Box sets » Fiscal risks report - July 2017

When discussing the potential impact of fiscal risks on the public sector balance sheet in our 2017 Fiscal risks report, we focused on the Government’s target measure of public sector net debt and its broader, but less-well-known counterpart, public sector net financial liabilities. In this box we considered some of the pros and cons of three even broader measures of the public sector balance sheet.

Our 2017 Fiscal risks report noted the historical and international evidence that financial crises have been a major source of risk to the public finances. Since the crisis of the late 2000s, the UK Government has reformed its regulation of the financial system. In this box we outlined key elements of those reforms, which aim to ensure that should a bank fail it can be managed in a way that protects the wider economy and financial system.

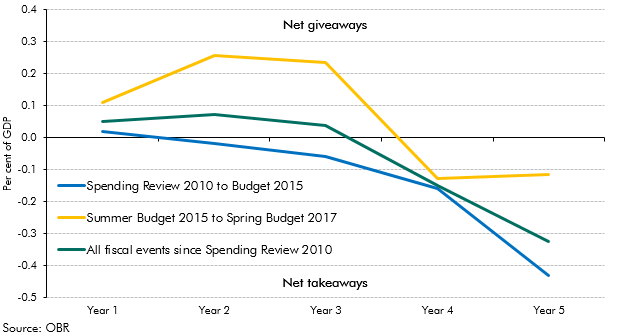

In each Budget or Autumn Statement, there are typically lots of policy giveaways (tax cuts or spending rises) and takeaways (tax rises or spending cuts). The net effect of these will be to raise or reduce borrowing in specific years and on average over the five years of the forecast – in other words to loosen or tighten fiscal policy. In this box from our 2017 Fiscal risks report we considered the pattern of those policy changes since 2010, noting that near-term giveaways are often financed by the promise of medium-term takeaways.