Russia’s invasion of Ukraine in late February 2022 led to a surge in wholesale and retail energy prices, and a subsequent rise in inflation to a four-decade high. To support households and businesses, the Government introduced a series of policies during 2022 which were a key factor pushing spending and borrowing outturn in 2022-23 above both our March 2021 and March 2022 forecasts. This box examines how the costs associated with this policy response in 2022-23 evolved over successive forecasts and in initial outturn.

This box is based on DESNZ and OBR data from September 2023, March 2022, November 2022 and March 2023 .

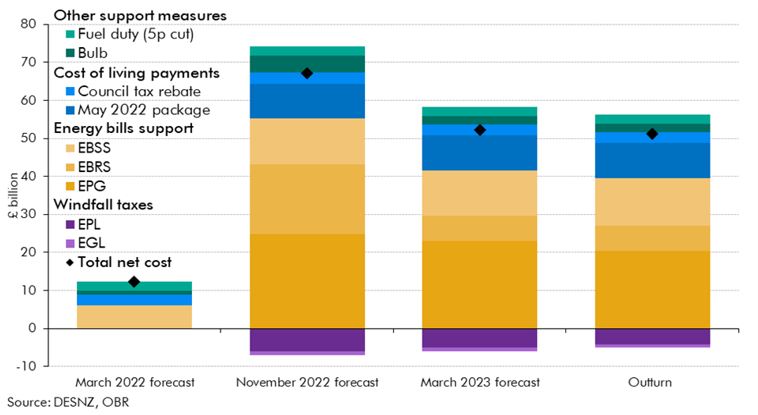

Russia’s invasion of Ukraine in late February 2022 led to a surge in wholesale and retail energy prices, and a subsequent rise in inflation to a four-decade high. To support households and businesses, the Government introduced a series of policies during 2022 which were a key factor pushing spending and borrowing outturn in 2022-23 above both our March 2021 and March 2022 forecasts. This box examines how the costs associated with this policy response in 2022-23 evolved over successive forecasts and in initial outturn (summarised in Chart A).

In our March 2022 forecast, completed shortly after the invasion, we expected total energy support to cost £12.3 billion (less than 1 per cent of GDP) based on the measures announced by Chancellor Sunak in the March 2022 Budget. Over financial year 2022-23:

- the energy bills support scheme (EBSS), a £200 energy bills discount to all households in October 2022 was estimated to cost £6.0 billion;

- a £150 council tax rebate, to be paid to most households in April 2022, was expected to cost £2.9 billion; and

- other support consisted of a 5p cut in fuel duty, expected to cost £2.4 billion, and the bailout of Bulb Energy which we expected to cost £1.0 billion.

By the time of our November 2022 forecast, the Government announced a series of additional measures to support households and business, which increased our forecast of the total cost of energy support in 2022-23 to £67.1 billion (2.7 per cent of GDP). The key additional measures whose costs were reflected in our November 2022 forecast included:

- a May 2022 package of cost-of-living payments to households which added £9.2 billion of spending. This package consisted of a one-off payment to those on means-tested, pension-age, and disability benefits.

- the windfall taxes on energy producers via the energy profits levy (EPL) and the electricity generator levy (EGL). Combined, we forecast the EPL and EGL to raise £7.1 billion, with over four-fifths of that from the EPL.

- the EBSS was also expanded in May 2022 to £400 discount on household energy bills in October. This added another £6.0 billion to the cost of this scheme, bringing the total cost of the EBSS to £12.0 billion.

- the energy price guarantee (EPG) announced in September 2022 capped annual energy bills for a typical household at £2,500 from October to the end of 2022-23.a We initially expected this to cost £24.8 billion.

- the energy bill relief scheme (EBRS) performed the same role as the EPG for businesses, and we included a cost of £18.4 billion.

- our estimate of the cost of the Bulb Energy bailout rose to £4.6 billion because of the rise in wholesale energy costs.

In our March 2023 forecast, we revised down the total cost of the energy support package in 2022-23 to £52.2 billion largely due to:

- the cost of the EPG was revised down from £24.8 billion to £23.0 billion: of this, there was a £1.7 billion downwards revision due to lower-than-expected energy use, slightly offset by a rise of £0.3 billion due to higher energy prices. The lag in changes in wholesale energy prices impacting retail energy prices due to the Ofgem price cap meant that the fall in wholesale energy prices between our November 2022 and March 2023 forecasts was reflected in a much lower expected cost for the EPG in the following financial year, 2023-24, rather than in 2022-23.b

- we made a more significant downwards revision of £11.7 billion to the cost of the EBRS, bringing the cost in 2022-23 down to £6.7 billion. Just over one-third of this downward revision was due to sharp falls in wholesale energy prices (£2.8 billion) and lower discounts than we had expected (£1.6 billion). The remaining two-thirds (£7.3 billion) was a result of lower volumes of eligible energy use, reflecting lower overall energy use during a warm autumn and early winter, and a lower share of energy use being eligible for the scheme.

- the cost of the Bulb Energy bailout was revised down from £4.6 billion to £2.1 billion on the back of the Government reducing the allotted sums for the two facilities it extended to Bulb.

- receipts from the windfall taxes were revised down by £7.1 billion to £6.0 billion due to lower wholesale energy prices.

Initial outturn data shows that the total net cost of energy support policies in 2022-23 was £51.1 billion in 2022-23 (2.0 per cent of GDP). This was £38.8 billion above our March 2022 forecast but £16.1 billion and £1.1 billion below our November 2022 and March 2023 forecasts, respectively. Around two thirds (£41.6 billion) of the gross cost of this support went on energy bills support (EBSS, EPG and EBRS), with the remaining fifth mostly spend on wider cost-of-living payments and council tax rebate (£12.1 billion). Just under 9.0 per cent of the gross cost was offset via windfall taxes on energy producers.

Many of the policies introduced in response to the energy crisis extend into 2023-24 and beyond. In our March 2023 forecast, we projected the net costs in 2023-24 to be £11.3 billion (0.4 per cent of GDP). From 2024-25 onwards, of all the policies described in this box, only the windfall taxes continue to impact the public finances. We expect them to raise £6.8 billion (0.3 per cent of GDP) on average over the remaining four years of our forecast.c

Chart A: Total cost of energy support policies in 2022-23

This box was originally published in Forecast evaluation report – October 2023

a The EPG extended in to 2023-24, ending in June. Initially, the £2,500 cap on a typical annual household energy bill applied to the whole period but the cap was raised to £3,000 from April 2023 in the November 2022 Autumn Statement.

b Household energy bills are adjusted for expected changes in wholesale gas and electricity prices every three months via the Ofgem price gap.

c See Box 3.1 of the March 2023 EFO.