Our annual Forecast evaluation report (FER), published each autumn, examines how our forecasts compare to subsequent outturn data and identifies lessons for future forecasts.

Boxes

Within each of our key publications we include topical ‘boxes’. These self-contained analyses are unique to this publication and tend to cover recent developments in the economy or public finances that complement the main discussion of our analyses.

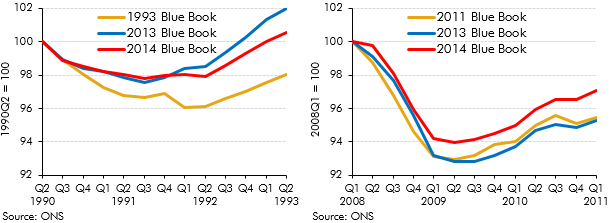

Revisions to National Accounts data are a normal part of the Blue Book process, which reconciles the different measures of GDP and incorporates information from annual data sources. The 2014 Blue Book contained particularly large changes because it was the first time that the National Accounts were published on an ESA10 accounting basis. This box set out some of the key changes in Blue Book 2014 and their impact on some of the key economy variables.

‘Computable general equilibrium’ (CGE) modelling is a tool for assessing the potential medium and long-term economic impact of policy changes. This box explored recent Government CGE studies of cuts to corporation tax and fuel duties alongside the potential impact of other recent tax rises and spending cuts.

This box explored the implications of the new 2010 European System of Accounts (ESA10) on our public finances forecast, ahead of its incorporation in our December 2014 EFO. Annex B of our March 2014 EFO explained these changes in more detail.

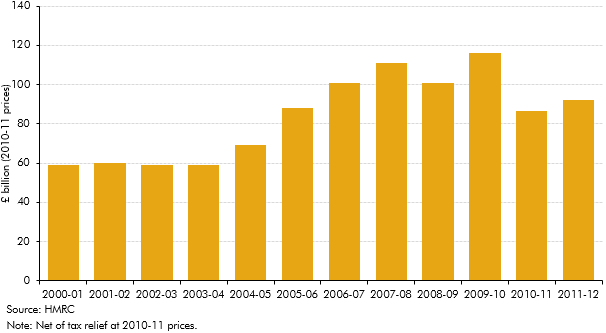

An additional rate of income tax of 50p for incomes over £150,000 was introduced in April 2010. Budget 2012 announced that this rate would be reduced to 45p from April 2013. This box explored how the incomes of those affected by this change evolved over this period - in particular the significance of forestalling and income shifting.