In the late-2000s recession, total investment in the UK fell by more than in other similarly-developed economies, but in the March 2014 forecast we expected it to pick up strongly. This box considered possible reasons for the previous weakness and compared the investment-to-GDP ratio in our forecast against OECD averages.

This box is based on OECD investment data from February 2014 .

From peak to trough, total investment in the UK fell by 23 per cent during the recession, half as far again as the 15 per cent average in similarly developed economies. The recovery in UK investment since the recession has also been far weaker than expected. With profitability rising, confidence building and credit conditions easing, we expect total investment to grow by nearly 50 per cent in real terms over the forecast period. Some doubt whether such a recovery is possible given the lack of growth in recent years. This box assesses UK investment patterns relative to other advanced OECD economies in order to test our forecast judgement further.

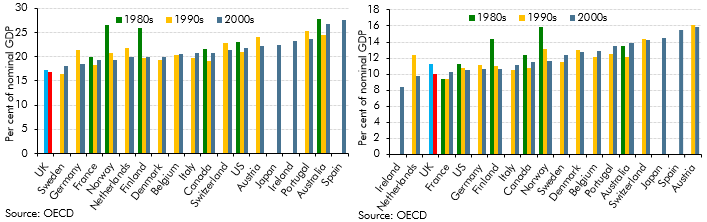

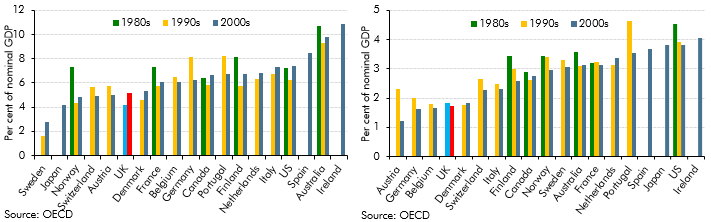

By international standards, total nominal investment as a share of GDP is low in the UK. This seems to be true in all sectors – corporate investment, housing investment and government investment – and has been true over a sustained period. There are many factors that could help explain this – for example, outsourced production as a result of globilisationa and a relatively large share of services. MPC member Ian McCafferty noted in a recent speech that ”over the past twenty years, there appears to have been a steady decline in the [capital to output]ratio… probably as a result of the growing importance of the service sector in GDP.”b A larger UK service sector has also generated a relatively high rate of intangible investment.c

One possible factor that is common across sectors is the rationing effect of the planning regime, which may reduce the quantity of all forms of investment. During the pre-crisis decade, when the UK (like many advanced economies) experienced rapid house price growth, the rise in house building was less marked than in other countries.d Dwellings investment in the UK peaked at 6.4 per cent of GDP, far below the 14.4 per cent seen in Ireland or even the 8.9 per cent in the US. The Government has introduced reforms to the planning system that may support investment growth among private firms and house builders over the forecast period.

The persistence of low levels of investment in the UK raises the question of whether a sustained period of strong investment growth, such as that in our forecast, would require an implausible improvement in our relative investment position. But, given the very low starting point, by the end of the forecast period we expect the total investment-to-GDP ratio to reach 17 per cent in the UK, which would still be below the OECD average of the past decade.

Chart G: Total investment, decade averages (left) and Chart H: PNFC investment, decade averages (right)

Chart I: Household investment, decade averages (left) and Chart J: General government investment, decade average (right)