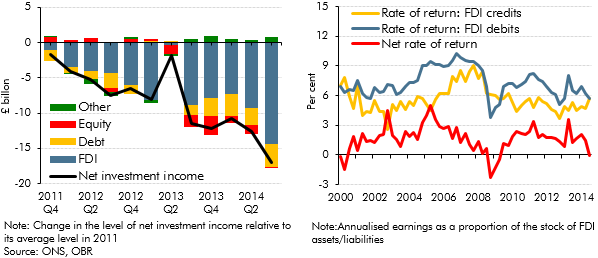

Our forecast for the current account balance is constructed in a bottom-up way by forecasting its main component balances that cover cross-border flows of: trade in goods and services, investment income, transfers, and employee income.

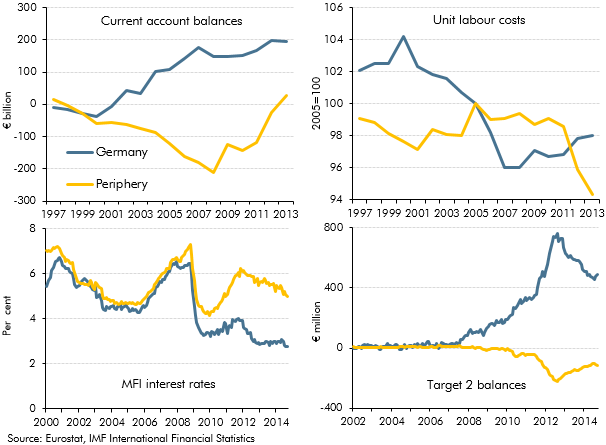

The UK has run a large current account deficit for the past couple of decades. We forecast that the UK will continue to run a large current account deficit over the next five years, driven by the trade and investment income balances.