Box sets » Receipts » Oil and gas revenues

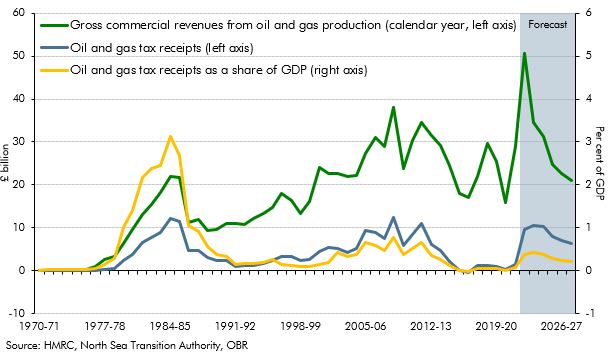

Fiscal categories: Receipts, Fuel duty, Income tax, Oil and gas revenues

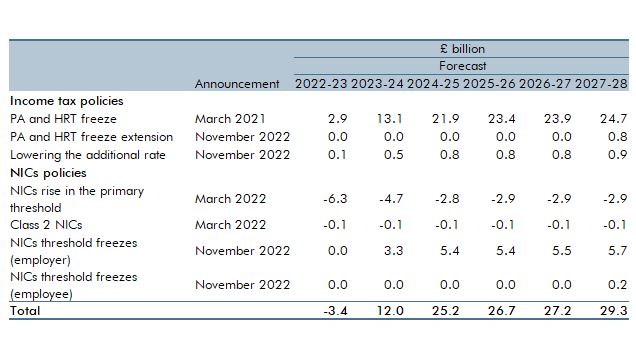

Cross-cutting categories: Fiscal drag and price uprating

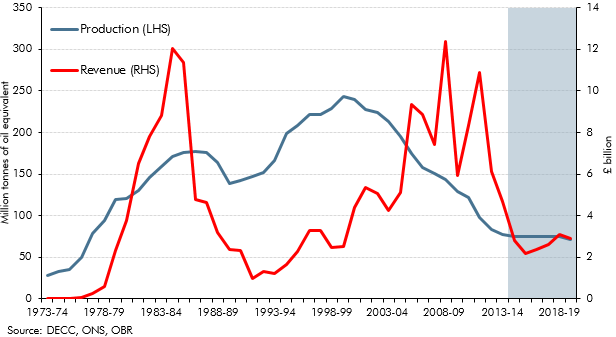

Fiscal categories: Oil and gas revenues

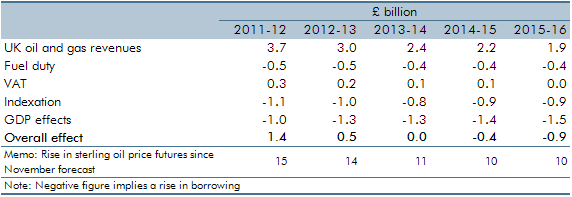

Economy categories: Nominal GDP, Oil prices

Fiscal categories: Receipts, Oil and gas revenues

Economy categories: GDP by expenditure, Inflation, Residential investment, Housing market, GDP by income, Household disposable income, Property transactions, Household consumption

Fiscal categories: Public spending, Departmental spending, Receipts, Oil and gas revenues

Cross-cutting categories: Pensions, Financial sector

Fiscal categories: Receipts, Oil and gas revenues

Fiscal categories: Whole of Government Accounts and National accounts, Public service pension payments, Oil and gas revenues, Receipts, Public spending

Cross-cutting categories: Pensions

Economy categories: Oil prices

Fiscal categories: Receipts, Fuel duty, Oil and gas revenues