On 24 December, four and a half years after the EU referendum, the UK and the European Union concluded the Trade and Cooperation Agreement (TCA). This box compared the provisions of the TCA against our previous broad-brush assumption that UK-EU trade would take place under the terms of a ‘typical’ free-trade agreement. It also discusses the initial evidence regarding its short-term impact.

This box is based on Highways England and Bank of England calculations data from February 2021 .

Our November 2020 EFO was conditioned on the broad-brush assumption that the additional trade barriers associated with leaving the EU would reduce the long-run productivity of the UK by around 4 per cent.a The full impact was assumed to take 15 years to be realised. Around twofifths of the 4 per cent impact has effectively already occurred as a result of uncertainty since the referendum weighing on investment and capital deepening. With the terms of the deal now known, we can assess how the TCA compares with our previous assumption of a ‘typical’ FTA, and take account of the early evidence on its immediate impact.

How does the deal compare to a ‘typical’ FTA?

Free-trade agreements are complex. No two are the same, and most involve the removal of trade barriers rather than their reimposition. The impact of the new trading relationship assumed in our previous forecasts was based on an average of several external studies of the economic impact of trading with the EU on ‘typical’ FTA terms.b These studies are based on estimates of reducing the cost of trading across borders which increases the intensity of trading activity and raises long-run potential productivity. Using them to estimate the potential impact of the TCA, which instead increases trading costs, adds an extra layer of uncertainty around the estimated magnitude of its economic effects.

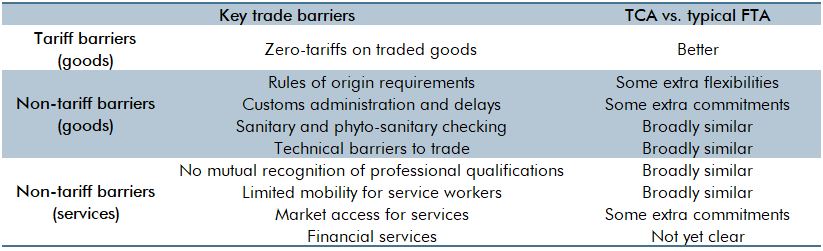

Table A summarises our assessment of the TCA against a ‘typical’ FTA of the sort embodied in these studies and assumed in our recent forecasts, drawing on independent analysis where possible. That analysis concludes that the TCA:

- Retains the position of no tariffs or quotas on goods traded between the UK and the EU, subject to meeting appropriate qualifying conditions, such as those on ‘rules of origin’. This goes somewhat beyond a typical FTA, where some tariffs – typically on agriculture – are often retained.

- Some flexibilities have been achieved around rules of origin requirements, although the Trade Policy Observatory (TPO) note that there are no standard international benchmarks upon which to assess this aspect of the deal.c There are commitments to streamline some aspects of customs administration, for example, IPPR highlight the commitment on working towards simplified customs procedures, basing controls on risk management and creating a ‘trusted traders’ programme.d

- In other areas, the deal exhibits broadly typical goods trade barriers. Sanitary and phytosanitary checking and technical barriers to trade provisions are similar to those required of other non-EU countries. Deloitte conclude that these provisions “very much mirror the basic texts from other FTAs which the EU has agreed”.e

- Introduces significant barriers to trade in services. The IfG note that while the deal follows the broad ambition set in the EU-Canada FTA to mutually recognise professional qualifications, no qualifications have yet been recognised under this framework.f The mobility of service workers is now subject to significant restrictions, with provisions that can also be found in other EU FTAs. In terms of market access for services, the TPO note that while the deal is similar to EU agreements with Canada and Japan, in practice there will be a variety of rules in supplying services to each member state, meaning that many firms will need to establish a new commercial presence within the EU.g

- The deal has “very little to say about the cross-border provision” of financial services and many of the EU’s unilateral equivalence decisions for the UK have been postponed.h The UK and EU are aiming to agree a ‘memorandum of understanding’ on the future framework for financial services regulation over the coming months.

Table A: Assessment of the deal, relative to a typical FTA

Overall, the TCA goes beyond a typical FTA with regards to tariffs on goods, by not introducing tariffs on the agriculture sector, but that has a relatively small aggregate economic impact. While some extra commitments have been achieved with respect to non-tariff barriers to goods trade, many of these are similar to other FTAs. The introduction of non-tariff barriers in services, which accounted for 42 per cent of the UK’s exports to the EU in 2019, is far more significant. It is this channel that accounts for much of the long-term reduction in productivity, in line with the findings of some of the studies that informed our previous assessment.i And, as set out above, some trade experts suggest the new trading arrangements for services may necessitate some firms establishing new subsidiaries within the EU to continue trading. At this point, we therefore see no case for altering our 4 per cent loss of productivity assumption.

Impact of disruption on our short-term trade outlook

Our previous forecasts assumed a smooth transition to the new trading relationship, with both the UK and EU exercising forbearance in the imposition of border checks and administrative requirements to give traders time to adjust. In practice, while the UK has delayed or reduced stringency in the application of some tax burdens and checks until July 2021, the EU has applied full customs requirements due on exports from Great Britain to the EU since 1 January.

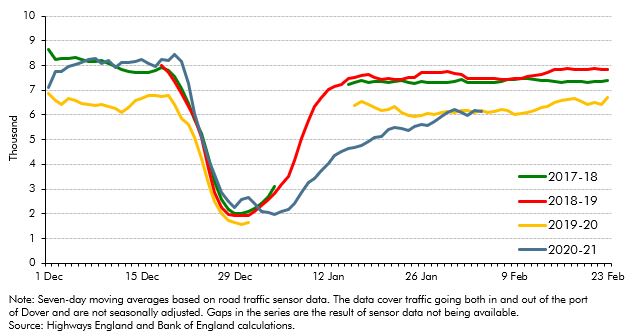

While official data on trade volumes in January will not be available until 12 March, commercial traffic flows through the main channel ports fell significantly in January. Chart B shows that HGV traffic around Dover was 10 to 15 per cent lower over the second half of January than a year earlier, although traffic levels appears to have recovered in February. Data on traffic volumes is only a partial indicator of trade activity and will not reflect factors such as the proportion of empty vehicles and the value of goods in transit. The picture is also clouded by the introduction of additional health checks at the EU-UK border to restrict the spread of the ‘Kent’ strain of the virus, and stockpiling by traders on either side of the Channel in the run-up to the end of the transition period.

Taking all these factors into account, we now expect the temporary near-term disruption to EUUK goods trade to reduce GDP by 0.5 per cent in the first quarter of this year. This reflects both that exports appear to have been hit harder than imports and that the trade disruption will affect UK supply chains. As firms on both sides of the Channel grow accustomed to new trading arrangements, this disruption dissipates, though further disruption is possible when the UK enforces the agreement in full on its side of the border later in the year.

Chart B: Number of heavy goods vehicles on roads around Dover

This box was originally published in Economic and fiscal outlook – March 2021