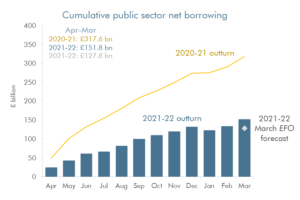

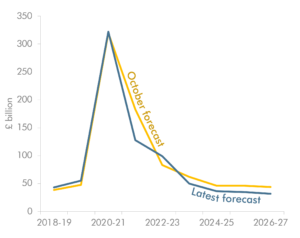

Higher inflation delivers record debt interest spending

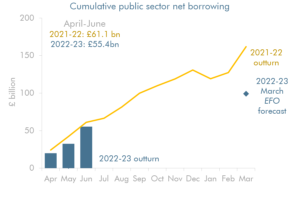

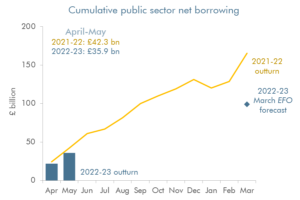

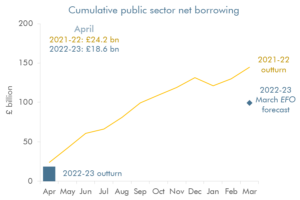

The budget deficit continues to fall year on year, with April-to-June borrowing of £55.4 billion down £5.7 billion on last year. But it was £3.7 billion above our most recent forecast profile, largely reflecting higher spending, alongside modestly lower receipts. Debt interest spending hit a record high – for both the single month of June…