During the financial crisis, both Bradford & Bingley (B&B) and Northern Rock (Asset Management) (NRAM) were transferred to public ownership. The ONS has announced that it will reclassify both bodies into the central government sector. This box outlined the impact of the reclassification on our fiscal forecast.

During the financial crisis, both Bradford & Bingley (B&B) and Northern Rock (Asset Management) (NRAM) were transferred to public ownership (in the case of NRAM, originally as part of Northern Rock). To date, neither bank has been included by the ONS in the fiscal aggregates that exclude the temporary effects of the recent financial interventions, which we are required to forecast.

Following revised international guidance, the ONS has announced that it will reclassify both bodies into the central government sector, as they are closed to new business and will be unwound over time. The reclassification will take effect from January 2010 and July 2010 respectively, and is expected to be implemented in the monthly public sector finance statistics in early 2013. The decision has two effects on our forecasts.

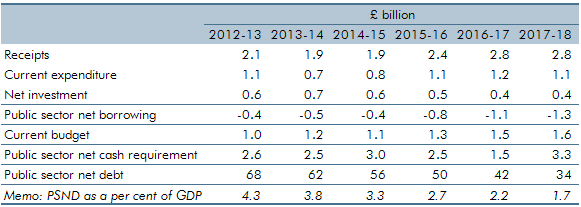

First, flows between the banks and the Exchequer will now net off within the central government sector. Public sector net debt (ex) will rise, because government loans to these entities will no longer count as liquid assets of the public sector and be netted off against gross debt. Similarly, interest paid to the government on these loans will no longer count as revenue and repayments of principal will not reduce the government’s cash requirement. These effects are shown in Table A. The figures are consistent with the banks’ latest business plans, based on their own economic forecasts.

Table A: The effect of cancelling intra-sector flows

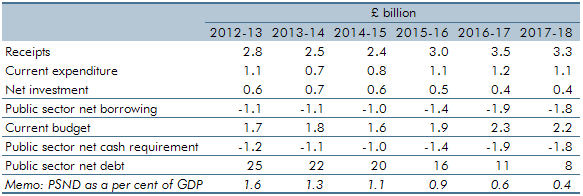

Second, the banks’ external borrowings and debt will now also be included in the public sector net borrowing ex and net debt ex measures. Table B illustrates these additional effects. The treatment of particular income and spending streams is yet to be decided by the ONS. We assume for the purposes of this forecast that:

- receipts will increase as the banks accrue income, mainly through mortgage interest payments;

- current expenditure will be higher as the banks’ running costs are included;

- capital expenditure will be higher due to loan write-offs; • public sector net borrowing will be lower over the forecast period, as the additional receipts outweigh these costs; and

- public sector net debt will be higher throughout the forecast period, with the impact declining over time. PSND captures total liabilities, but only subtracts liquid assets – which do not include long-term assets like mortgages. The mortgage books are now closed and being run down over time, so the liabilities will fall as principal repayments are made.

Table B: Additional effects on the forecast

Table C illustrates the overall impact on the forecast. In Box 4.4 we consider the total cost of the financial sector interventions, including those in support of B&B and NRAM.

Table C: Overall effect on the fiscal forecast