Initial estimates of the deficit can be revised significantly over subsequent months as more reliable data become available. This box set out how our forecasts during 2016 and 2017 evolved and how the outturns for 2016-17 were revised over time.

This box is based on ONS data from September 2017 .

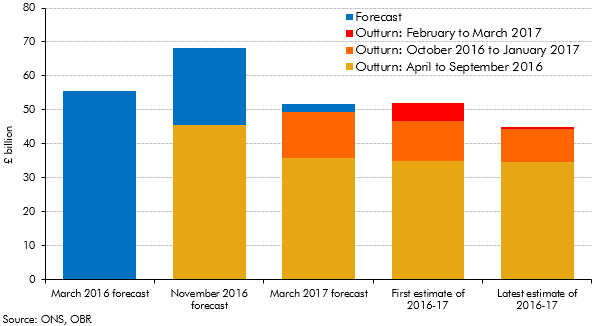

The September 2017 estimate of PSNB in 2016-17 is £45.0 billion. That is £7.0 billion lower than the initial ONS estimate published in April and between £6.7 and £23.1 billion lower than our three most recent forecasts. Chart A sets out how the public finances data and our forecasts for 2016-17 evolved in the period after our March 2016 forecast was presented:

- Our November 2016 forecast was based on published ONS outturn data for the first six months of 2016-17, which showed a 4.8 per cent fall in borrowing relative to the previous year, much slower than was implied by our March 2016 forecast. So, on a like-for-like basis, we revised our 2016-17 forecast up by £12.2 billion to £68.2 billion. Revised data for the first six months of 2016-17 now show a much larger year-on-year fall of 19.9 per cent.

- Our March 2017 forecast utilised a further four months of outturns. By then, PSNB in the first half of the year had been revised down by £9.6 billion, of which £7.7 billion reflected the move to recording corporation tax on a time-shifted accruals basis. Underlying receipts growth from October to January was also stronger-than-expected. We revised our PSNB forecast down by £13.4 billion on a like-for-like basis to £51.7 billion.

- The initial ONS estimate of 2016-17 PSNB (released in April) was £52.0 billion, just £0.3 billion above our March 2017 forecast produced the month before.

- The latest ONS estimate of 2016-17 PSNB (released in September) has been revised down by £7.0 billion relative to the initial estimate, to £45.0 billion.

Chart A: PSNB in 2016-17

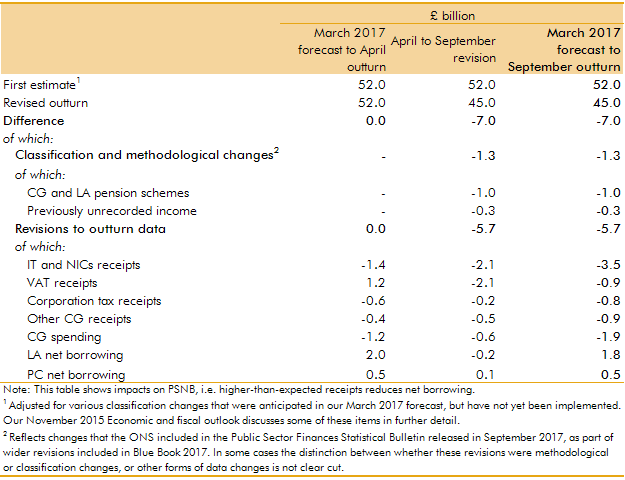

Table A sets out the drivers of the difference between our March 2017 forecast for 2016-17, the first ONS estimate released in April and the latest estimate (which will remain subject to revision for some time). In this table we have adjusted our forecast up by £0.3 billion to account for the effect of ONS classification changes that affect the recording of several small items of receipts and spending. These have been announced (so we include them in our forecasts) but not implemented (so they are not yet included in the outturn data).

On this basis, the difference between our March forecast and the initial estimate was just £5 million. That reflected a number of offsetting factors, including higher local authority borrowing but also higher income tax and NICs receipts and lower departmental spending.

Between April and September, the ONS revised PSNB in 2016-17 down by £7.0 billion. Methodological and classification changes implemented in the September data release explain £1.3 billion of the revision (the bulk relating to public sector pension schemes). The remaining £5.7 billion revision has been broad-based, with central government receipts revised up, central government spending revised down and local authority borrowing also lower. Only public corporations’ borrowing – revised up £0.1 billion since April – has had an offsetting effect.

Relative to our March forecast, Table A shows that on the basis of the latest estimates:

- Income tax and NICs receipts were £3.5 billion higher last year than we thought in March. Around £2 billion reflects receipts on stronger-than-expected bonuses in the financial and business services sectors at the end of the year. On an unchanged assumption about growth in bonuses, this would lead to higher receipts in each year of the forecast. The remaining £1½ billion reflects alignment of outturn data with the latest HMRC trust statement.

- VAT receipts were £0.9 billion higher than expected. Most of this reflects timing effects on cash receipts in the early part of 2017-18 that accrue back to 2016-17. On an unchanged assumption about growth in the tax base, only part of this would be expected to affect future years.

- Corporation tax (CT) receipts were £0.8 billion higher than expected, reflecting strong cash payments between April and June 2017. Under the new time-shifted accruals basis for CT, all these cash receipts are accrued back to earlier years. The implications of this for future years depend on whether those higher cash receipts imply that previous years’ liabilities are being paid off more quickly – i.e. a timing effect – or that the liabilities themselves have been higher than expected – i.e. that the underlying position is stronger, which all else equal would boost the forecast.

- Central government spending was £1.9 billion lower than expected, largely reflecting greater-than-expected underspending against departments’ plans. Given different pressures on departmental budgets in different years of the Spending Review period, there is no mechanical link between outturns in 2016-17 and the judgements that we would make about future years.

Partly offsetting those factors, local authority net borrowing was £1.8 billion higher than expected, as spending exceeded local revenue by a greater extent than we had assumed, mainly through higher than expected use of prudential borrowing. The implications of this for future years are not yet clear.

Table A: March 2017 PSNB: outturn versus forecast

This box was originally published in Forecast evaluation report – October 2017