Residential property transactions fell sharply in 2008 as the availability of mortgage finance fell and stricter credit standards were introduced. This box explored recent trends in transactions and discussed our medium-term forecast, which is determined by our projection of average rate of turnover in the housing market. In our March 2012 forecast we expected the level of transactions to remain around 20 per cent below the pre-crisis peak by the end of the forecast period.

This box is based on HMRC housing data from February 2012 .

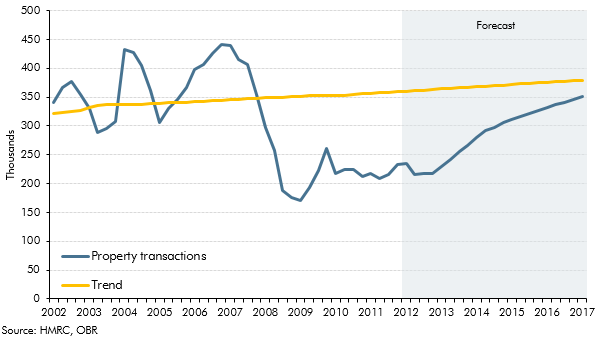

Residential property transactions fell sharply in 2008 as the availability of mortgage finance fell. Lenders’ risk appetite was reduced, as funding conditions deteriorated, resulting in stricter credit standards. This led to a sharp fall in purchases by first-time buyers, who are now typically asked to raise a 25 per cent deposit, compared to 10 per cent before the crisis.a Turnover has recovered a little from its trough in 2009, but remains well below its long-run trend, as shown on Chart A.

There has been a pick-up in residential property transactions and mortgage approvals in the past few months, probably driven by the upcoming expiry of the stamp duty exemption for first-time buyers in March 2012. We, therefore, expect transactions to fall back again in the short term, before recovering slowly from 2013 onwards as credit conditions ease.

Our medium-term projection of property transactions are conditioned on a return toward the long-run average rate of turnover in the housing market – which implies owner-occupiers move once every 19 years. The depressed current level of transactions is consistent with owner-occupiers moving only once every 30 years. We are forecasting a relatively slow return to the long-run average, which is not quite complete by the end of the forecast period. By this time, and despite strong growth rates, the level of property transactions is still around 20 per cent below the pre-crisis peak.

Chart A: Property transactions