A commonly used metric of credit impairment is the price of interbank lending relative to the interest rate on short term government debt, although this does not indicate anything about the quantity of interbank lending, which fell significantly following the financial crisis. This box discussed qualitative survey evidence to assess changes to cost and availability of credit to household and firms. The Bank of England credit conditions survey suggested a modest loosening of credit conditions for both households and medium-sized firms over 2010, but the availability of credit remained constrained compared to their pre-crisis levels.

This box is based on Bank of England credit conditions data from July 2010 .

A commonly used metric of credit market impairment since the financial crisis began has been the price at which banks lend to one another in the short term relative to the interest rate on short term government debt. However, this measure tells us nothing about the quantity of interbank lending, which fell significantly. The link between interbank lending and the wider economy is also unclear. An alternative, qualitative, approach is to assess what survey evidence tells us about the cost and availability of credit to households and firms.

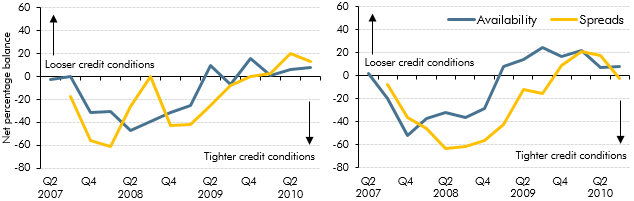

The Bank of England credit conditions survey points to a modest loosening in both the terms of credit and its availability to households. Medium sized corporations have limited access to capital markets and depend more heavily on banks to finance their investments. On average, these firms have also reported a slight easing in credit conditions over 2010, although the price of credit relative to the prevailing Bank Rate is reported to have risen slightly in the third quarter, reflecting changes in the price of wholesale funding. The charts set out the direction of credit availability and prices for households (secured credit only) and medium-sized firms respectively.

The current credit environment should be considered against a backdrop of severe deterioration in credit conditions over the course of the financial crisis. The modest easing over 2010 has done little to alleviate the constraints faced by borrowers relative to their pre-crisis levels and lending growth remains weak by historical standards. Our central forecast is for credit market impairment to unwind over the coming years, but we do not anticipate price or availability returning to their pre-crisis levels.

The financial instability arising from developments in Ireland and UK banks’ exposures present a downside risk to our central view (see Box 3.5), as does the possibility that continued deleveraging in the financial sector might curtail credit growth and lending to the broader economy. Credit conditions remain a key area of uncertainty over the forecast period.