Our pre-measures fiscal forecast was closed earlier than usual to give the Chancellor a stable base to make decisions for the Budget and Spending Review. This box described the impact of news since the forecast closed on headroom to the Government's fiscal targets.

The Foreword to this document describes how our pre-measures fiscal forecast was finalised earlier than usual, on 1 October, in order to give the Chancellor a stable base on which to make

decisions for the Budget and Spending Review. And Box 2.3 describes the news that has accumulated over the intervening period. We conclude that upside news in historical GDP data

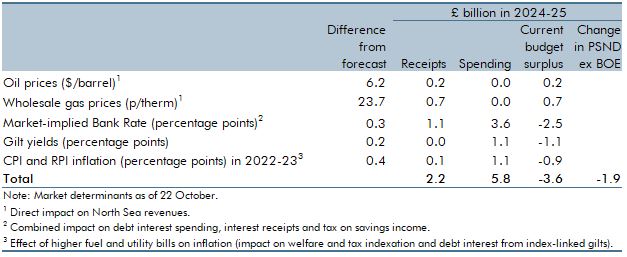

was broadly offset by more recent downside news in terms of the outlook for real GDP, but that higher energy prices point to a higher near-term path for inflation, while market expectations for interest rates have risen materially. Using ready-reckoners drawn from relevant fiscal forecast models, we can calculate the direct effect of these developments on the headroom against debt falling and balancing the current budget in 2024-25. As Table A reports, headroom would be slightly smaller, but still positive, for both.

The £1.9 billion loss of headroom against debt falling and £3.6 billion loss relative to the current balance are largely explained by the net effect of higher interest rates on debt interest spending and interest receipts. North Sea revenues are also boosted by the higher energy prices, while welfare and public service pensions spending are lifted by higher inflation. The fact that income tax thresholds are frozen in cash terms means higher inflation does not lead to a loss of fiscal drag (with the cost instead being borne by taxpayers).

Table A: Indicative effects on target headrooms of news since closing the forecast

This box was originally published in Economic and fiscal outlook – October 2021