The Government undertook a number of interventions in the financial sector in response to the financial crisis and subsequent recession of the late 2000s. This box provided an update of the estimated net effect of them on the public finances as of July 2015.

This box is based on HM Treasury data from March 2015 .

This box provides an update on crisis-related interventions in the financial system, in particular:

- equity injections into Royal Bank of Scotland (RBS), Lloyds and the nationalisation of Northern Rock plc;

- holdings in Bradford & Bingley (B&B) and NRAM plc, now managed by UK Asset Resolution (UKAR);

- loans through the financial services compensation scheme (FSCS) and various wholesale and depositor guarantees; and

- other support, through the asset protection scheme, special liquidity scheme, credit guarantee scheme and a contingent capital facility – all now closed.

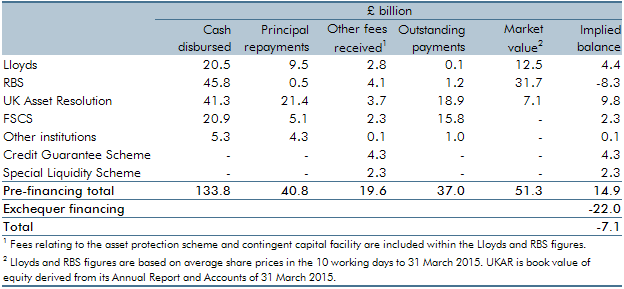

Table B summarises the position as at the end of March 2015. Since then, the Government has sold further shares in Lloyds and has extended the Lloyds trading plan until end of December 2015. It has also announced plans to begin the process of selling RBS shares.

In total, £134 billion has been disbursed by the Treasury to date since the crisis. By the end of March, principal repayments on loans, proceeds from share sales and redemptions of preference shares amounted to £41 billion, up from the £39 billion reported in our last EFO. The additional repayments mainly relate to the sale of Lloyds shares through the trading plan and the UKAR loan (Northern Rock and NRAM plc). In total, the Treasury also received a further £20 billion, mainly from fees, but also from interest that is now included for all institutions as ‘other fees received’. So the net cash position stood at around a £73 billion shortfall.

By the end of March, the Treasury was owed £37 billion (largely the value of loans outstanding); it held shares in Lloyds and RBS valued at £44 billion; and its holdings in B&B and NRAM plc had an equity book value of £7 billion according to their latest Annual Report and Accounts.

If the Treasury was to receive all loan payments in full, and sold the shares at their end of March 2015 values, it would realise an overall cash surplus of £15 billion, but these figures exclude the costs to the Treasury of financing these interventions. If all interventions were financed through debt, the Treasury estimate that additional debt interest costs would have amounted to £22 billion by end of March 2015, implying an overall cost of £7 billion to the Government.

Table B: Cost of financial interventions

This box was originally published in Economic and fiscal outlook – July 2015