In the years prior to our March 2011 forecast there had been a number of changes to the rate of VAT, which affected CPI inflation. The Consumer Price Index excluding indirect taxes (CPIY) provides a measure of inflationary pressures excluding the effects that policy changes have on the CPI measure. This box considered how changes in VAT had contributed to the difference between CPIY and CPI at the time and what this meant for underlying inflationary pressures.

This box is based on ONS inflation data from February 2011 .

Changes in the Consumer Prices Index excluding indirect taxes (CPIY) provide a measure of inflationary pressures excluding the effects that policy changes have on the CPI. For example, it excludes price changes which are due to changes in indirect taxation, such as VAT, alcohol, tobacco and fuel duties.

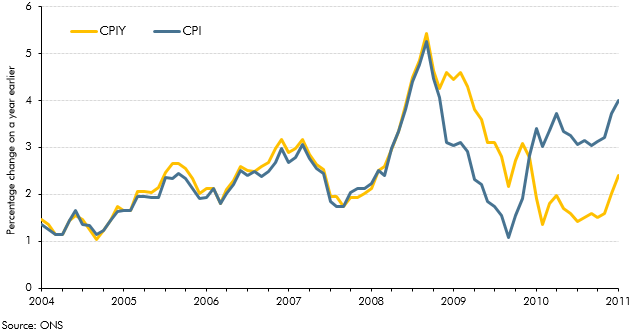

Chart A plots CPI inflation and CPIY inflation to give an illustration of the possible effect of changes in the rate of VAT on CPI inflation over recent years. The temporary reduction in the VAT rate from 17½ per cent to 15 per cent from December 2008 put downward pressure on CPI inflation over 2009. Similarly, annual CPIY inflation remained within the range of 1.3 to 2 per cent over 2010, highlighting the upward pressure on CPI inflation as a result of the return of VAT to 17.5 per cent in 2010. However, the CPIY measure assumes that VAT changes are passed on to the consumer immediately and in full. To the extent that firms absorb some of the rise in VAT in margins, underlying inflation may be higher than implied by CPIY.

Chart A: CPIY and CPI inflation