In our November 2015 forecast, we anticipated the effect on the public finances of the ONS decision to reclassify private registered providers of social housing in England. This box outlined the policy measures which affect our forecast, the effect on the public finances and changes in these forecasts since November.

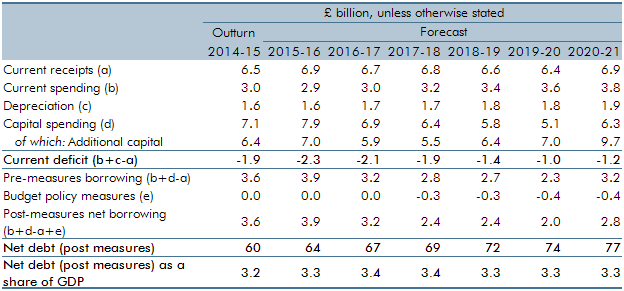

In our November forecast, we anticipated the effect on the public finances of the ONS decision to reclassify private registered providers of social housing in England – which includes most housing associations (HAs) and some other private sector providers – into the public sector (see Annex B of that EFO.) The ONS has now implemented that decision in the official data, reflecting 2014-15 ‘global accounts’ data for HAs that were not available when we completed our November forecast. The ONS estimates that HAs increased public sector borrowing by £3.6 billion and net debt by £60 billion (3.3 per cent of GDP) in 2014-15. That is around £1 billion lower for borrowing than we had estimated (due to lower capital spending), but about £0.5 billion higher for debt (due to the inclusion of certain lease obligations and other items).

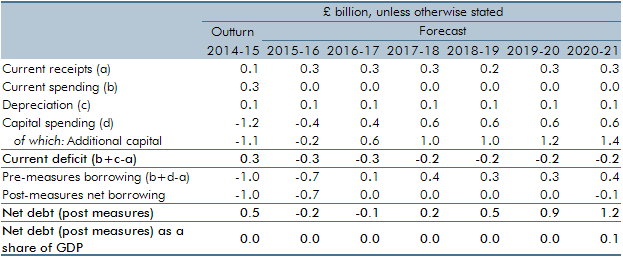

Our pre-measures forecast for HAs’ borrowing in 2015-16 is £0.7 billion lower than in November, mainly due to lower capital spending. We have recalibrated our forecast model to be consistent with the latest ONS estimate for 2014-15, which implied that HAs had leveraged grants and cash surpluses by less than we had assumed. All else equal, that would reduce capital spending in the initial years of the forecast. Offsetting that, we have revised up our forecast of rental income and cash surpluses to make the forecast consistent with how the ONS has grossed up the ‘global accounts’ data for small providers not covered in that report. That pushes up capital spending via our assumption about leveraging. By 2020-21, that means our pre-measures HAs borrowing forecast has been revised up by £0.4 billion. Effects on PSND have been largely offsetting, with revisions since November averaging less than £1 billion a year across the forecast period.

Our forecast now factors in the effect of the right-to-buy pilot that was announced in November, but that the Government did not provide us with a costing at that time. The full expansion of right-to-buy to HA tenants has not yet been specified sufficiently to be included in our forecast. In this Budget, the Government has announced two further policy measures that affect our HAs fiscal forecast:

- the pay to stay policy announced in July 2015 has been amended in two ways. First, it has been made voluntary for HAs (although it remains mandatory for local authorities) as the Government seeks to reduce its control over HAs. Some HAs are expected not to charge tenants the additional rent and some to implement the policy in a way that is more generous to tenants. The Government has also announced that rent increases will now be tapered as income rises, replacing the ‘cliff-edge’ policy design whereby rents would jump to 80 per cent of market rent when a households’ income topped £30,000 (£40,000 in London) and 100 per cent of market rent when it topped £40,000 (£50,000 in London). Both amendments are expected to reduce HAs’ rental incomes; and

- the 1 per cent a year social sector rent cuts for supported housing will also be deferred by a year, raising HAs’ rental income.

The pay to stay policy amendments have the biggest effect on our HAs’ borrowing forecast, because they reduce rental income and cash surpluses. We assume that this feeds more than one-for-one into lower capital spending on housebuilding.

Table A: March forecast for HAs’ effects on the public finances

Table B: Changes in post-measures HAs forecast since November

This box was originally published in Economic and fiscal outlook – March 2016