Our general government employment (GGE) forecast is based on projections of the growth of the total government paybill and paybill per head, which is in turn based on the Government's latest spending plans. Ahead of our November 2010 forecast, those plans were updated as part of the 2010 Spending Review. We also made a number of refinements to our forecasting approach. In this box we described revisions to our general government employment forecast and explain the extent to which these changes were the result of methodological changes as opposed to revised spending plans.

For its June Budget forecast the interim OBR projected general government employment.a The projection was driven by two factors:

- implied resource Departmental Expenditure Limits (RDEL),b which determines the growth of funds available for total paybill; and

- projected paybill per head growth rates.

Total paybill growth and paybill per head growth can be combined to produce a forecast for general government employment. In the absence of specific estimates for departmental paybill growth, we have followed this same broad ‘top-down’ approach to update our forecast of general government employment, incorporating revisions to RDEL plans since the June Budget. In doing so we have made two refinements to the methodology used by the interim OBR:

The June Budget forecast used growth in implied RDEL as a proxy for total paybill growth, except for local government paybill, which was assumed to grow in line with total local government expenditure. Total local government expenditure is made up of central government contributions, part of RDEL, and local authority self-financed expenditure (LASFE), which scores in Annually Managed Expenditure (AME) and not in RDEL. For the June Budget central government contributions were assumed to grow in line with total RDEL. Since then, the Spending Review has set out plans for local government spending. To account for this, we can project total general government paybill growth using growth in the sum of RDEL and LASFE. This captures total local government spending so we do not project local government paybill separately. The June Budget approach also excluded expenditure on the BBC, which is not part of RDEL but is part of central government,c and so should be incorporated in general government paybill growth.

In summary, our approach is to use growth in the sum of RDEL and those components of AME likely to include significant amounts of pay. For this forecast we have therefore assumed that total paybill growth is in line with the growth in the sum of RDEL, LASFE and BBC current expenditure.

Paybill per head growth is affected by changes in basic pay settlements, pay drift, employer pensions contributions and other factors, such as National Insurance contributions. The June Budget forecast included a number of workforce-specific adjustments. Our approach for the November forecast is to take a consistent approach across the projection, so we have removed these adjustments.

In addition, since the June Budget the Government has published the outcome of its 2010 Spending Review. The Spending Review revises upwards the profile for RDEL relative to the June Budget (see Table 4.15). This implies a smaller decline in total paybill growth than assumed at the time of the June Budget.

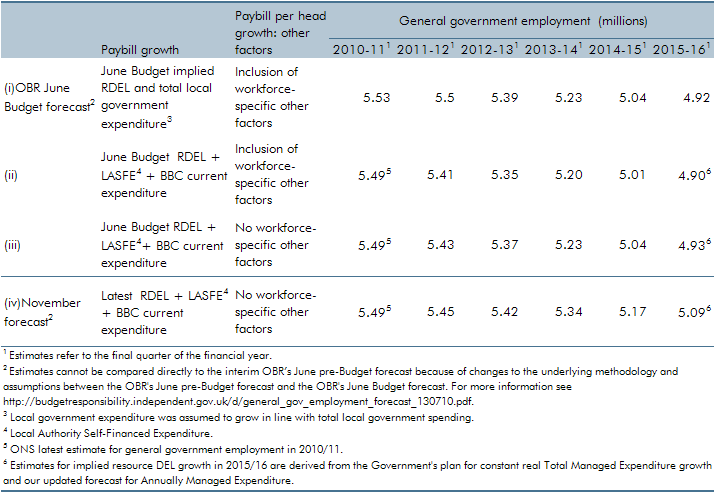

The table below sets out:

- the June Budget forecast for general government employment;

- the profile for general government employment using the June Budget expenditure plans, but using our new approach of modelling paybill growth as equal to RDEL plus LASFE and BBC current expenditure. This includes an updated estimate for general government employment in 2010-11;

- the profile for general government employment using the June Budget plans expenditure, modelling paybill growth as equal to RDEL plus LASFE and BBC current expenditure, but without the workforce-specific adjustments made in June.

- Lines (ii) and (iii) show how the OBR’s June Budget estimate would have changed if we apply our new methodological approach to spending plans from the June Budget. The final line shows our November forecast using our new methodology and based on Spending Review plans:

- our updated forecast for general government employment, using the Spending Review plans for RDEL, modelling paybill growth as equal to RDEL plus LASFE and BBC current expenditure, but without the workforce-specific adjustments made in June.

All these projections are inevitably subject to a large degree of uncertainty: they are based on a set of stylised assumptions and do not reflect departmental paybill plans or policy.

The updated forecast implies a reduction in general government employment of around 330,000 between 2010/11 and 2014/15.d This reduction is around 160,000 smaller than the reduction of 490,000 implied by the June Budget forecast; of this, around 30,000 is accounted for by methodological refinements and around 130,000 is attributable to changes in spending plans since the June Budget.

In particular, the difference of around 130,000 reflects the higher nominal growth in the sum of RDEL, LASFE and BBC current expenditure in the final Spending Review plans compared to the June Budget. This can be shown by comparing expenditure growth rates at the Spending Review and the June Budget. The sum of RDEL, LASFE and BBC current expenditure fell by a cumulative 0.5 per cent between 2010-11 and 2014-15 in nominal terms on the basis of the plans set out in the June Budget, compared to cumulative positive growth of 2 per cent on the basis of the latest plans. Multiplying this change in nominal growth of around 2.5 per cent by the June Budget estimate for 2014-15 general government employment (just over 5 million) gives the approximate change in forecast general government employment attributable to the change in spending plans since the June Budget (equal to around 130,000).