effects affect PSND, but not the net cash requirement.)

In the following sections, we describe the direct effects of the three interventions on the public finance aggregates. We do not quantify the overall direct and indirect effect relative to a counterfactual where the MPC had not pursued unconventional monetary policies.

Direct fiscal impacts of the APF’s gilt purchases

The effects of APF gilt purchases on the APF’s balance sheet and net income

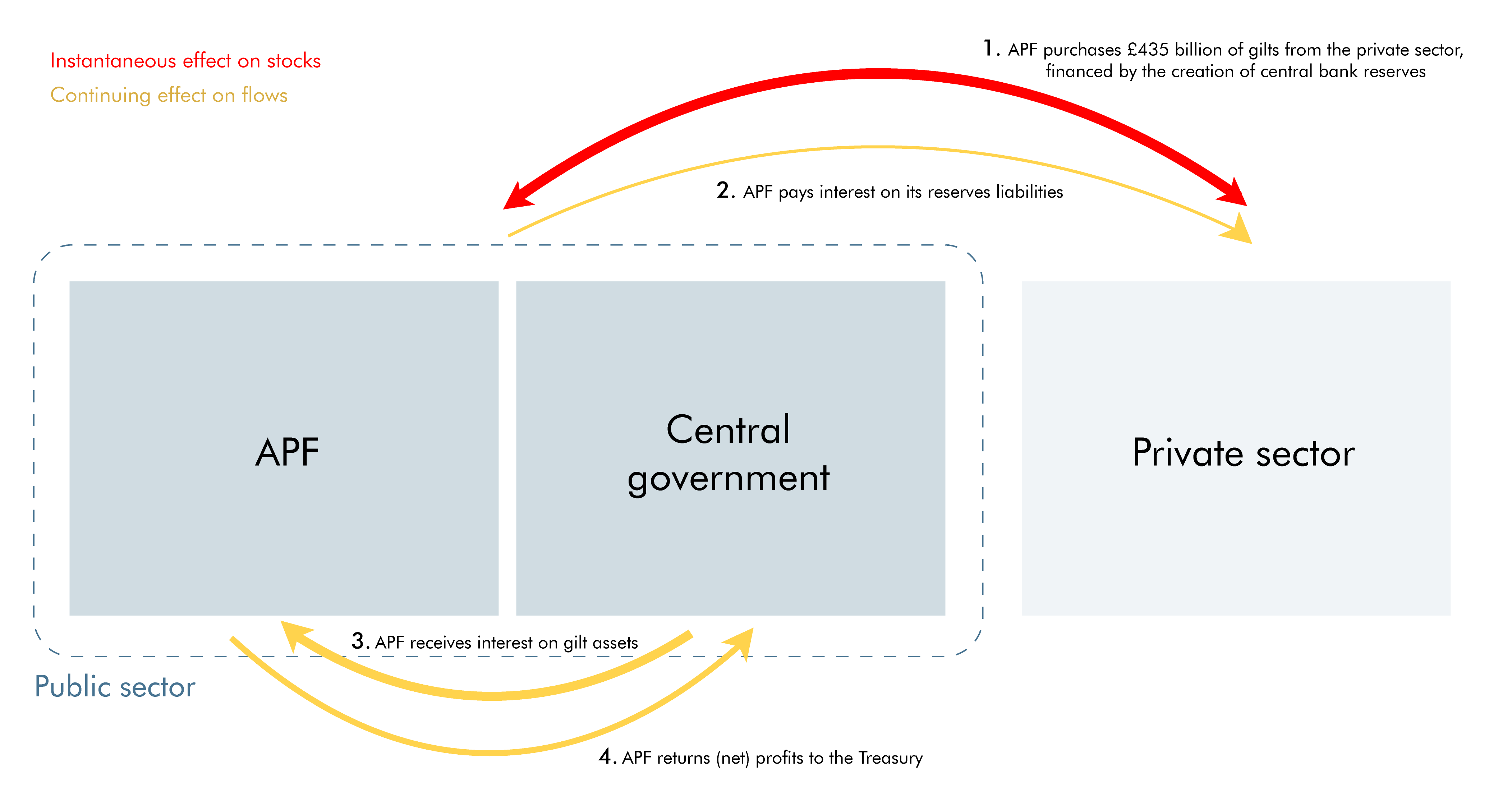

The gilt purchases made under quantitative easing have had the largest effect on the APF’s balance sheet of any unconventional monetary policy. The following five types of transaction are associated with these purchases:[7]

- Acquisition of assets – the APF purchases gilts from the private sector in the secondary market, financed by a loan from the Bank of England that in turn is financed by the creation of Bank of England reserves that are credited to commercial banks’ accounts.

- Incurrence of liabilities – the Bank of England issues reserves on behalf of the APF, which shows on the APF’s balance sheet as a loan owed to the Bank.

- Debt interest payments – the APF pays Bank Rate on its loan from the Bank, which in turn pays Bank Rate on reserve liabilities to the private sector.

- Debt interest receipts – once the APF has acquired gilts it receives the associated interest payments from central government.

- Transfers to the Treasury – the Treasury has granted the APF an indemnity. Under the terms of the indemnity the APF pays any cash profits from the scheme to the Treasury.[8] But were the APF to make a loss or require a cash top-up to replace redeeming gilts, the Treasury would transfer the necessary funds. Figure 1.1 summarises the transactions associated with the APF. Gilt purchases have an instantaneous effect on the APF’s balance sheet: increasing its assets (gilts) and liabilities (the reserves-financed loan from the Bank) by equal amounts. (For simplicity, the figure looks through the step between the APF and the Bank in respect of issuing reserves.[9]) This is followed by a continuing effect on the APF’s income and expenditure: it pays interest on the reserves, receives interest on the gilts, and – after subtracting redemption losses and operating costs – returns any net profits to the Treasury. To date, the effective interest rate on its gilt assets has exceeded that on its liabilities (Bank Rate) by a significant margin, so the APF has run at a profit.

In the period since APF gilt purchases got under way in March 2009, the APF has purchased gilts financed by the issuance of £435 billion worth of reserves. In 2017-18, it paid out less than £2 billion on the reserves issued to finance this purchase, but received £15 billion in interest from the gilts. Some of this cash surplus was used for the reinvestment of redeeming gilts.[10] It transferred £9 billion to the Treasury.

Figure 1.1: Transactions associated with the APF

The effects of APF gilt purchases on public sector fiscal aggregates

Instantaneous effects

The APF buys gilts in the secondary market, financed by issuing reserves. This transaction does not affect the level of central government debt, but it does change who it is owed to – gilt liabilities to the private sector fall one-for-one with the rise in the APF’s holdings of gilts. Cash increases equal the change in the value of the reserves liabilities and cash decreases equal the value of gilt assets purchased, so net financial transactions are unaffected.

As well as a large immediate effect on the composition of PSND, there have been smaller immediate increases in its level. This is due to a valuation effect. PSND values gilts at their nominal value (the principal eventually due), rather than their market value (as revealed by the cash exchanged when the gilts are purchased). In theory, gilts could be sold at either a premium or a discount to their nominal value. But market yields have generally fallen in recent years to below the coupons offered on gilts, and thus market prices are higher than the nominal redemption value of most gilts. As a result, when the APF purchases gilts in the secondary market it tends to pay more than the amount they are valued at in PSND, so the fall in the nominal value of gilt liabilities to the private sector is smaller than the increase in reserve liabilities financing the purchases. This raises PSND.

Continuing effects

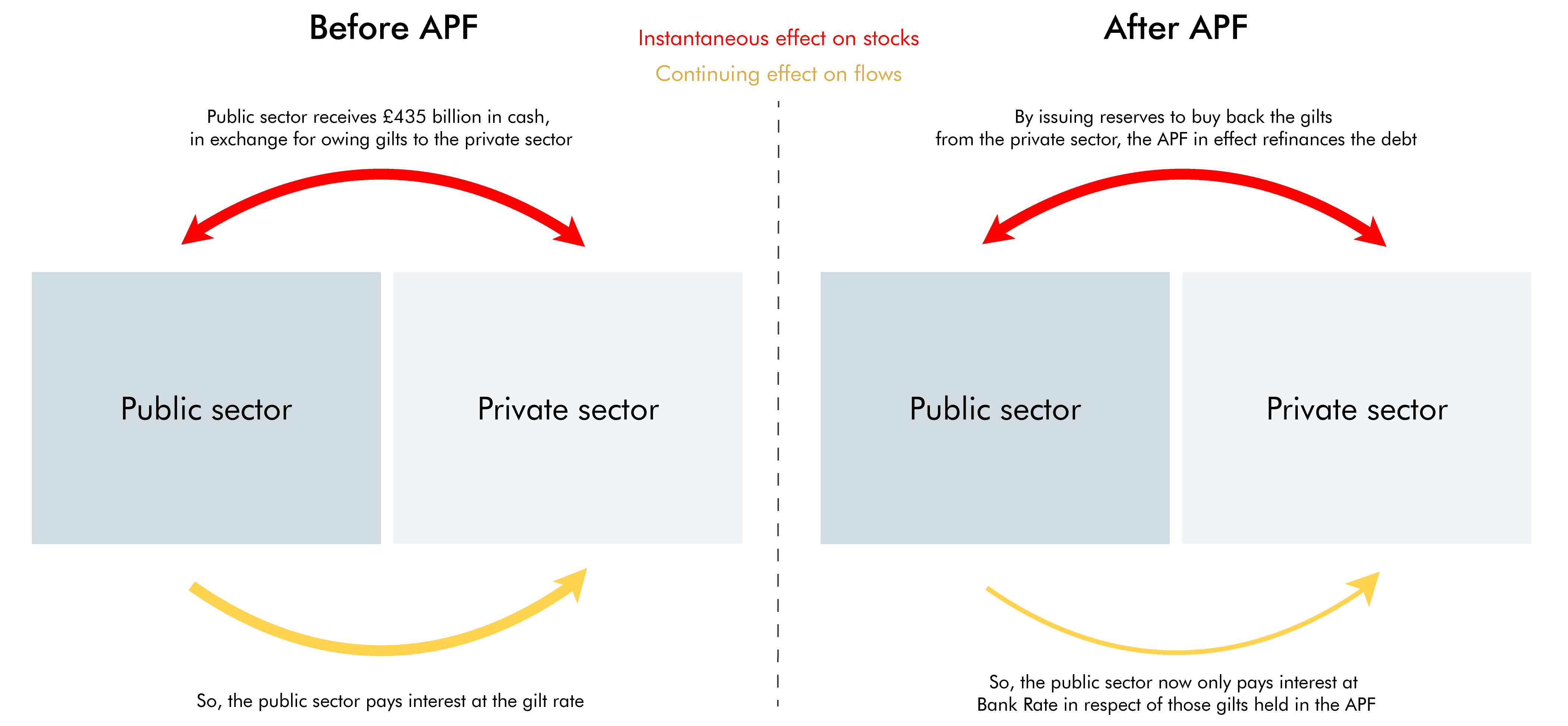

The new make-up of the public sector’s balance sheet generates a handful of continuing effects. By far the most important fiscally is a reduction in net debt interest spending.

Because the stock of central government debt is unaffected by the APF’s gilt purchases, central government gross debt interest spending is not affected either. But as the APF now holds some gilts and it is part of the wider public sector, central government debt interest payments to the APF are precisely offset by the APF’s interest receipts at the public sector level. But the APF’s gross debt interest spending also increases, as it must now pay interest on the reserves issued to finance the gilt purchases.

As Figure 1.2 shows, from the perspective of the consolidated public sector, the overall effect is as though the gilts purchased by the APF had been refinanced at Bank Rate (instead of paying the relevant gilt rate). And because Bank Rate has been lower than gilt rates since the financial crisis, the public sector has effectively profited from the spread between the two rates, reducing public sector net debt interest spending and hence PSNB.

Figure 1.2: How APF gilt purchases affect public sector net debt interest payments

Other continuing effects on the public finances from the APF’s gilt purchases are smaller:

- Transfers from the APF to the Treasury reduce central government borrowing but correspondingly increase the APF’s net borrowing. This only has small, second round effects on the public sector as a whole: receiving this cash upfront rather than holding it in the APF allows the Treasury to reduce gilt issuance, slightly reducing debt interest.

- Rolling over redemptions affects APF gilt premia. The MPC’s policy has been to hold the stock of purchased gilts constant, so when any gilts it holds are redeemed they are replaced by further purchases. This can result in the premia effect described in paragraph 1.15 changing due to movements in market prices for gilts. These effects tend to be larger if the value of gilts redeemed in a particular year is unusually high.

Direct effect of the APF’s gilt purchases on the public finances

Table 1.1 illustrates the size of the direct effects that the APF’s gilt purchases had on the key public finance aggregates in 2017-18.

The market value of reserve liabilities was £62.8 billion greater than the reduction in the nominal value of gilt liabilities. This difference increased PSND. But in effect refinancing £435 billion worth of gilts at Bank Rate reduced debt interest payments by £13.5 billion. Were the savings associated with this, together with the equivalent savings from preceding years, to have reduced gilt issuance, PSND would have been £81.0 billion lower by the end of 2017-18. As a result, the direct effect of the APF’s gilt purchases on the public finances has been to reduce PSND by £18.2 billion.

Table 1.1: Direct effect of APF gilt purchases on public sector flows and stocks

| £ billion in 2017-18 | ||

| Effect on flows | ||

| Receipts | No effect | |

| Spending | Interest on reserves | 1.6 |

| Interest on gilts no longer leaves public sector | -15.1 | |

| PSNB | -13.5 | |

| Effect on stocks | ||

| Assets | No effect | |

| Liabilities | Reserves liabilities increase | 427.7 |

| Existing gilt liabilities decrease (nominal value) | -364.9 | |

| Lower PSNB reduces gilt issuance | -81.0 | |

| PSND | -18.2 | |

| Source: ONS, OBR estimate | ||

Direct effect of the CBPS on the public finances

The operation of the Corporate Bond Purchase Scheme involves the same five transactions as the APF’s gilt purchases: purchasing assets, incurring a liability that finances those purchases, paying interest on the reserves, receiving interest on the assets, and transferring any net income to the Treasury. The assets purchased by the APF as part of the CBPS are “sterling investment-grade bonds issued by firms making a ‘material’ contribution to the UK economy”.[11] Corporate bonds (in general) are not deemed by the ONS to be sufficiently liquid to net off as an asset against PSND.

The reserves created to finance the purchase of corporate bonds increase public sector liabilities in the same way as those associated with gilt purchases. But purchasing corporate bonds does not affect public sector assets or liabilities as they are measured for PSND, because the bonds are private sector liabilities and they do not net off as liquid assets. A financial transaction equal to the full value of the newly issued reserves therefore increases PSND. And as the bonds are not valued at all in PSND, there are no valuation effects associated with corporate bond purchases.

The effect on PSNB is also more straightforward than with the APF’s gilt purchases. Higher public sector interest receipts from corporate bonds outweigh higher interest spending on the relevant reserves, so public sector net interest spending falls, lowering PSNB.

As with the APF’s stock of gilts, the stock of corporate bonds will naturally redeem over time, so it must be topped up if the MPC wishes to maintain the value of its purchases. This would have no effect on PSND if the stock of reserves remained constant, and only small effects on PSNB associated with any change in the extent to which the average interest paid on the corporate bonds held changed relative to the rate paid on the reserves (Bank Rate).

The reserves issued to finance the purchase of corporate bonds have so far added £10 billion to PSND. The spread between the comparably high interest paid on these bonds (we forecast this to be over 2 per cent from 2018-19) and the reserves issued to finance their purchase generated a stream of profits for the exchequer worth £0.1 billion in 2017-18. As the size of this intervention is relatively small, and these savings have only been accumulating since 2016, this scheme has had relatively little effect on the public finances.

Table 1.2: Direct effect of CBPS purchases on public sector stocks and flows

| £ billion in 2017-18 | ||

| Effect on flows | ||

| Receipts | Interest on corporate bonds | 0.1 |

| Spending | Interest on reserves | 0.0 |

| PSNB | -0.1 | |

| Effect on stocks | ||

| Assets | No effect | |

| Liabilities | Reserves liabilities increase | 9.9 |

| Lower PSNB reduces gilt issuance | -0.1 | |

| PSND | 9.8 | |

| Source: Bank of England, OBR estimate | ||

The direct effects of the TFS on the public finances

Since January 2019, the TFS has been on the Bank of England’s own balance sheet, having initially been recorded on the APF balance sheet.[12] Under the scheme, the Bank provides loans to commercial banks, financed by issuing more reserves. As with the APF’s corporate bond assets, these loans are treated as illiquid assets in PSND. The Bank pays interest on its liabilities (the reserves issued to finance the TFS loans) and receives interest on its assets (the loans). Because the loans pay rates on average very close to Bank Rate, which the Bank pays on the reserves, net interest receipts associated with the TFS are only just above zero.

As with the CBPS, the reserves associated with TFS loans raise public sector debt liabilities. But as illiquid assets, the loans do not net off against them in PSND, so a financial transaction increases PSND by the full amount of the newly issued reserves. Given the almost identical interest rates on assets and liabilities, there is virtually no effect on PSNB.

The initial outlays associated with the TFS had increased PSND by £127 billion by the time the scheme closed to new loans in February 2018.

Table 1.3: Direct effect of TFS on public sector stocks and flows

| £ billion in 2017-18 | ||

| Effect on flows | ||

| Receipts | Interest on TFS loans | 0.3 |

| Spending | Interest on reserves | 0.3 |

| PSNB | 0.0 | |

| Effect on stocks | ||

| Assets | No effect | |

| Liabilities | Reserves liabilities increase | 127.0 |

| PSND | 127.0 | |

| Source: Bank of England, OBR estimate | ||

Summary of effects to date and our latest forecast

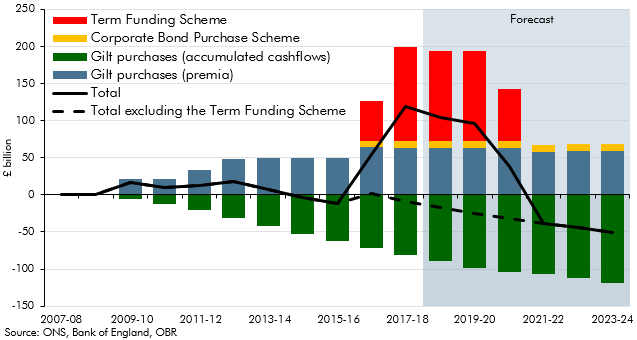

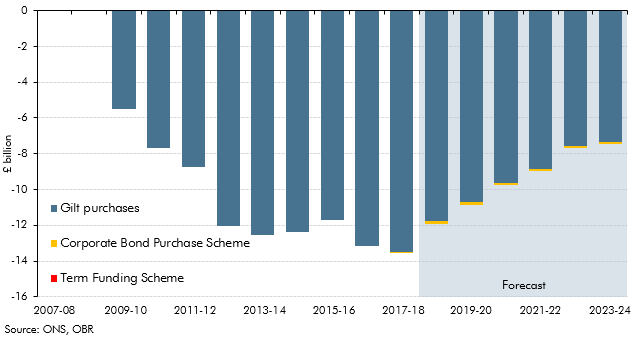

Chart 1.2 shows the direct effect of unconventional monetary policy on the path of PSND from 2007-08, before the crisis hit, up to 2023-24, the final year of our latest forecast.

Initially, the direct effects on PSND were relatively small. Between 2009-10 and 2015-16, the premia resulting from successive gilt purchases raised PSND. This was partly offset by the cumulative effects of lower debt interest spending at first – and was more than offset by those savings from 2014-15 onwards.

But the acquisition of illiquid assets following the EU referendum – the £127 billion of loans extended under the TFS and the £10 billion of corporate bonds acquired under the CBPS – increased PSND sharply in 2016-17 and 2017-18. The total effect of unconventional monetary policy on PSND peaks at £119 billion in 2017-18.

TFS loans remain the largest source of year-to-year fluctuations in our PSND forecast. In 2018-19, £5.6 billion of loans were repaid early rather than at the end of their 4-year terms in 2020-21 and 2021-22. We have therefore reduced the expected redemptions in those years by an equivalent amount. But we have assumed that these were one-offs and that there are no further repayments between now and the term of the remaining loans. There are of course risks to this assumption, but at this stage there is insufficient information to forecast the size and timing of any future early repayments.

Beyond this point, debt interest savings continue to accumulate (under our current assumptions for Bank Rate and the yield curve), increasing the total reduction in debt.

Chart 1.2: Unconventional monetary policy: direct effects on PSND

Chart 1.3 shows the effect of the same policies on PSNB via their effects on public sector debt interest spending. At first the debt interest saving increased as an increasing proportion of debt was in effect refinanced at Bank Rate via APF gilt purchases. The CBPS lowers PSNB from 2017-18 onwards, but by a fraction of the amount. The debt interest saving declines from 2017-18 onwards as a result of Bank Rate gradually rising (to 0.75 per cent now and to 1.1 per cent by 2023-24) and reducing the spread between Bank Rate and gilt rates.

Chart 1.3: Unconventional monetary policy: direct effects on PSNB

Effects of ‘exiting’ unconventional monetary policy on the public finances

Our latest forecast is conditioned on Bank Rate rising to just 1.1 per cent in 2023-24, so it does not assume any reduction in the APF’s gilt or corporate bond holdings (consistent with the MPC’s current guidance).[13] If and when the time comes that the MPC decides to reduce those asset holdings, the direct effects on the public finances could be significant.

For example, if such a decision were prompted by signs of the economy overheating, Bank Rate and gilt yields could be significantly higher than they are now and than is assumed in our latest central forecast. In such circumstances, the APF might sell gilts at market prices lower than those it paid when the gilts were purchased, thereby raising less than the value of the reserves created to finance the purchases and prompting a call on the Treasury indemnity to cover the associated losses. But, of course, any such effects would materialise against the backdrop of an economy that was operating above its potential, which could be expected to boost the public finances in other ways.