Our post-EU referendum publications noted many direct or indirect Brexit-related uncertainties across our economy and fiscal forecasts. One area that will be directly affected after Brexit is customs duties. In our March 2017 Economic and fiscal outlook, this box outlined the how customs duty was currently treated in the public finances data and the fiscally neutral approach that we had used in our forecast pending further information on post-Brexit policy settings.

In our November 2016 EFO we set out our assumptions regarding the UK’s exit from the EU, which we have retained for this EFO. In terms of financial flows between the UK and the EU after the UK’s exit, the assumptions we have made are fiscally neutral. The actual situation post-Brexit will no doubt differ in its composition and its effect on borrowing. One area where this will be relatively complex relates to custom duties, which are currently collected on behalf of the EU.

Customs duties are taxes levied on imports by all EU member states under the common customs tariff.a The receipts are passed on to the EU, minus a fixed share (currently 20 per cent) retained to cover collection costs. In the UK, these retained receipts are recorded in the public finances as sales of services, which are deemed to be negative expenditure rather than positive receipts. (The treatment of expenditure transfers to EU institutions is covered from paragraph 4.128.)

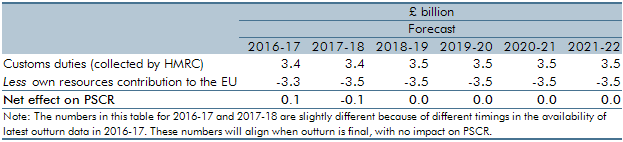

The treatment of customs duties in the public finances data – and therefore in our forecast – involves two steps. The taxes are collected by HMRC, so are reflected in the ‘National Accounts taxes’ aggregate. But as they are collected on behalf of the EU, neither the collection of the taxes nor their subsequent transfer affect ‘public sector current receipts’ or the budget deficit. The positive effect on National Accounts taxes is therefore offset by a negative line in other receipts. Our current forecast for customs duties is shown in Table C.

Table C: Customs duties in the public finances

The Government’s white paper on exiting the EU states that post-exit the UK “will not be bound by the EU’s common external tariff”. It does not set out precisely what future tariff regime it will seek, beyond replicating as far as possible the EU’s goods and services schedules at the World Trade Organisation. So we are not in a position to make any forecast of the level of customs duty the Government intends to levy in future or the extent to which it will wish to reallocate any net income.

Instead for this forecast we maintain the fiscally neutral impact of customs duties on the forecast as given in Table C. An alternative fiscally neutral assumption could be made that the same level of duties are collected after exiting the EU, but that they are retained as UK receipts and spent within the UK. As this involves more assumptions and deviating further from the current treatment in the public finances we have chosen not to do this. When the Government does establish a post-exit customs regime, its effect on our forecasts will be set out transparently.

This box was originally published in Economic and fiscal outlook – March 2017