The Government undertook a number of interventions in the financial sector in response to the financial crisis and subsequent recession of the late 2000s. This box provided an update of the estimated net effect of them on the public finances as of March 2015.

This box is based on HM Treasury data from March 2015 .

This box provides an update on crisis-related interventions in the financial system, in particular:

- equity injections into Royal Bank of Scotland (RBS), Lloyds and the nationalisation of Northern Rock plc;

- holdings in Bradford & Bingley (B&B) and NRAM plc, now managed by UK Asset Resolution (UKAR);

- loans through the financial services compensation scheme (FSCS) and various wholesale and depositor guarantees; and

- other support, through the asset protection scheme, special liquidity scheme, credit guarantee scheme and a contingent capital facility – all now closed.

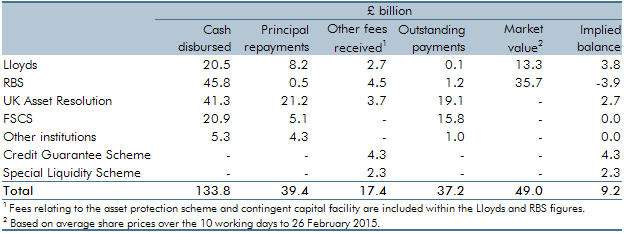

Table A summarises the position as at the end of February 2015.a Since then, the Government has sold further shares in Lloyds and has announced an intention to sell more. It has also announced plans to sell NRAM plc assets, principally the Granite securitisation vehicle, held by UK Asset Resolution (UKAR). These are discussed later in the chapter.

In total, £134 billion has been disbursed by the Treasury to date since the crisis. By the end of February, principal repayments on loans, proceeds from share sales and redemptions of preference shares amounted to £39 billion, up from the £35 billion reported in our last EFO. The additional repayments mainly relate to the loan to UKAR (Northern Rock, NRAM plc and B&B working capital facility) and the recovery of the claim on Landsbanki estate (which operated its UK branch as Icesave) for depositors in the UK. In total, the Treasury also received a further £17 billion, mainly from fees. So the net cash position stood at around a £77 billion shortfall.

By the end of February, the Treasury was owed £37 billion – largely the value of loans outstanding – and held shares in Lloyds and RBS – valued at £49 billion – and holdings in B&B and NRAM plc.

If the Treasury was to receive all loan payments in full, and sold the shares at their latest values, it would realise an overall cash surplus of £9 billion. But these figures exclude the costs to the Treasury of financing these interventions, and any offsetting interest and dividend receipts. If all interventions were financed through debt, the Treasury estimate that additional debt interest costs would have amounted to £22 billion to date. The Treasury has also received around £5 billion of interest over the same period.

Table A: Cost of financial interventions