Over the past six months, the global energy and food supply shocks emanating from Russia’s invasion of Ukraine have intensified. The further curtailment of Russian imports saw European wholesale gas prices rise ten-fold from pre-pandemic levels, and markets now expect prices to remain four times higher in the medium term. Rising energy, food, and other goods prices have pushed up the interest rates set by inflation-targeting central banks to levels not seen since the 2008 financial crisis. This has taken much of the wind out of the global economic recovery from the pandemic and ratcheted up the financial pressure on governments that emerged from it with higher debt and are again being called upon to help households and businesses through this latest crisis.

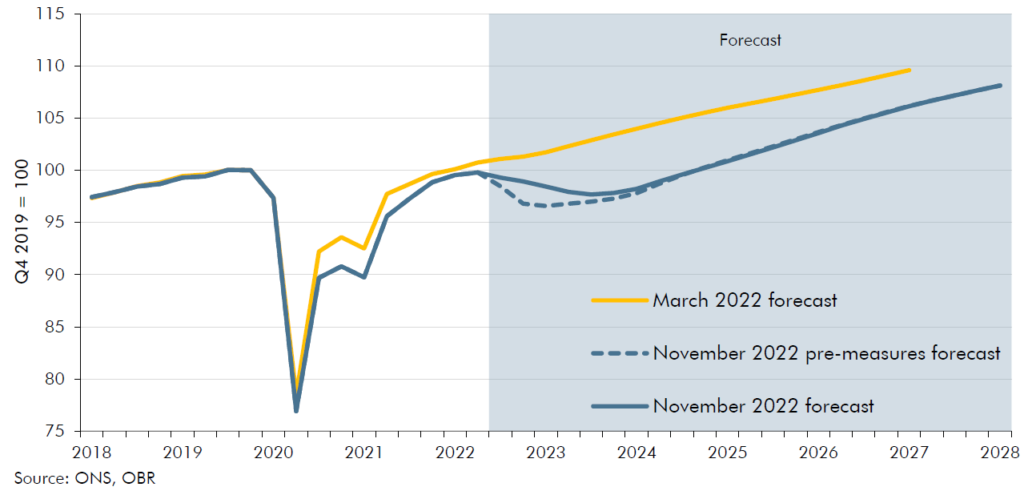

In the UK, CPI inflation is set to peak at a 40-year high of 11 per cent in the current quarter, and the peak would have been a further 2½ percentage points higher without the energy price guarantee (EPG) limiting a typical household’s annualised energy bill to £2,500 this winter and £3,000 next winter. Rising prices erode real wages and reduce living standards by 7 per cent in total over the two financial years to 2023-24 (wiping out the previous eight years’ growth), despite over £100 billion of additional government support. The squeeze on real incomes, rise in interest rates, and fall in house prices all weigh on consumption and investment, tipping the economy into a recession lasting just over a year from the third quarter of 2022, with a peak-to-trough fall in GDP of 2 per cent. Unemployment rises by 505,000 from 3.5 per cent to peak at 4.9 per cent in the third quarter of 2024.

Chart 1: Real GDP

Inflation drops sharply over the course of next year and is dragged below zero in the middle of the decade by falling energy and food prices before returning to its 2 per cent target in 2027. The resulting recovery in real incomes, consumption, and investment sees GDP return to growth in 2024 and output recover its pre-pandemic level in the fourth quarter of that year. As the output gap closes over the remainder of the forecast, GDP grows more rapidly than our estimate of its sustainable rate, which reaches 1¾ per cent in 2027. The rate of growth in potential output in the final year of the forecast is unchanged since March, albeit with a larger contribution from net migration offsetting slower growth in productivity.

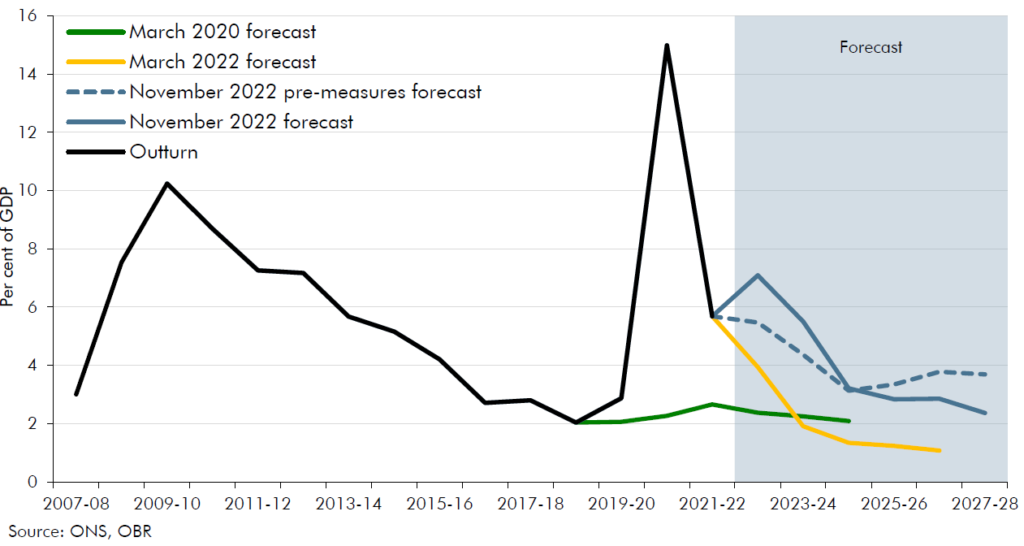

The medium-term fiscal outlook has materially worsened since our March forecast due to a weaker economy, higher interest rates, and higher inflation (the latter largely due to global factors, so raising public spending much more than it boosts tax bases). Based on policy as it stood in March, government borrowing would have been £108 billion (3.7 per cent of GDP) in 2027-28 and underlying debt would have been rising in every year. Of the £75 billion increase in the pre-measures deficit in 2026-27 relative to March, almost two-thirds is due to higher debt interest costs from higher interest rates, with the energy-shock-driven loss of receipts and the inflation-driven rise in welfare spending the other major factors.

Fiscal policy has been characterised by a high degree of uncertainty since March, first increasing and then reducing the medium-term deficit. Across five major fiscal policy statements, three successive governments have announced:

- near-term support for households and businesses with their energy bills on 26 May and 8 September costing £86.4 billion in total across 2022-23 and 2023-24;

- a medium-term fiscal loosening via personal and corporate tax cuts in the 23 September Growth Plan costing £48.2 billion in 2027-28, of which all but £21.1 billion was subsequently cancelled via announcements on 3 and 17 October; and

- a medium-term tightening in the Autumn Statement, which raises £19.3 billion in 2024-25 and material sums thereafter, rising to £61.7 billion in 2027-28.

The net effect of these measures is to increase borrowing relative to our March forecast by £64.2 billion in 2022-23 and £39.8 billion in 2023-24, reducing the fall in output when the economy is in recession and unemployment rising. Policy decisions then reduce borrowing from 2024-25 onwards – when the economy is recovering and unemployment falling – by amounts rising to £39.4 billion in 2027-28. Taking forecast and policy changes together, the deficit rises from £133.3 billion (5.7 per cent of GDP) last year to £177.0 billion (7.1 per cent of GDP) this year. Borrowing then falls by £37.0 billion next year to £140.0 billion (5.5 per cent of GDP), thanks to previously announced tax rises and scaled-back fiscal support, and continues falling to £69.2 billion (2.4 per cent of GDP) in 2027-28. The tax burden rises from 33.1 per cent of GDP in 2019-20 to 37.1 per cent of GDP at the forecast horizon, 1.0 percentage point higher than forecast in March and its highest sustained level since the Second World War. Despite cuts in departmental budgets, total public spending also rises – from 39.3 per cent of GDP in 2019-20 to 43.4 per cent of GDP in 2027-28 – 2.9 percentage points higher than predicted in March, reflecting higher debt interest and welfare spending raising cash spending, and the energy-shock-driven smaller economy.

Chart 2: Public sector net borrowing

Higher borrowing pushes underlying debt (excluding the Bank of England) up sharply, from 84.3 per cent of GDP last year to a 63-year high of 97.6 per cent in 2025-26. Tax rises, spending cuts and a pick-up in GDP growth are then sufficient for it to fall modestly in 2026-27 and 2027-28. The Government’s two legislated fiscal targets to balance the current budget and get underlying debt falling in 2025-26 are on course to be missed by £8.7 billion and £11.4 billion respectively. Given the scale of the energy shock and the recession it has induced, the Government has announced new targets: to get borrowing below 3 per cent of GDP and underlying debt falling in five years’ time, which it achieves, respectively, with £18.6 billion and £9.2 billion to spare. But the near-tripling of interest rates since March means the share of revenues consumed by servicing that debt rises from under 5 per cent in 2019-20 to 8½ per cent in 2027-28, leaving the public finances more vulnerable to future shocks or swings in market sentiment.

Against this more challenging backdrop, global and domestic risks to the outlook remain elevated. The main positive risk would stem from a rapid end to Russia’s invasion of Ukraine that stabilised energy markets and lowered prices. That could relatively quickly feed through to reduced inflationary pressure, smaller rises in interest rates, and a stronger economic recovery – raising the prospect of meeting the legislated fiscal targets again. The main adverse risks relate to a further escalation in the war in Ukraine intensifying pressures on European energy supplies, inflation, and interest rates. Gas prices returning to their late-August peak would, all else equal, add £42 billion to borrowing next year, while a 1 percentage point rise in interest rates would add around £25 billion a year by 2027-28.