The new SCAPE discount rate, to be implemented in April 2024, increases the present value of future pensions payments and in turn causes employer contributions to rise. Box 4.4 explained the SCAPE rate change and its overall impact on the public finances.

This box is based on HMT data from November 2023 .

Unfunded public service pensions include central government pay-as-you-go schemes (the largest of which are the Civil Service, National Health Service, Teachers, and the Armed Forces) and locally administered police and firefighters’ schemes. Public spending on these schemes is measured in AME in net terms as total payments to each scheme’s pensioners less total pension contributions from public sector employers and current employees.

The Superannuation Contributions Adjusted for Past Experience (SCAPE) rate is the discount rate used by unfunded public service pension schemes to place a current value on expected future pension payments. It has been subject to a series of adjustments over the past eight years, reducing the SCAPE discount rate from CPI plus 3 per cent in 2011 to CPI plus 2.4 per cent in 2018. In the most recent update, the Government announced a further decrease to CPI plus 1.7 per cent, which will impact employer contribution rates from April 2024, prompted by revisions to our long-term growth forecasts.

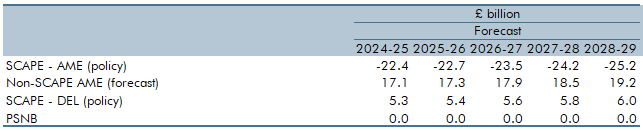

A lower discount rate means that the present value of past and future pension promises to public sector workers is higher than previously estimated. This results in a higher valuation of existing pension liabilities and the cost of ongoing pensions being accrued by current members of the schemes. This increase in liabilities and the higher expenditure needed to cover these costs might be expected to increase measures of both debt and the deficit. However, the accounting rules used by the ONS for the main fiscal aggregates combined with the operation of departmental spending limits means this is not the case, which is an example of a ‘fiscal illusion’.a Table A shows the impact of SCAPE-related changes in this forecast:

- Net pensions AME spending: The ONS account for pension expenditure in cash terms within AME. Cash payments to current pensioners made by pension schemes are not affected by the SCAPE change. However, pension scheme receipts increase, as the SCAPE change leads to an increase in employer contributions required to finance the higher future liabilities. Overall, therefore net unfunded pension spending in AME falls. In this forecast, this has been partially offset by the other changes described in paragraph 4.65.

- DEL spending: The net effect of the changes in AME require public sector employers to increase contributions by an average of £5.6 billion per year. The Government has committed to providing funding for these increased costs which raises DEL spending to exactly offset the impact.b

- PSNB: The net result of these changes in AME and DEL spending means there is no impact on PSNB.c Payments out of the public sector to pensioners are unchanged, while higher employer contributions have been offset by the addition to DEL.

- PSND: Pensions liabilities are not recognised in PSND. So, the stock change in liabilities caused by the SCAPE change has no direct impact on PSND.

- PSNW: Pensions liabilities are recognised in PSNW but changes in the SCAPE discount rate will not impact the liability recorded by the ONS as they use a constant discount rate.

Table A: Impact of SCAPE rate changes in our forecast

The reduction in the SCAPE rate reflects our more pessimistic view on long term economic growth as set out in the 2022 Fiscal risks and sustainability report. All else equal, this reduces the expected future tax revenues available to pay for future pension payments. So, in isolation, the SCAPE rate change suggests the public finances are less sustainable than previously thought. But the overall sustainability of unfunded public pensions is also affected by numerous other factors, including the rate of future pay increases which are also likely to be affected by lower growth. We will address these wider issues when we update our comprehensive estimates of the future fiscal impacts of pensions as part of our next long-term fiscal projections in summer 2024.

This box was originally published in Economic and fiscal outlook – November 2023