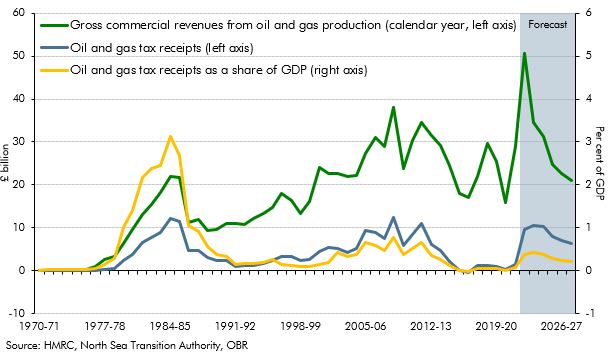

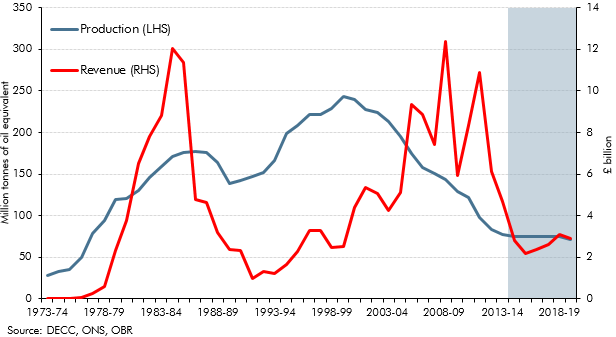

UK oil and gas revenues consist of offshore corporation tax (which includes ‘ring fence’ corporation tax and the supplementary charge), petroleum revenue tax and the energy profits levy (EPL). These taxes apply to the profits of companies involved in the production of oil and gas in the UK and on the UK continental shelf (UKCS) (“The North Sea”). In 2024-25 we forecast that oil and gas revenues will raise £3.8 billion. The four streams of revenue are:

- ‘Ring fence’ corporation tax (RFCT) is calculated in the same way as onshore corporation tax, but with the addition of a ‘ring fence’ and the availability of 100 per cent first-year allowances for virtually all capital expenditure. The ring fence prevents taxable profits from oil and gas extraction in the UK and the UKCS being reduced by losses from other activities. The current rate of tax on ring-fenced profits is 30 per cent.

- The supplementary charge (SC) is an additional charge on a company’s ring-fenced profits (but with no deduction for finance costs). The current supplementary charge rate is 10 per cent. It was reduced from 20 per cent on 1 January 2016.

- Petroleum revenue tax (PRT) is a ‘field-based’ tax charged on the profits arising from individual oil and gas fields that were approved for development before 16 March 1993. The rate of PRT was permanently set at zero per cent effective from 1 January 2016 but it has not been abolished so that losses (such as losses arising from decommissioning PRT-liable fields) can be carried back against past PRT payments. PRT was deductible as an expense in computing profits chargeable to RFCT and SC.

- The energy profits levy (EPL) is an additional surcharge on the profits of oil and gas companies, which came into effect on 26 May 2022. The surcharge was initially set at 25 per cent and due to expire by 31 December 2025. The 2022 Autumn Statement increased the rate to 35 per cent from 1 January 2023 and extended the levy until March 2028. Spring Budget 2024 extended it for an additional year to March 31 2029.